This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Credit Agricole, Turkexim, DB and Others Price Bonds

January 9, 2026

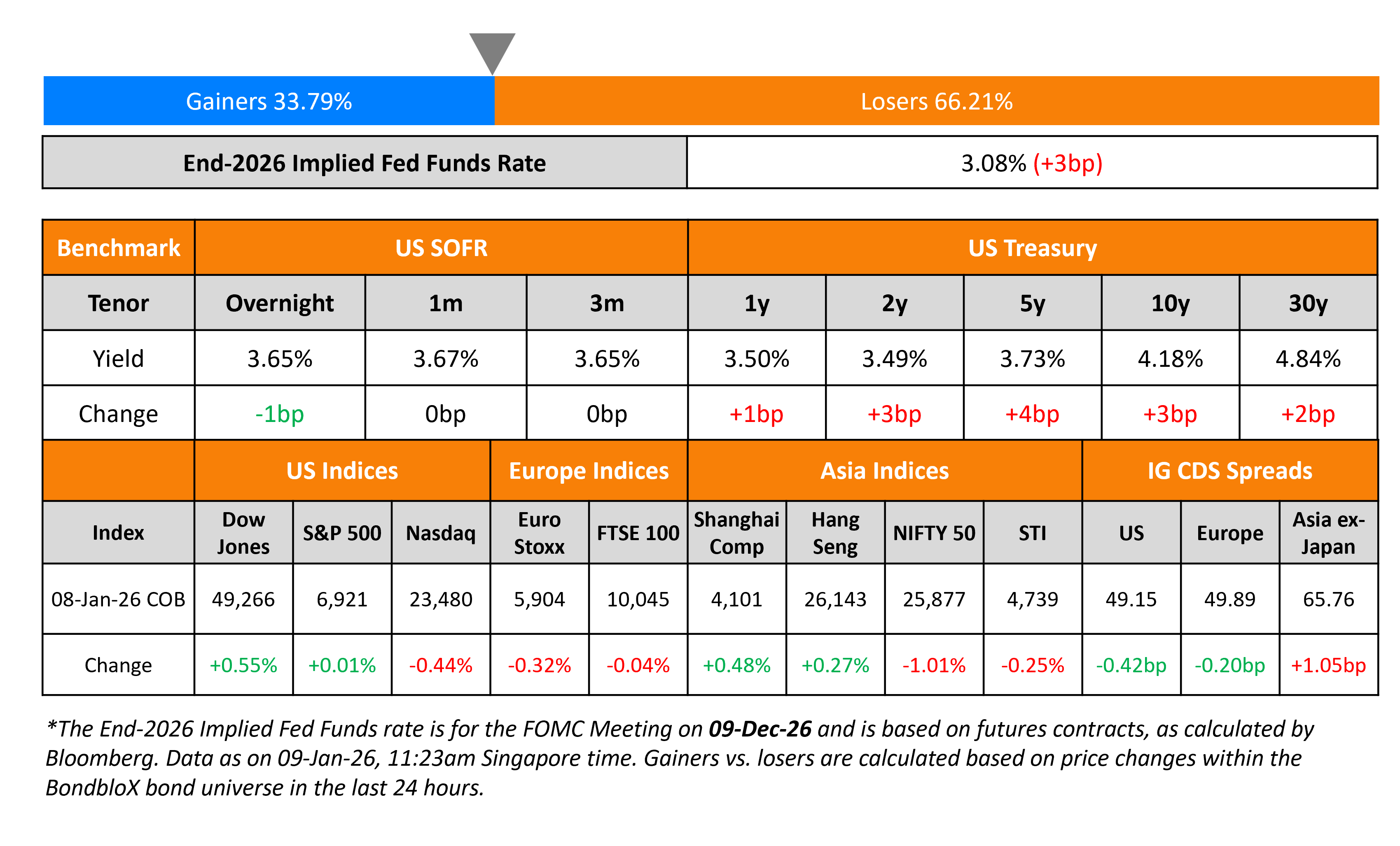

US Treasury yields were higher by 3-4bp across the curve. Initial jobless claims for the prior week came in at 208k, better than expectations of 210k. All eyes will be on the NFP report later today with economists expecting a 70k print. Separately, US Treasury Secretary Scott Bessent said that interest rates were “substantially above the neutral rate” and that they should “not be in restrictionary mode”.

Looking at US equity markets, the S&P ended flat while the Nasdaq ended lower by 0.4%. US IG CDS spreads tightened by 0.4bp while HY CDS spreads were tighter by 2.4bp. European equity indices ended lower. The iTraxx Main CDS spreads were 0.2bp tighter while the Crossover CDS spreads were 0.2bp wider. Asian equity markets have opened with a positive bias this morning. Asia ex-Japan CDS spreads were wider by 1.1bp.

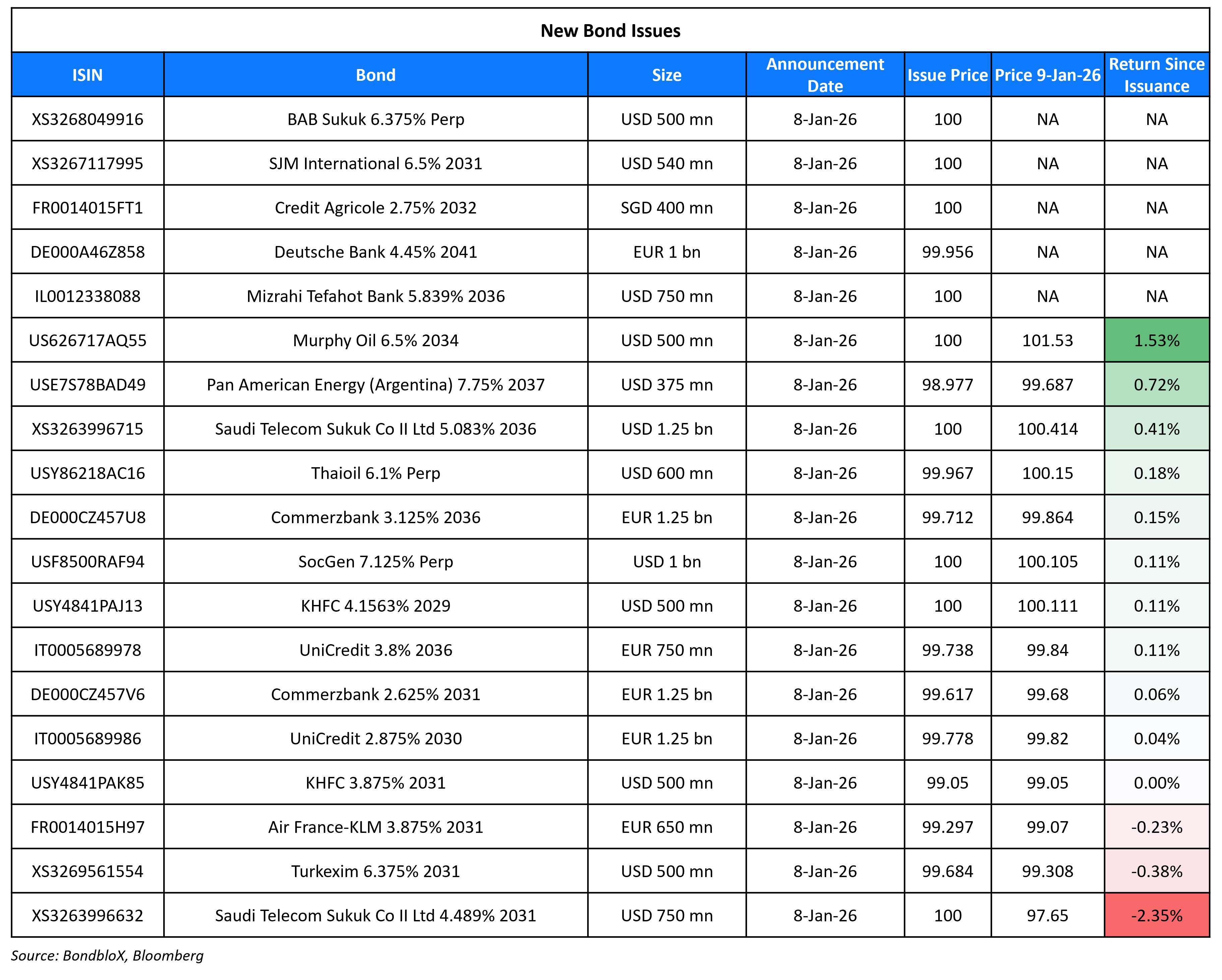

New Bond Issues

Credit Agricole raised S$400mn via a 6NC5 bond at a yield of 2.75%, 30bp inside initial guidance of 3.05% area. The senior non-preferred notes are rated A3/A-/A+.

Turkiye Ihracat Kredi Bankasi (Turkexim) raised $500mn via a 5Y bond at a yield of 6.45%, 30bp inside initial guidance of 6.75% area. The senior unsecured notes are rated Ba3. Proceeds will be used for general corporate purposes. The new bond is priced at a new issue premium of 23bp over its existing 6.375% 2030s that currently yield 6.22%. The bond offers a yield pick-up of 137bp over the Turkey sovereign’s 11.875% 2030s (rated Ba3/BB-/BB-) that currently yield 5.08%.

UniCredit raised €2bn via a two-tranche offering. It raised €1.25bn via a 4.5NC3.5 bond at a yield of 2.946%, 30bp inside initial guidance of MS+85bp area. It also raised €750mn via a 10Y bond at a yield of 3.832%, 30bp inside initial guidance of MS+125bp area. The senior preferred notes are rated A3/A-/A-, and received orders of ~€7.4bn, 3.7x issue size.

Deutsche Bank raised €1bn via a 15.3NC10.3 Tier-2 bond at a yield of 4.458%, 40bp inside initial guidance of MS+195bp area. The subordinated notes are rated Baa3/BBB-/BBB and received orders of over €7bn, around 7x issue size.

Air France-KLM raised €650mn via a 5Y bond at a yield of 4.033%, 40bp inside initial guidance of MS+190bp area. The senior unsecured notes are rated BB+/BBB- (S&P/Fitch) and received orders of over €2.15bn, around 3.3x the issue size.

Murphy Oil raised $500mn via an 8NC3 bond at a yield of 6.5%, inline with initial guidance. The senior unsecured notes are rated Ba3/BB. Proceeds will be used to redeem its 5.875% 2027s and 6.375% 2028s, repay outstanding borrowings under its revolving credit facility, and for general corporate purposes.

Mizrahi Tefahot Bank raised $750mn via a 10.25NC5.25 Tier-2 bond at a yield of 5.839%, 30bp inside initial guidance of T+240bp area. The subordinated bond is rated BBB-/BBB (S&P/Fitch). Proceeds will be used for general corporate purposes.

Pan American Energy raised $375mn via an 11Y bond at a yield of 7.9%, 10bp inside initial guidance of low-8% area. The senior unsecured notes are rated B1/BB-. The notes will amortize by 33% in year 2035, 33% in year 2036 and 34% in year 2037, and have a weighted average life of 10 years. Proceeds will be used to invest in exploration and development of assets in Argentina, repay existing debt, finance the branch’s investment plan for refining and distribution assets, pursue acquisitions or business expansions in Argentina, and meet working capital needs.

Saudi Telecom Company (STC Sukuk Company II Ltd) raised $2bn via a two-tranche offering. It raised $750mn via a 5Y bond at a yield of 4.489%, 40bp inside initial guidance of T+115bp area. It also raised $1.25bn via a 10Y bond at a yield of 5.083%, 35bp inside initial guidance of T+125bp. The senior unsecured notes are rated A3/A+, and received orders of over $5.2bn, 2.6x issue size. Proceeds will be used for general corporate purposes.

SJM Holdings raised $540mn via a 5NC2 bond at a yield of 6.50%, 37.5bp inside initial guidance of 6.875% area. The note is rated B1/BB-. Proceeds will be used for refinancing existing debt and for general corporate purposes. The notes have a special put option upon the occurrence of certain events relating to the termination, revocation or modification of gaming license.

Bank Albilad (BAB Sukuk Ltd.) raised $500mn via a PerpNC5 bond at a yield of 6.375%, 37.5bp inside initial guidance of 6.75% area. The junior subordinated notes are unrated, and received orders of over $1.75bn, 3.5x issue size. If not called by 15 January 2031, the coupon will reset to the prevailing US 5Y Treasury yield + 265bp. Proceeds will be used to improve the bank’s Tier 1 capital and for general banking purposes.

Thai Oil (Thaioil Treasury Center Co Ltd) raised $600mn via a PerpNC5.25 bond at a yield of 6.10%, 52.5bp inside initial guidance of 6.625% area. The subordinated notes are rated Ba2/BB-. If not called by 15 April 2031, the coupon will reset to the prevailing US 5Y Treasury yield + 237.5bp. If not called by 15 April 2036, there is a coupon step-up of 25bp. Also, if not called by 15 April 2051, there is an additional step-up of 75bp. Proceeds will be used for general corporate purposes, including onward lending to entities within the group.

Korea Housing Finance Corp (KHFC) raised $1bn via a two-tranche offering. It raised $500m via a 3Y FRN at SOFR+49bp, inline with initial guidance of SOFR+49bp area. It also raised $500m via a 5Y at a yield of 4.087%, 27bp inside initial guidance of T+63bp area. The senior unsecured notes are rated Aa2/AA (Moody’s/S&P). Proceeds will be used to finance and/or refinance a range of mortgage loan products to facilitate access to housing finance, inline with its sustainable financing framework.

Rating Changes

- Moody’s Ratings upgrades Micron’s senior unsecured ratings to Baa2; outlook stable

- Graham Packaging Co. Inc. Upgraded To ‘B+’ From ‘B’ On Recapitalization; Outlook Stable; New Debt Rated

- Baytex Energy Corp. Ratings Taken Off CreditWatch And Affirmed; Outlook Stable

Term of the Day

Weighted Average Life (WAL)

Weighted average life (WAL) is a feature of amortizing bonds, which are different from straight bonds in that they payback principal through the life of the bond rather than a one-time payment of the full principal at maturity. WAL refers to the average time, stated in years, in which the bond’s unpaid principal remains outstanding. WAL is calculated as follows with an example of a 3Y bond with a $100 face value where P1 refers to principal repayment in year one, P2 in year two and P3 in year three: WAL = [(P1 x 1) + (P2 x 2) + (P3 x 3)] / $100

Talking Heads

On Trump May Decide on Fed Before or After Davos – Scott Bessent, US Treasury Secy.

The timeframe for a Fed decision may be “right before or right after that (Davos) — I think in January… We are still substantially above the neutral rate, and I think that we should not be in restrictionary mode. I think most models would show 2.50 to 3.25”

On Wanting 150 Points of Cuts in 2026 to Boost Jobs – Stephen Miran, Fed Governor

“I’m looking for about a point and a half of cuts. A lot of that is driven by my view of inflation. Underlying inflation is running within noise of our target, and that’s a good indication of where overall inflation is going to be going in the medium term”

On Rates Appropriate, Uncertainty Very High – ECB Vice President Luis de Guindos

“In a complex geopolitical environment, business investment may be affected and is showing a very moderate evolution… current level of interest rates is appropriate; the latest data are aligning perfectly with our projections… If circumstances change, our monetary policy will be adjusted”

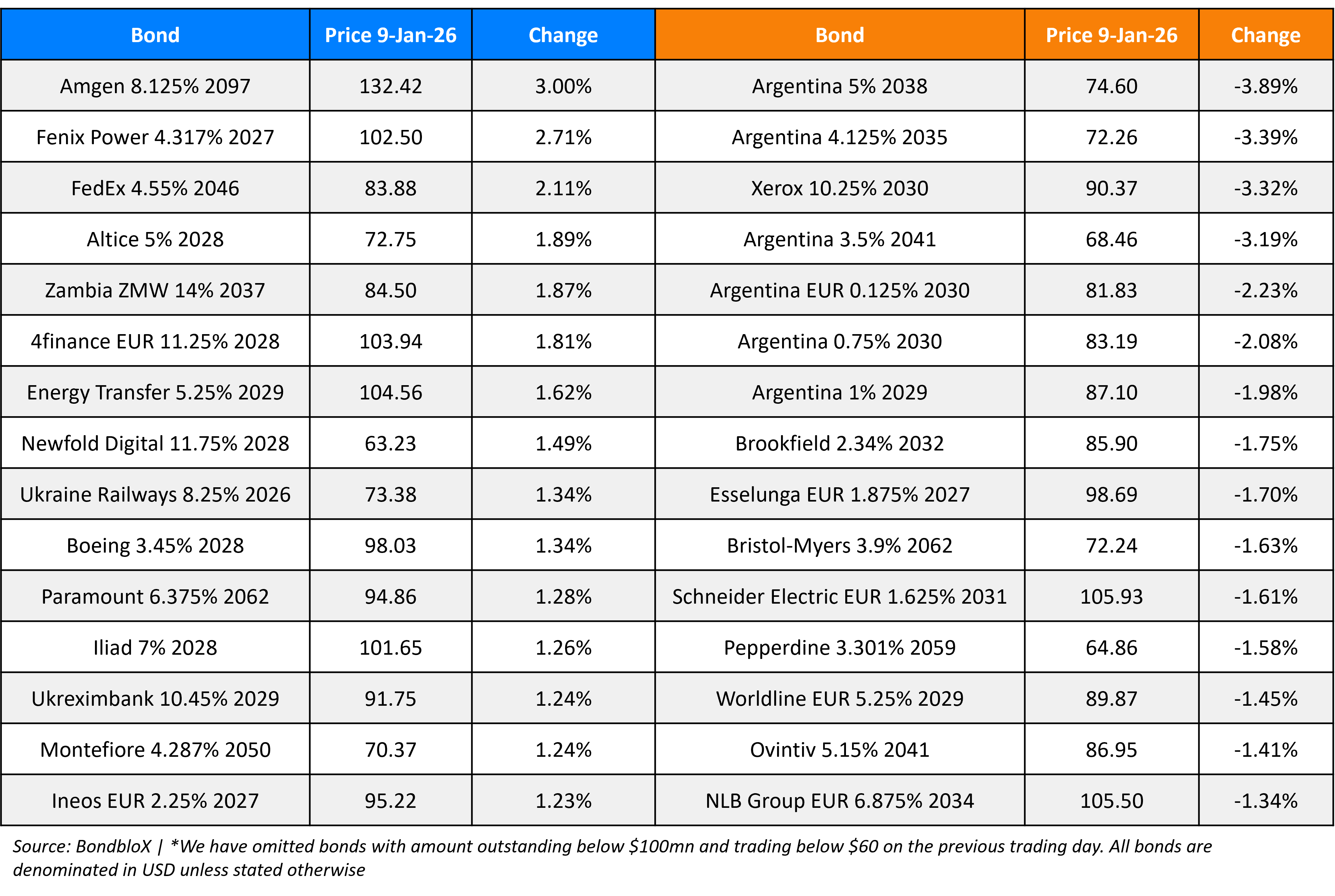

Top Gainers and Losers- 09-Jan-26*

Go back to Latest bond Market News

Related Posts: