This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

CPI In-Line with Expectations, Markets Price 25bp Sep Cut

September 12, 2024

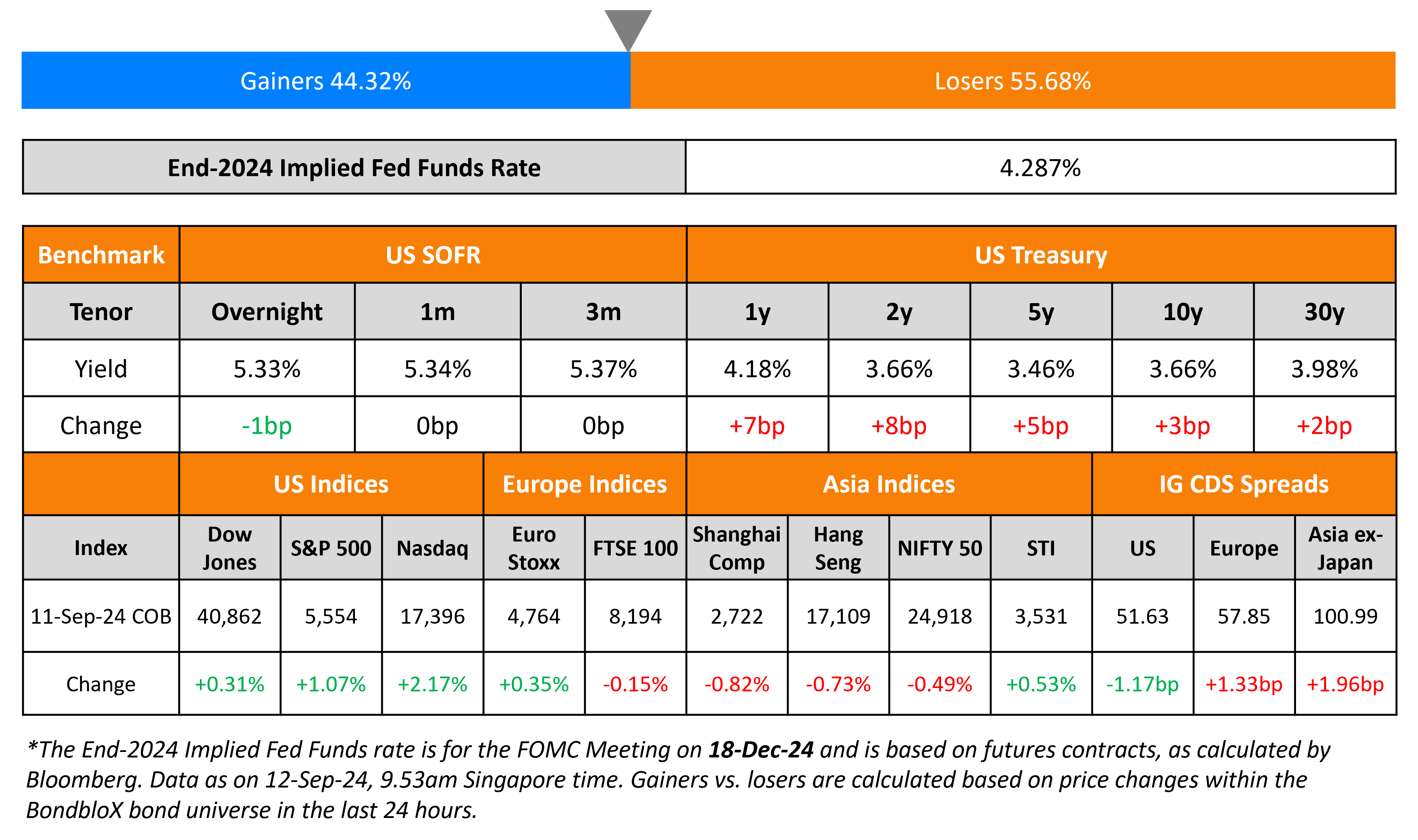

The Treasury yield curve bear flattened with the 2Y yield up by 8bp, while the 10Y yield rose 3bp. US CPI rose as expected, by 2.5% YoY in August vs. 2.9% in July. Core CPI held steady and was in-line with expectations at 3.2%. Separately, the US Treasury’s 10Y auction saw strong demand with a bid-to-cover of 2.64x (vs. 2.32x last month) and an indirect acceptance rate of 76% (vs. 66.2% last month). Following the data release, markets are now pricing-in a 25bp rate cut by the Fed next week. Overall, markets are still pricing-in 100bp of cuts by end-2024. US IG CDS spreads tightened by 1.2bp and HY CDS spreads were tighter by 6bp. Looking at US equity indices, the S&P and Nasdaq were both higher by 1.1% and 2.2% respectively.

European equity markets ended mixed. Looking at Europe’s CDS spreads, the iTraxx Main spreads were wider by 1.3bp while Crossover spreads widened by 2.9bp. Asian equity indices have opened broadly higher this morning. Asia ex-Japan CDS spreads widened by 2bp.

New Bond Issues

Nigeria raised $900mn via a debut domestic 5Y dollar bond issuance at a yield of 9.75%. The notes are rated. The new bonds were priced at a new issue premium of 8bp over its existing 8.375% 2029s that yielded 9.67% at the time of issuance. As per Adetilewa Adebajo, economist and CEO at CFG Advisory, investors favored the local dollar bond “as it offered very high returns and a hedge against foreign-exchange devaluation”.

Rating Changes

- Moody’s Ratings upgrades Glencore to A3, outlook stable

- Fitch Upgrades Volcan IDRs to ‘B-‘; Outlook Stable

- Fitch Upgrades Meituan to ‘BBB’; Outlook Positive

- Moody’s Ratings downgrades Maldives’ rating to Caa2, places rating under review for downgrade

- Operadora de Servicios Mega S.A. de C.V. SOFOM E.R. Downgraded To ‘SD’ On Missed Interest Payment

- TalkTalk Telecom Group Ltd. Downgraded To ‘CC’ On Proposed Debt Restructuring; Outlook Negative

Term of the Day

Non-Viability Trigger Event

This is an event when the regulators/relevant authorities determine that the company under consideration may be non-viable or may not remain a going concern unless measures are taken to revive its operations given financial difficulties. Once the regulators determine that the company would be non-viable, it would trigger an action where for example, the company would have a right to irrevocably write-off (partly or fully) the outstanding principal of the bonds and make this portion non-payable henceforth. It could also include accrued and unpaid interest/dividends being unpayable. Thus, in this case, the regulator determines that without a write-off, the issuer would become non-viable and without a public sector injection of capital or other equivalent support, the issuer would become non-viable.

Talking Heads

On Traders Overpricing Fed Rate Cuts – Deutsche Bank’s Holtze-Jen

“The market is due for a repricing and of course on the back of that, there will be volatility. The US economy looks like it is still on a fairly solid footing, especially from a consumer perspective. This can continue”

On US Inflation Is ‘at Target’ – Blackstone Finance Chief Michael Chae

“Soft landings are hard to land. They’re pretty rare in history — but where we sit today looks pretty encouraging”… stripping out shelter costs and adding other metrics puts BlackRock’s inflation measure at 1.7%… “at target”

On Morgan Stanley’s Mike Wilson Says the AI Theme Is ‘Overcooked’

“The AI dream — a little bit of that luster has come off. We just got overcooked on the whole AI theme. It doesn’t mean it’s over… I do think the stock market is pro-Trump, The stock market has traded better when his odds go up, and vise versa”

Top Gainers & Losers-12-September-24*

Go back to Latest bond Market News

Related Posts: