This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Commerzbank Prices S$ Tier 2 at 6.5%; Treasuries Sell-off on Strong Retail Sales Data

October 18, 2023

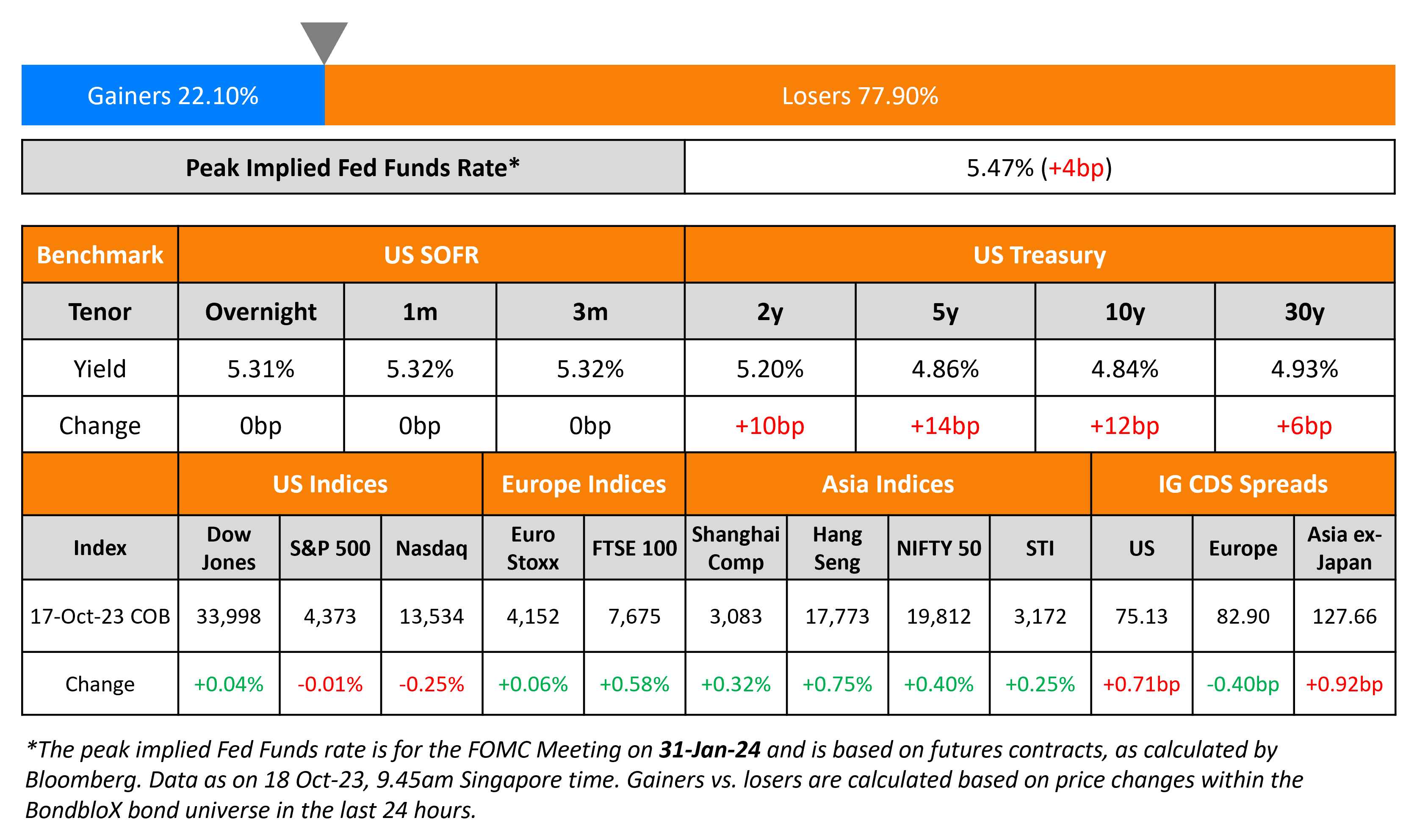

US Treasury yields soared higher on Tuesday, with 2Y yields up 10bp to 5.20% to its highest level since 2006 and the 10Y up 12bp to 4.84%. The move higher in yields came following US retail sales that increased by more than forecasted in September, in a broad advance showing durable household demand. Retail sales rose 0.7% vs. expectations of 0.3%. Also, manufacturing output rose 0.4% last month, higher than expectations of no change and August’s revised -0.1%, indicating a possible turnaround in the manufacturing sector. US credit markets saw IG CDS spreads widen 0.7bp and HY spreads wider by 4.3bp. The S&P ended flat and Nasdaq was down 0.3%.

European equity markets closed higher. In credit markets, European main CDS spreads were tighter by 1.0.4bp and crossover spreads tightened 0.6bp. Asian equity markets have opened lower this morning and Asia ex-Japan IG CDS spreads widened 0.9bp.

New Bond Issues

- MUFG $750mn Perp NC5.25 AT1 at 8.875% area

- ICBC $ 3Y Green FRN/ $ 3Y Green/ € 3Y Green at SOFR+105bp/T+90bp/MS+80bp area

- Jinan Lixia $ 3Y at 7.7% area

- Qingdao Conson $ 3Y at 7.6% area

Commerzbank raised S$300mn via a 10.5NC5.5 Tier 2 bond at a yield of 6.5%, 12.5bp inside initial guidance of 6.625% area. If uncalled in 2029, the coupon will reset at the 5Y SGD Swap rate plus a spread of 309.9bps. The bonds also have a statutory resolution measure which grants the appropriate resolution authority to write down (including to zero) the obligations of the issuer, convert them into equity or apply any other resolution measure, including (but not limited to) any transfer of the obligations to another entity, an amendment of the Terms and Conditions or a cancellation of the notes. The bonds have expected ratings of Baa3 (Moody’s), and received orders over S$665mn, 2.2x issue size. The table below compares Commerzbank’s new Tier 2s with other similarly rated SGD-denominated Tier 2s.

KEB Hana raised $500mn via a 5Y social bond at a yield of 5.834%, 25bp inside initial guidance of T+125bp area. The senior unsecured bonds have expected ratings of Aa3/A+. Proceeds will be used to finance/refinance eligible social assets and projects under its sustainability financing framework.

New Bond Pipeline

- PIF hires for $ 5Y/10Y Sukuk

- Medco Energi hires for $ 5.5NC2 bond

- Oman Telecom hires for $ 7Y Sukuk

Rating Changes

-

Fitch Downgrades China Vanke to ‘BBB’; Outlook Stable

- Fitch Downgrades Rite Aid’s IDR to ‘D’

- Moody’s downgrades Gemdale’s and Famous’ ratings to B3/Caa1; changes outlook to negative

-

Chesapeake Energy Corp. Outlook Revised To Positive On Improved Cash Flow/Leverage Metrics, ‘BB’ Ratings Affirmed

Term of the Day

Tier 2 Bonds

Tier 2 bonds are debt instruments issued by banks to meet their regulatory tier 2 capital requirements. Tier 2 capital (and thus tier 2 bonds) rank senior to tier 1 capital, which consists of common equity tier 1 (CET1) and additional tier 1 (AT1) capital. CET1 consists of a bank’s common shareholders’ equity while AT1 consists of preferred shares and hybrid securities or perpetual bonds. Tier 2 capital consists of upper tier 2 and lower tier 2 wherein the former is considered riskier to the latter. From a bond investor’s perspective, tier 2 bonds are senior, and therefore less risky compared to AT1 bonds as AT1s would be the first to absorb losses in the event of a deterioration in bank capital.

Talking Heads

On Fed Having Time to See If More Needed to Tame Inflation – Richmond Fed President, Thomas Barkin

“I am still looking to be convinced, both that demand is settling and that any weakness is feeding through to inflation… path for inflation “isn’t yet clear”… “we have time to see if we have done enough, or whether there’s more work to do.”

On Treasury Liquidity Mostly in Line With Volatility – NY Fed Economist, Michael Fleming

Liquidity in the US government bond market “continues to closely track the level that would be expected by the path of interest rate volatility”… 5Y and 10Y Treasuries conform, while 2Y notes show “somewhat higher-than-expected price impact given the volatility”… “The market’s capacity to smoothly handle large trading flows has been of concern since March 2020”

On inflation still too high – Minneapolis Fed President, Neel Kashkari

Inflation has taken much longer than expected for inflation to come down, and it is “still too high.”

On Country Garden close to potential default on offshore debt – CreditSights

“With homebuyers still biased towards state-linked developers, those privately-run developers still not yet in a default would likely find staying afloat an increasingly challenging prospect, squeezed by both insufficient contracted sales generation and funding inaccessibility”

Top Gainers & Losers- 18-October-23*

Go back to Latest bond Market News

Related Posts: