This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Colombia to Sell Euro Bonds and Buy Back US-Dollar Debt

September 9, 2025

Colombia said it plans to issue euro-denominated bonds for the first time since 2016 and launch a tender offer for dollar notes, as the government moves to diversify its debt amid deepening fiscal imbalances. The administration will offer euro-denominated bonds due in 2028, 2032 and 2036, according to preliminary prospectuses and filings published Monday. BNP Paribas, BBVA and Citigroup are acting as joint bookrunners for the transaction. Colombia also plans to launch a tender offer to buy back debt maturing in 2026 that currently pays a coupon rate of 3.875%, targeting “certain tendering holders,” according to the documents, giving priority to investors who want to exchange the bonds for the euro-denominated notes maturing in 2028. Last week, global banks bought back $5.4bn worth of Colombian dollar notes through a tender offer, a transaction tied to a total return swap executed by the government. It is also the second time this year that Colombia taps global investors; the country sold a record $3.8bn of bonds in April.

Colombia’s dollar bonds traded stable with its 3.875% 2027s at 99.43, yielding 4.24%

For more details, click here

Go back to Latest bond Market News

Related Posts:

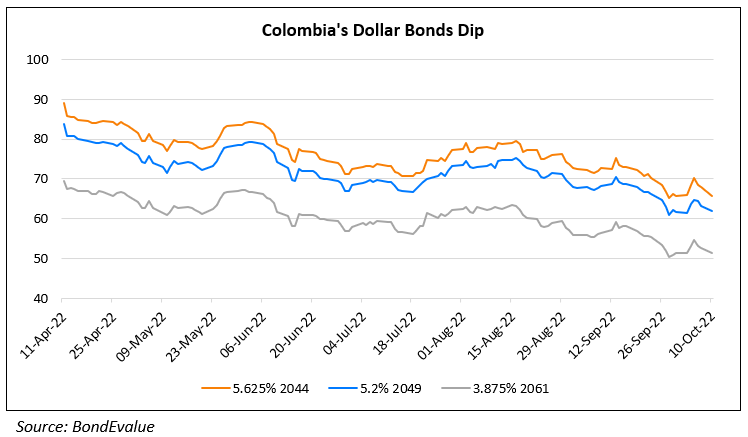

Colombia’s Dollar Bonds Near All-time Lows

October 10, 2022

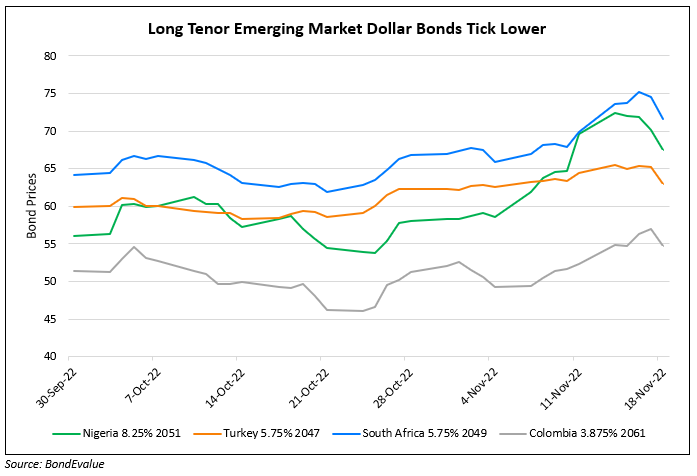

Long-Dated Bonds of EM Sovereigns Drop Over 3%

November 18, 2022