This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Colombia to Overhaul Its Debt Financing Strategy

April 2, 2025

Colombia is revamping its debt financing strategy by offering shorter-maturity bonds and euro-denominated debt to attract foreign investors and manage refinancing risks, according to its new public credit director Javier Cuellar. He added that, the treasury will prioritize issuing local peso-denominated (TES) bonds with 5-10 year maturities, which is the “sweet spot” for offshore investors seeking higher risk-adjusted returns. Maintaining foreign participation is crucial to controlling rising interest costs, as foreign TES holdings have dropped to 17% of the total, the lowest proportion since 2016. Colombia also aims to reduce reliance on dollar-denominated obligations by establishing a euro debt curve. However, investors remain wary of Colombia’s 6.8% fiscal deficit, the highest since the pandemic. Investors expect concrete actions to curb the deficit, with Cuellar emphasizing compliance with the fiscal rule. The finance ministry will adjust its bond auction schedule to implement this new strategy while ensuring debt sustainability.

Colombia’s local and dollar bonds rallied after the announcement, with its 5.625% 2044s up by 0.5 point to 75.7, yielding 8.2%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

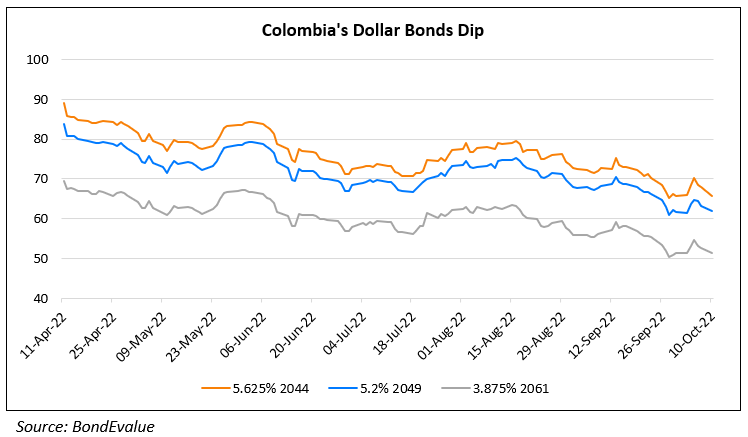

Colombia’s Dollar Bonds Near All-time Lows

October 10, 2022

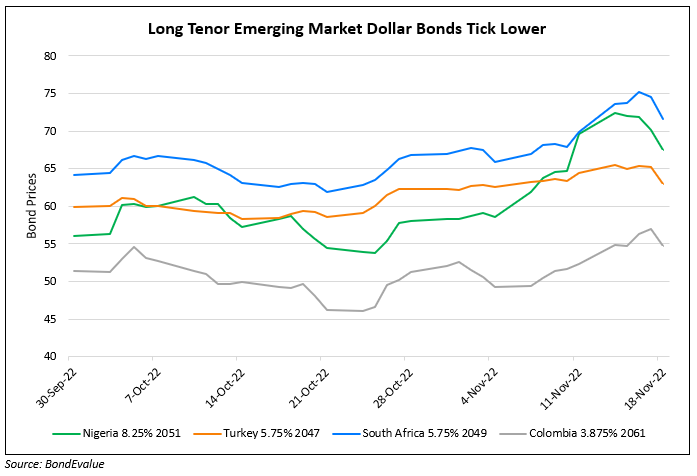

Long-Dated Bonds of EM Sovereigns Drop Over 3%

November 18, 2022