This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Colombia Plans Extending Bond Buybacks

October 17, 2025

Colombia’s government plans to continue repurchasing sovereign bonds as part of its strategy to revamp the country’s debt profile, said Javier Cuellar, the Director or Public Credit. He added that the country would issue new tranches of EUR-denominated bonds and reduce interest payments to at least 3.8% of GDP from 4.7% currently. Colombia’s liability management operations have included local and dollar debt repurchases, the issuance of euro-denominated bonds for the first time in almost ten years and a $9.3bn total return swap. However, there are underlying fiscal and political concerns, with the deficit being the highest since the pandemic and uncertainty around presidential elections next year. Colombia’s dollar bonds have returned more than 9% since the strategy was announced in early July, according to a Bloomberg index.

Colombia’s 5.625% 2044s was marginally up at 82.9 cents on the dollar, yielding 7.33%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

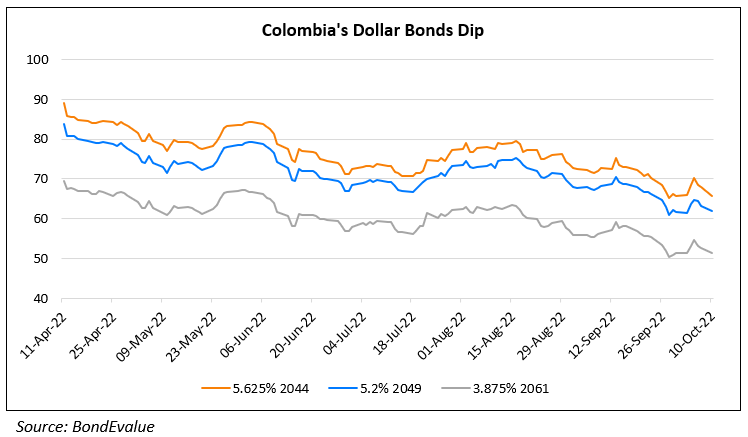

Colombia’s Dollar Bonds Near All-time Lows

October 10, 2022

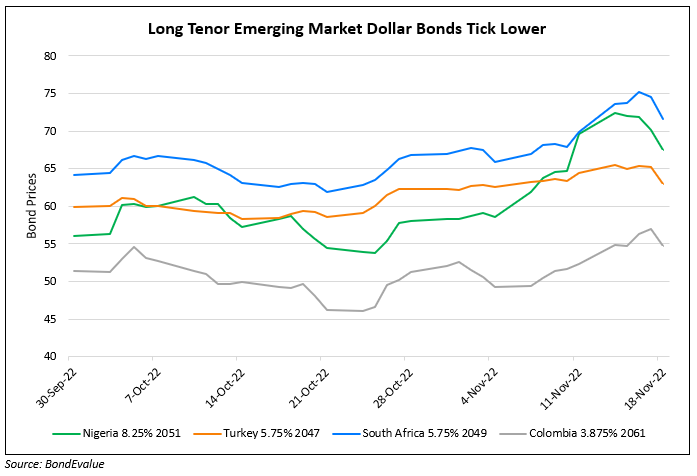

Long-Dated Bonds of EM Sovereigns Drop Over 3%

November 18, 2022