This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Colombia Downgraded to Baa3 by Moody’s

June 27, 2025

Colombia was downgraded by a notch to Baa3 from Baa2 by Moody’s on the back of worsening fiscal metrics, with persistent high deficits exceeding the country’s fiscal rule limits. The government has suspended the fiscal rule for three years despite no macroeconomic shock, signaling weaker fiscal policy effectiveness. According to Moody’s, Colombia’s general government debt to GDP is projected to rise to 59.5% in 2025 and peak at 64% by 2027. Moreover, as Colombia is currently facing high domestic and external borrowing costs, the increasing indebtedness will contribute to a weakening of debt affordability. The country’s fiscal management reflects negatively on its fiscal policy effectiveness and departs from the track record of prudent policymaking that subsequent administrations have built over the past several decades, the rating agency added.

Colombia’s 3% 2030s are trading ~0.7 points higher at 86.58, yielding 6.43%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

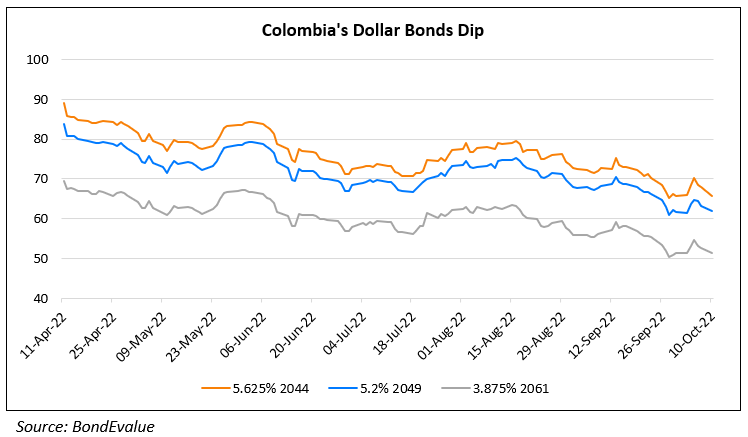

Colombia’s Dollar Bonds Near All-time Lows

October 10, 2022

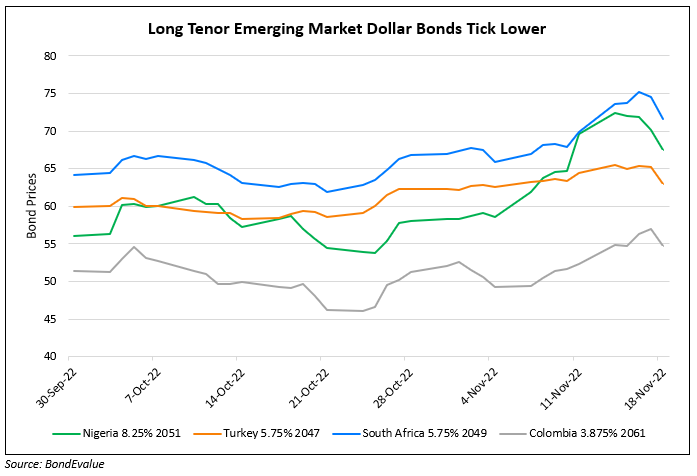

Long-Dated Bonds of EM Sovereigns Drop Over 3%

November 18, 2022