This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

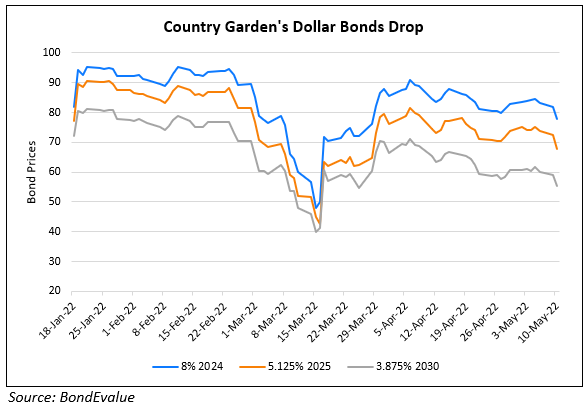

COGARDs Dollar Bonds up 2-3 Points On Planned Yuan Bond; R&F Gets Approval to Delay Local Bond Repayment

Country Garden’s (COGARD) dollar bonds moved 2-3 points higher on news of a planned RMB 500mn ($74mn) onshore yuan bond offering. Besides, Chinese financial platform Cailin reported that Country Garden will issue asset-backed securities (ABS) and asset-backed notes (ABN) in June.

Separately, R&F Properties got investors’ approval to delay the principal repayment of its onshore RMB 4.6bn ($680mn) 6.8% bond that matured on Monday, May 16. The developer will start making principal repayments from November, via monthly installments of 10% of the total amount due until May 16, 2023, when the final 40% will be delivered. R&F’s dollar bonds were trading slightly lower at ~21 cents on the dollar.

Go back to Latest bond Market News

Related Posts: