This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

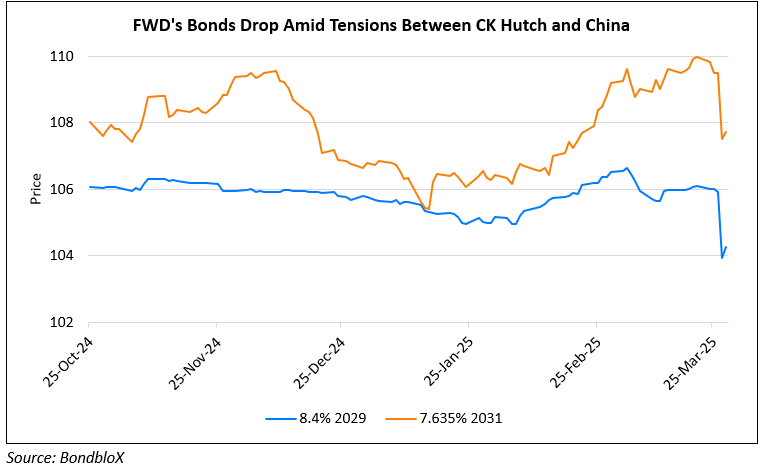

CK Hutchison and FWD Bonds Drop Amid Tensions Between CK Asset and China

March 28, 2025

Bonds of CK Hutchison and FWD Group traded lower after China instructed state-owned firms to pause new collaborations with businesses linked to Hong Kong billionaire Li Ka-shing after his decision to sell two Panama ports to a BlackRock-led consortium. Existing partnerships remain unaffected, but regulators are reviewing Li’s investments domestically and abroad. The directive does not outrightly ban new dealings, but increases pressure on Li, whose conglomerate, CK Hutch, stands to gain over $19bn from the sale. The move comes amid US-China tensions, with Washington framing the deal in order to reduce China’s influence. While CK Hutchison has limited exposure to China, its property arm CK Asset, headed by Li’s older son Victor, has one-fifth of its long-term rental property portfolio by area in the mainland. FWD Group, the insurance arm of Pacific Century Group, headed by Li’s second son Richard, also maintains significant mainland business interests. Meanwhile, due diligence on the port sale continues, with deal finalization expected by April 2.

For more details, click here

Go back to Latest bond Market News

Related Posts: