This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

CK Hutch, Ping An, Seazen Launch $ Bonds

September 23, 2025

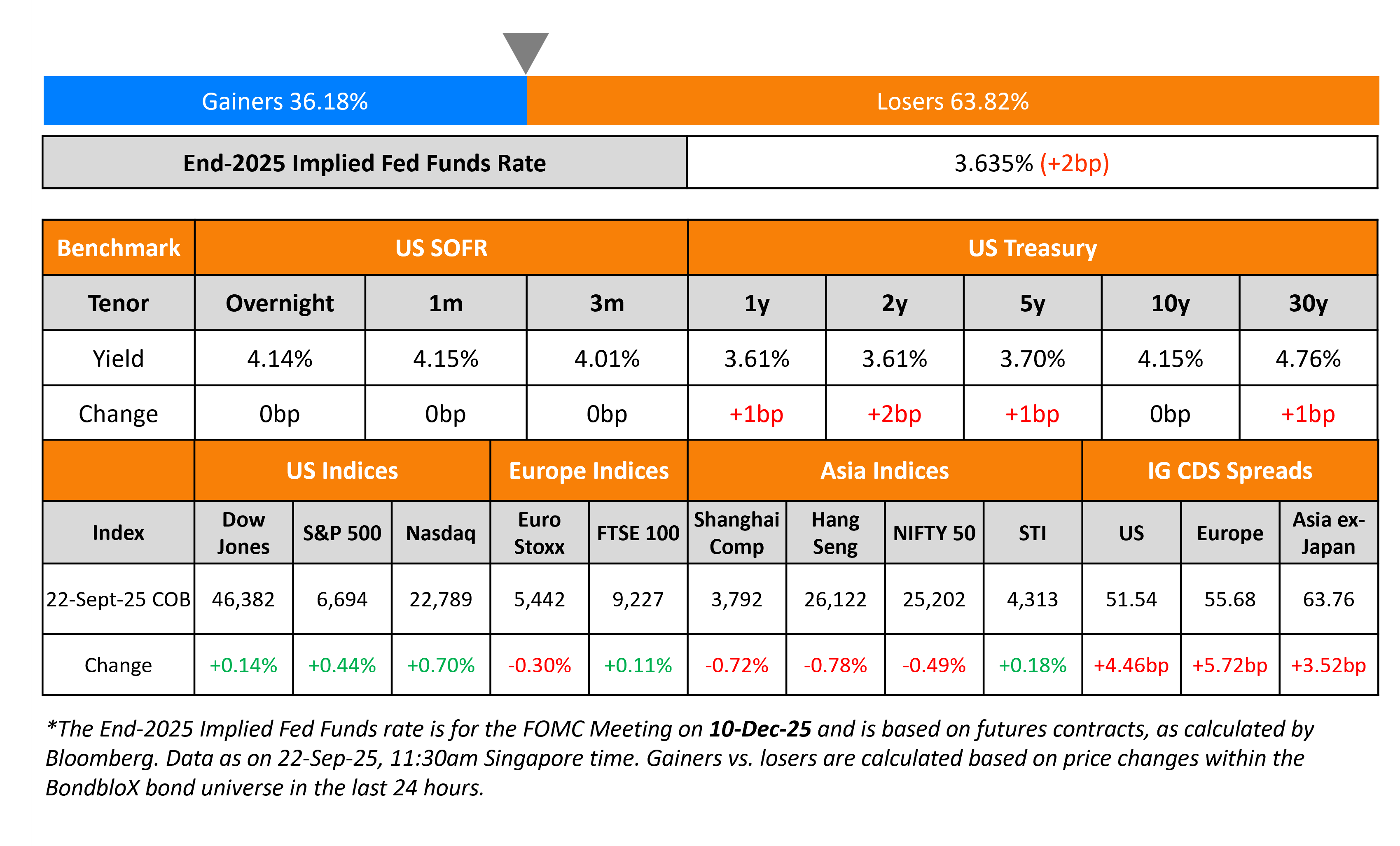

US Treasury yields were broadly unchanged. Several Fed speakers expressed their views on monetary policy. Cleveland Fed President Beth Hammack said that the Fed should be “very cautious” in removing its restrictive monetary policy as inflation is still above the 2% target and remains persistent. Donald Trump’s newly appointed Fed Governor Stephen Miran said that his projection “diverges from those of other FOMC members”, and that he is in favour of 50bp cuts at the Fed’s next two meetings. He said that a falling R-Star (neutral rate) warrants steep cuts. In the recent September FOMC meeting, Miran dissented and said that a 50bp cut was warranted. Atlanta Fed President Raphael Bostic said that he pencilled-in only one 25bp rate cut last week and does not see much reason to cut further.

Looking at equity markets, the S&P and Nasdaq continued to march higher by 0.4% and 0.7% respectively. US IG and HY CDS spreads were wider by 4.5bp and 0.2bp respectively. European equity markets ended mixed. The iTraxx Main and Crossover CDS spreads were 5.7bp and 19.8bp wider respectively. Asian equity markets have opened broadly weaker today. Asia ex-Japan CDS spreads were 3.5bp wider.

New Bond Issues

-

CK Hutchinson $ 5Y at T+95bp area

-

Seazen $ 2Y at 13.125% area

-

China Ping An $ 10Y at T+130bp area

- Clfford Capital $ 3Y at T+65bp area

- UBS A$ PerpNC5.5 at 6.75% area

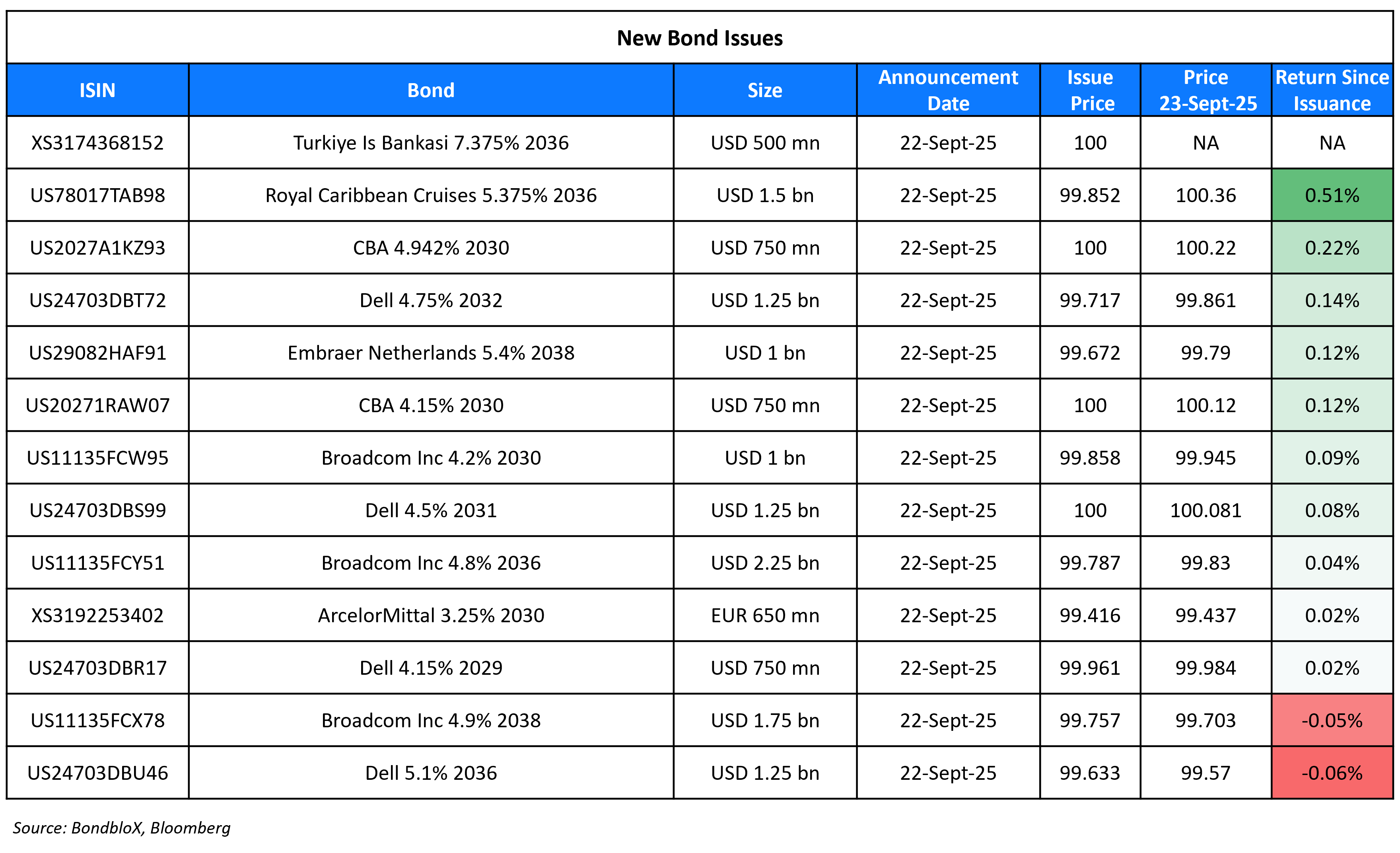

Royal Caribbean Cruises raised $1.5bn via a long 10Y bond at a yield of 5.395%, 35bp inside initial guidance of T+160bp area. The senior unsecured note is rated Baa3/BBB-/BBB-. Proceeds will be used to finance the upcoming delivery of the Celebrity Xcel ship and to redeem/refinance/repurchase a portion of its 2026s. Any remaining proceeds being used for general corporate purposes.

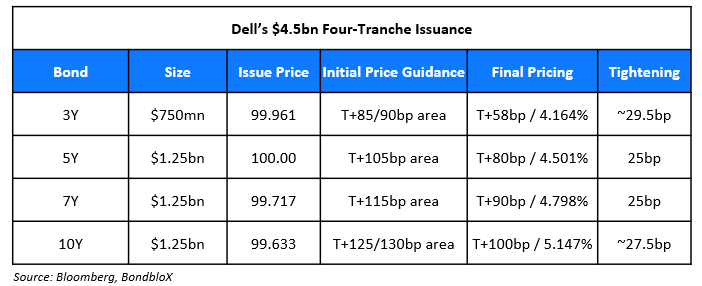

Dell raised $4.5bn via a four-trancher.

The senior unsecured notes are rated Baa2/BBB/BBB. Proceeds will be used to redeem a portion of Dell’s outstanding 6.02% 2026s. Any remaining proceeds will be used for general corporate purposes, which may include the repayment of other debt.

Isbank raised $500mn via a 10.5NC5.5 Tier-2 bond at a yield of 7.375%, 50bp inside initial guidance of 7.875% area. The subordinated note is rated B by Fitch, and received orders of over $2.4bn, 4.8x issue size.

ArcelorMittal raised €650mn via a 5Y bond at a yield of 3.379%, 30bp inside initial guidance of MS+130bp area. The senior unsecured note is rated Baa3/BBB. Proceeds will be used for general corporate purposes.

Aldar raised $290mn via a two-part tap of its notes. It raised $145mn via a tap of its 5.5% 2034s at a yield of 4.89%. It also raised $145mn via a tap of its 5.25% 2035s at a yield of 4.954%. The senior unsecured notes are rated Baa1. Net proceeds will be used to finance, refinance and/or invest, in whole or in part, certain eligible projects under its green framework.

CBA raised $1.5bn via a two-part deal. It raised $750mn via a 5Y bond at a yield of 4.15%, 25bp inside initial guidance of T+75bp area. It also raised $750mn via a 5Y FRN at SOFR+78bp vs. initial guidance of SOFR equivalent area. The senior unsecured notes are rated Aa2/AA-/AA-. Proceeds will be used for general corporate purposes. The new 5Y fixed rate bond is priced at a new issue premium of 12bp over its existing 4.608% 2030s that currently yield 4.03%.

Broadcom raised $5bn via a three-trancher. It raised:

- $1bn via a 5Y bond at a yield of 4.231%, 32bp inside initial guidance of T+85bp area. The new bond is priced at a new issue premium of 12bp over its existing 5% 2030s that currently yield 4.11%.

- $2.25bn via a long 10Y bond at a yield of 4.827%, 32bp inside initial guidance of T+100bp area

- $1.75bn via a long 12Y bond at a yield of 4.927%, 32bp inside initial guidance of T+110bp area

The senior unsecured notes are rated A3/A-/BBB+. Proceeds will be used for general corporate purposes and for debt repayment.

New Bond Pipeline

- Mirae Asset Securities $ 3Y/5Y

- Nickel Industries $ bond

- Binghatti $ 3Y bond

- Bank Muscat $ 5Y bond

Rating Changes

-

Fitch Upgrades Royal Caribbean’s IDR to ‘BBB’; Outlook Stable

-

Fitch Upgrades Generali’s IFS Rating to ‘AA-‘; Outlook Stable

-

Fitch Upgrades Broadcom to ‘BBB+’; Outlook Positive

-

Moody’s Ratings upgrades Broadcom’s senior unsecured rating to A3; outlook changed to positive

-

Fitch Upgrades SIAT’s IFS Rating to ‘A’; Outlook Stable

-

Royal Caribbean Cruises Ltd. Rating Outlook Revised To Positive; ‘BBB-‘ Rating Affirmed; Proposed Debt Rated ‘BBB-‘

-

Moody’s Ratings affirms SJM’s Ba3 CFR; changes outlook to negative

-

PM General Purchaser LLC Outlook Revised To Negative From Positive On Elevated Leverage; Ratings Affirmed

Term of the Day: Neutral Rate of Interest

The neutral rate aka natural rate or “R*” is the theoretical federal funds rate at which point the US Federal Reserve monetary policy is neither accommodative nor restrictive. In other words it is the short-term real interest rate that is consistent with the economy maintaining full employment and price stability. This rate is inferred and calculated via models and varies based on economic and financial market factors.

Talking Heads

On Miran Defending Low-Rate View as Colleagues Caution On Further Cuts

“The upshot is that monetary policy is well into restrictive territory. Leaving short-term interest rates roughly 2% too tight risks unnecessary layoffs and higher unemployment…Insufficiently accounting for the strong downward pressure on the neutral rate resulting from changes in border and fiscal policies is leading some to believe policy is less restrictive than it actually is… there is limited room for easing further without policy becoming overly accommodative”

On Vanguard Bullish on US Credit Despite Tariff Risks Still on The Horizon

Sara Devereux, Vanguard

“Credit spreads are near historical lows, but healthy fundamentals, attractive all-in yields, robust investor demand, a proactive Fed, and low recession risk support current valuations…Credit valuations are stretched but justified… Fed is unlikely to cut rates by as much as the market is expecting, unless the economy enters a recession.

On Quant Trades Bouncing Back With 19% Gain

Jordan Brooks, AQR Capital

“We could hold an equity portfolio that has the desired equity market exposure but have it tilted towards the stocks we think are attractive…That’s been a positive contributor.”

Alex Shahidi, Evoke Advisors

“When you look across all those assets, this year is almost the opposite of the previous decade – where US stocks did well and everything else didn’t…You could see that being sustained for an extended period of time.”

Top Gainers and Losers- 23-Sep-25*

Go back to Latest bond Market News

Related Posts: