This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

CK Hutch, Ping An, Enel, Seazen Price $ Bonds

September 24, 2025

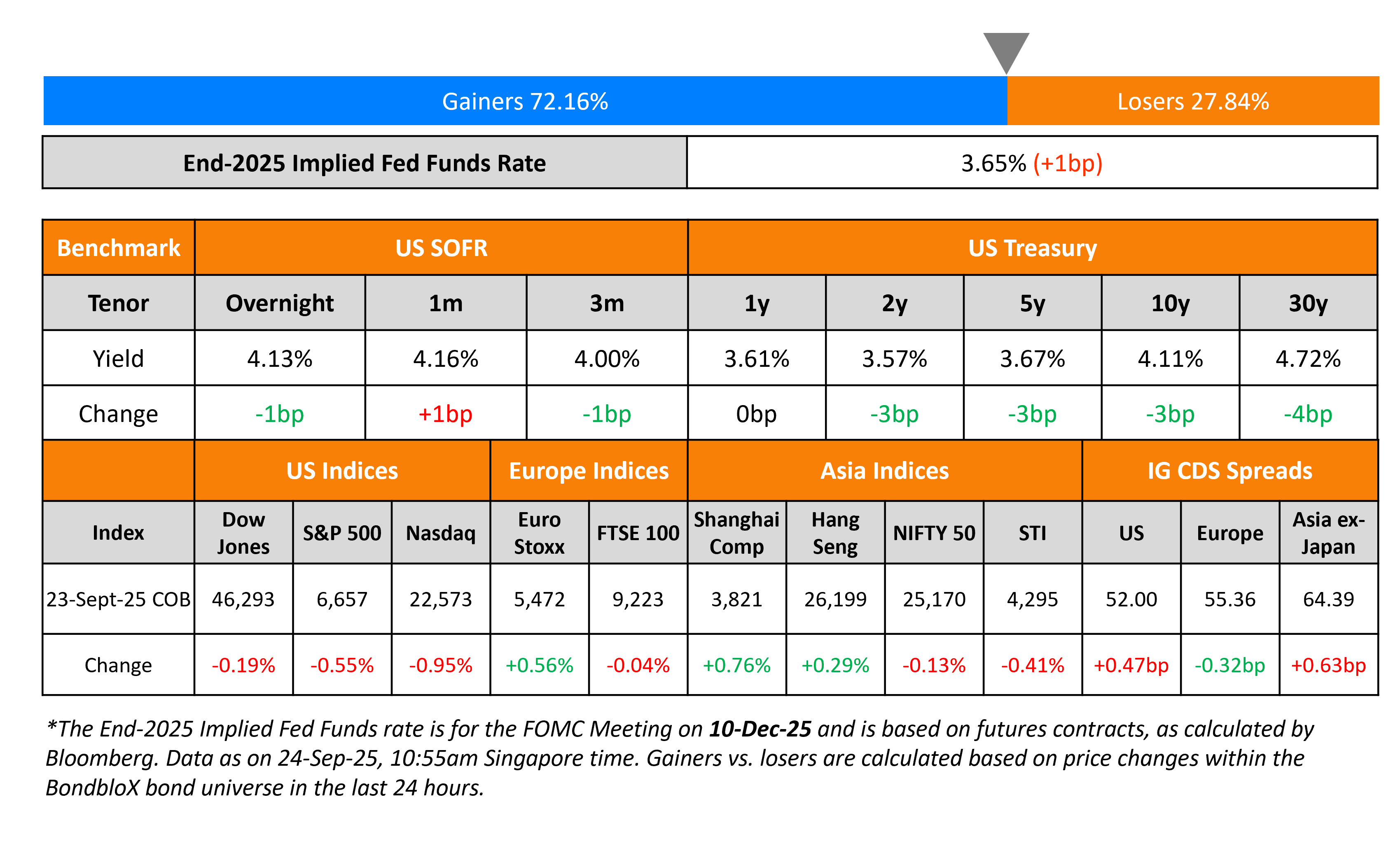

US Treasury yields were ~3bp lower on Tuesday. On the data front, the US S&P Manufacturing and Services PMIs came-in at 52.0 and 53.9, softer than expectations of 52.3 and 54.0 respectively. Another set of Fed speakers came out with their views on monetary policy yesterday. Fed Chairman Jerome Powell reiterated the Fed’s stance, noting that downside risks to employment shifted the balance of risks, prompting last week’s rate cut. Atlanta Fed’s Raphael Bostic said that inflation risks were still present in the economy, adding that labor markets were “very difficult to interpret”. Chicago Fed’s Austan Goolsbee said that while the Fed has more room to cut rates, they should be careful not to become aggressive on rate cuts.

Looking at equity markets, the S&P and Nasdaq ended 0.5% and 1% lower respectively. US IG and HY CDS spreads were wider by 0.5bp and 0.2bp reaspectively. European equity markets ended mixed. The iTraxx Main and Crossover CDS spreads were 0.3bp and 3.9bp tighter respectively. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were 0.6bp wider.

New Bond Issues

-

Nickel Industries $ 5NC2 at 9.25% area

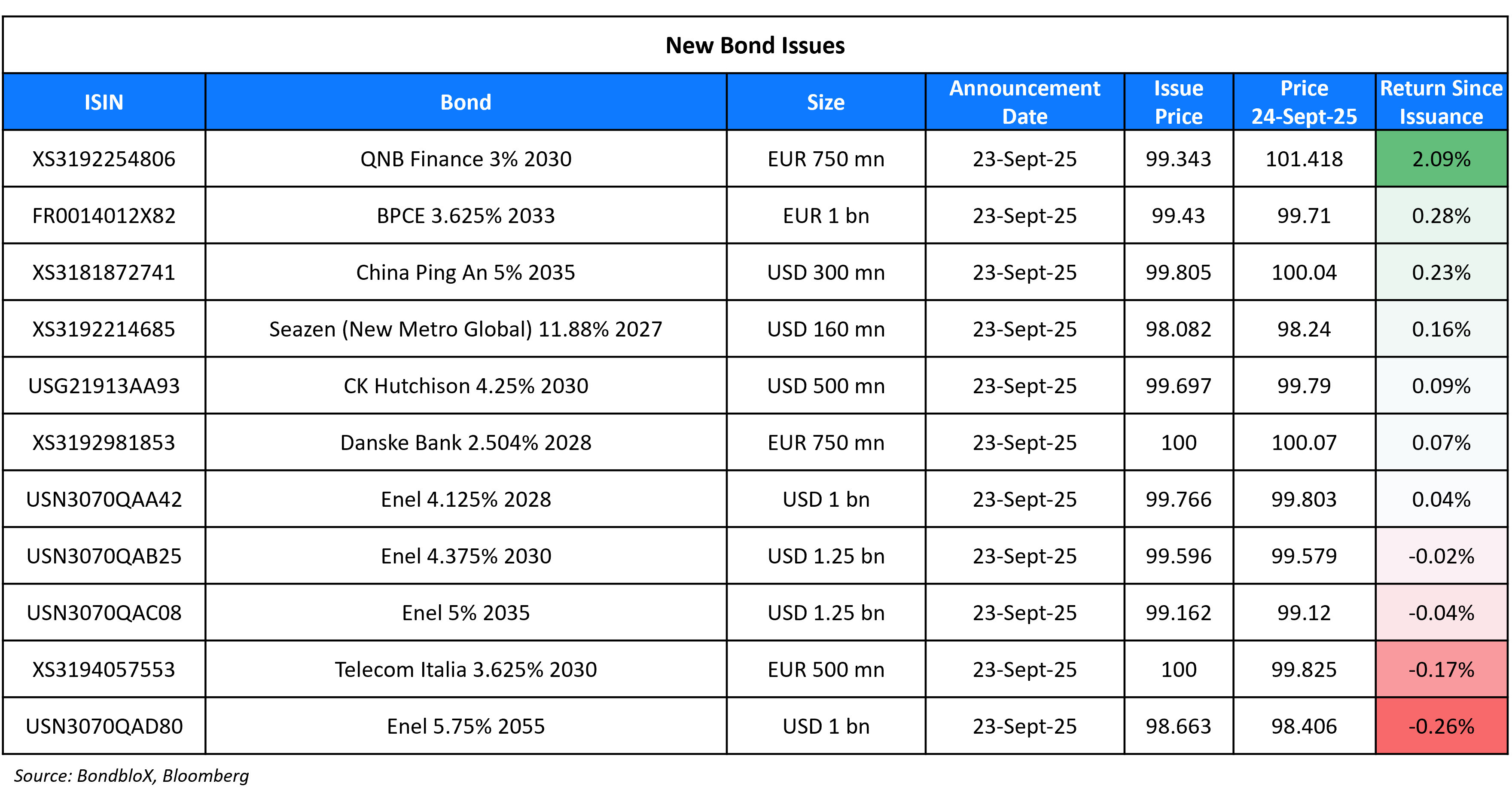

CK Hutchinson raised $500mn via a 5Y bond at a yield of 4.318%, 32.5bp inside initial guidance of T+95bp area. The senior unsecured note is rated A2/A/A-. Proceeds will be used to refinance certain debts and for general corporate purposes. The new bond is priced at a new issue premium of ~11bp over its existing 4.375% 2030s that currently yield 4.21%.

China Ping An Insurance raised $300mn via a 10Y bond at a yield of 5.025%, 41bp inside initial guidance of T+130bp area. The senior unsecured note is rated Baa2, and has a change of control put at 101. Proceeds will be used for refinancing and general working capital purposes of the issuer and/or its subsidiaries.

Seazen raised $160mn via a 2Y bond at a yield of 13%, 12.5bp inside initial guidance of 13.125% area. The guaranteed note is rated B- by S&P. Proceeds will be used to repay existing debt and for general corporate purposes.

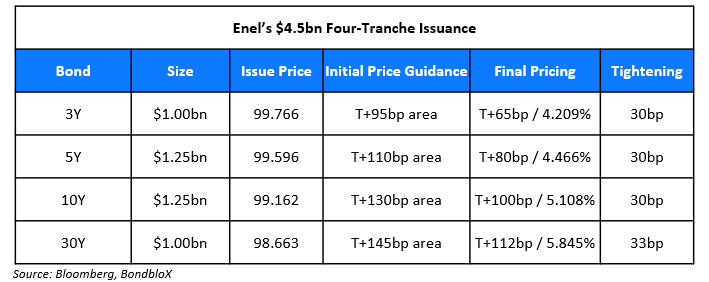

Enel Finance raised $4.5bn via a four-trancher.

The senior unsecured notes are rated Baa1/BBB/BBB+. Proceeds will be used for general corporate purposes. The new 3Y bond is priced roughly inline with its existing 2.125% 2028s that currently yield 4.22%.

The senior unsecured notes are rated Baa1/BBB/BBB+. Proceeds will be used for general corporate purposes. The new 3Y bond is priced roughly inline with its existing 2.125% 2028s that currently yield 4.22%.

Telecom Italia raised €500mn via a 5Y bond at a yield of 3.625%, 62.5bp inside initial guidance of 4.25% area. The senior unsecured note is rated Ba2/BB/BB. Proceeds will be used for general corporate purposes.

Qatar National Bank (QNB) raised €750mn via a 5Y green bond at a yield of 3.144%, ~27.5bp inside initial guidance of MS+100/105bp area. The senior unsecured note is rated Aa3/A+/A+. Proceeds will be used to finance, refinance and/or invest, in whole or in part, certain eligible projects under its green framework.

Danske Bank raised €750mn via a 3NC2 bond at a yield of 2.504%, 25bp inside initial guidance of 3m Euribor+75bp area. The senior non-preferred note is rated Baa1/A-/A+. Proceeds will be used for general corporate purposes.

BPCE raised €1bn via an 8NC7 social bond at a yield of 3.719%, 25bp inside initial guidance of MS+145bp area. The senior unsecured note is rated Baa1/BBB+/A, and received orders of over €4.8bn, 4.8x issue size. Net proceeds will be used to finance, refinance and/or invest, in whole or in part, certain eligible projects under its social framework.

New Bond Pipeline

- Mirae Asset Securities $ 3Y/5Y

- Binghatti $ 3Y bond

- Bank Muscat $ 5Y bond

Rating Changes

- Swedbank AB Upgraded To ‘AA-‘ On Solid Performance And Lower Residual Risks; Outlook Stable

- Fitch Upgrades FirstEnergy Pennsylvania Electric; Affirms FirstEnergy Corp. and Subsidiaries

- Fitch Downgrades Sempra Infrastructure Partners to ‘BBB’ Following Port Arthur LNG2 FID Announcement

- Fitch Downgrades IEnova to ‘BBB’ Following Parent Downgrade

- Hecla Mining Inc. Outlook Revised To Positive On Strong Credit Cushion; ‘B+’ Issuer Credit Rating Affirmed

Term of the Day: Haven Assets

Haven assets aka ‘safe havens’ refer to those class of assets/securities which are in demand when market conditions deteriorate. Examples of haven assets include US Treasury bonds, German Bunds, UK Gilts, Japanese Government Bonds (JGBs) and gold. These are in contrast to ‘risk assets’ which are generally those assets/securities that are in demand when market conditions are buoyant, like equities, real estate and high yield bonds.

Talking Heads

On Full impact of US tariff shock yet to come as growth holds up – OECD

“The full effects of these tariffs will become clearer as firms run down the inventories that were built up in response to tariff announcements and as the higher tariff rates continue to be implemented… “Additional increases in barriers to trade or prolonged policy uncertainty could lower growth by raising production costs and weighing on investment and consumption”

On Citigroup Exiting Treasuries Curve Trade as Fears Over Fed Subside

“Since our trade initiation in May, supply fears have become more muted… Fed policy meeting this month “has on the margin reduced Fed independence fears”

On Rise in Fed Funds Rate Signaling Potential Liquidity Strain

Gennadiy Goldberg, TD Securities

“The rise in the Fed funds rate for the first time in the cycle suggests that there may be some very early signs of pressures building in the very front-end of the curve”

John Canavan, Oxford Economics.

“At 4.09%, the effective fed funds rate isn’t yet at a point where it will be concerning for the Fed… highlights the extent of the firming in repo rates over the past few months”

Top Gainers and Losers- 24-Sep-25*

Go back to Latest bond Market News

Related Posts: