This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Citigroup, Sobha, Bombardier, SK Hynix and others Price $ Bonds

September 5, 2025

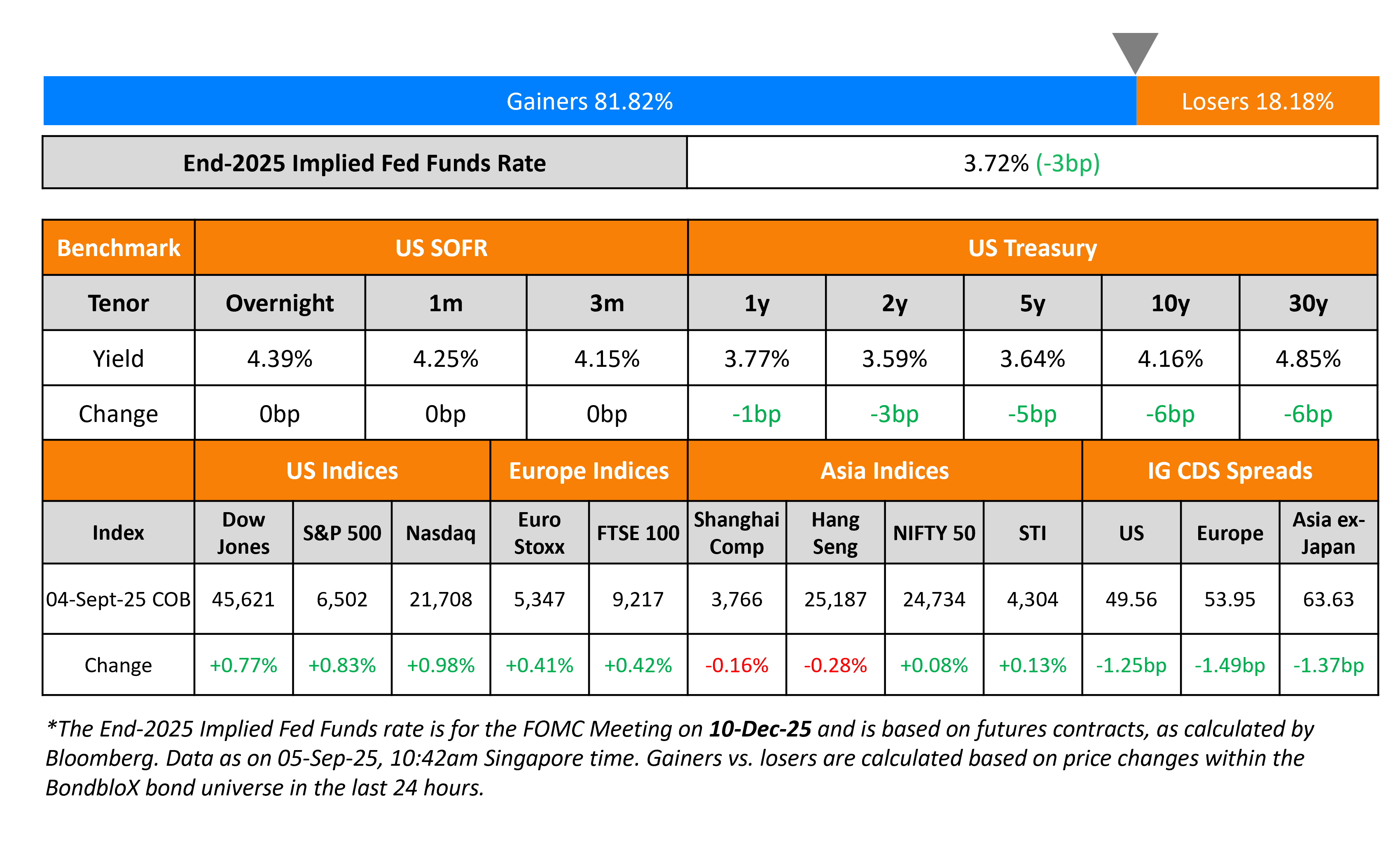

US Treasury yields fell by 5-6bp across the long-end of curve while the short-end eased by ~3bp. US ADP Payrolls came-in at 54k for August, lower than expectations of 68k and the prior month’s revised 106k. The ISM Services PMI for August came-in at 52.0, better than expectations of 51.0. Initial Jobless Claims for the previous week saw a rise to 237k, worse than expectations of 230k. Separately, New York Fed President John Williams said that it will “become appropriate to move interest rates toward a more neutral stance over time”

Looking at US equity markets, the S&P and Nasdaq were higher by 0.8% and 1% respectively. US IG CDS spreads were 1.3bp tighter while HY spreads tightened by 5.9bp. European equity markets ended higher too. The iTraxx Main and Crossover CDS spreads were 1.5bp and 4.5bp tighter respectively. Asian equity markets have opened in the green today. Asia ex-Japan CDS spreads were 1.4bp tighter.

New Bond Issues

Citigroup raised $6.5bn via a three-trancher. It raised:

- $3bnmn via a 6NC5 bond at a yield of 4.503%, 30bp inside initial guidance of T+115bp area. The new bond is priced at a new issue premium of 12bp over its existing 4.412% 2031s that currently yield 4.38%.

- $500mn via a 6NC5 FRN at SOFR+117.1bp vs. initial guidance of SOFR equivalent area

- $3bn via a 11NC10 bond at a yield of 6.45%, 30bp inside initial guidance of T+130bp area.

The senior unsecured notes are rated A3/BBB+/A. Proceeds will be used for general corporate purposes.

Sobha Realty raised $750mn via a 5Y green sukuk at a yield of 7.375%, ~43.75bp inside initial guidance of 7.75-7.875% area. The senior unsecured is rated Ba2/BB and issued by Sobha Sukuk l Holding Ltd. Net proceeds will be used to finance or refinance, in whole or in part, eligible projects under its green financing framework.

Bombardier raised $250mn via a tap of its 6.75% 2033s at a yield of 6.172%. The senior unsecured note is rated B1/BB-. Proceeds together with cash on hand will be used to fund the repayment and/or retire outstanding debt, including the redemption of all of its outstanding 7.125% 2026s, and ~$84mn of its outstanding 7.875% 2027.

Rede D’or Finance Sarl raised $500mn via a 10Y bond at a yield of 6.45%, inside initial guidance of the high-6% area. The senior unsecured note is rated BB+/BB+. The note has a change of control put at 101. Proceeds will be used for general corporate purposes, including capital expenditures, liquidity increase and debt repayment.

SK Hynix raised $1.2bn via a two-part deal. It raised $600mn via a 3Y bond at a yield of 4.284%, 42bp inside initial guidance of T+115bp area. It raised $600mn via a 5Y bond at a yield of 4.458%, 40bp inside initial guidance of T+120bp area. The notes are rated Baa2/BBB/BBB. Proceeds will be used for general corporate purposes, including repayment of outstanding borrowings. The new 3Y bond was priced 9bp tighter to its existing 5.5% bond due January 2029 that currently yields 4.37%. The new 10Y bond was priced ~10bp tighter to its existing 2.375% bond due January 2031 that currently yields 4.56%.

CCB London raised $1bn via a 3Y FRN at SOFR+50bp, 55bp inside initial guidance of SOFR+105bp area. It also raised $500mn via a 5Y FRN at SOFR+58bp, 57bp inside initial guidance of SOFR+115bp area. Proceeds will be used to finance and/or refinance, in whole or in part, loans to customers involved in, as well as the bank’s own operational activities in eligible green projects.

New Bond Pipeline

- Petron Corp $ Senior Perps

- Hong Kong USD/EUR/HKD/CNH Digitally Native Notes

Rating Changes

-

Marriott Vacations Worldwide Corp. Senior Unsecured Notes Rating Raised To ‘B+’; New Debt Rated

-

Moody’s Ratings upgrades Nucor’s senior unsecured rating to A3; outlook stable

-

Fitch Upgrades Samarco’s IDRs to ‘B’; Outlook Positive

-

Fitch Downgrades Spirit Airlines to ‘D’

-

Fitch Downgrades TalkTalk to ‘C’ on Confirmed Distressed Debt Exchange

-

Fitch Revises Mediobanca’s Rating Watch to Negative on Rejected Banca Generali Bid

-

Coty Inc. Outlook Revised To Negative; ‘BB+’ Issuer Credit Rating Affirmed

Term of the Day: Bond Vigilantes

Coined by Edward Yardeni, ‘Bond Vigilantes’ are bond market players who sell bonds in large quantities pushing up interest rates if they believe that the government isn’t protecting the currency. For example, if inflation rises, deficits grow, or a country’s creditworthiness is at risk, the bond vigilantes sell government bonds, which would lead to rising yields and therefore a higher borrowing cost for the government. Episodes of bond vigilantes selling bonds have been seen in the 1980s during the Clinton administration and also during the Obama administration as per Bloomberg.

Talking Heads

On Treasury Yields Lowest in Months as Jobs Data Back Rate Cuts

Tom di Galoma, Mischler Financial

“The Fed without doubt cuts rates in September”

Subadra Rajappa, Societe Generale

“Some of these cuts that are priced into the market are more preemptive than something that is warranted”

On Bond Vigilantes Fended Off as US Debt Emerges Surprise Winner

Ed Yardeni, Yardeni Research

“The bond market has been calm… US is still the best house in a crumbling neighborhood… still viewed as a safe haven”

Priya Misra, JPMorgan Investment Management

“If the labor market continues to lose momentum, the trend of US performance can persist”

On Wall Street Strategists Seeing More Unease on Fed Independence

Nikolaos Panigirtzoglou, JPMorgan

“Markets have become more concerned over Fed independence”

Goldman Sachs analysts

“A scenario where Fed independence is damaged would likely lead to higher inflation, lower stock and long-dated bond prices, and an erosion of the dollar’s reserve currency status”

Top Gainers and Losers- 05-Sep-25*

Go back to Latest bond Market News

Related Posts: