This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

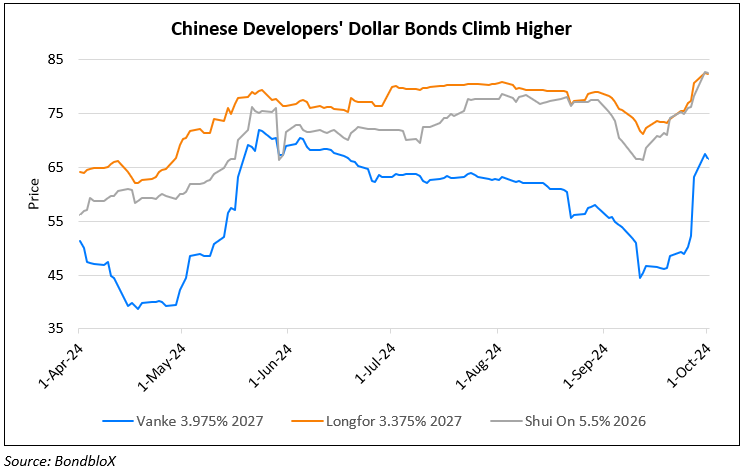

Chinese Property Bonds Continue to March Higher on Easier Home Purchase Rules

October 1, 2024

Bonds of Chinese developers including Vanke, Shui On, Longfor continued to march higher after major Chinese cities relaxed home purchase rules. This follows the recent stimulus package announced by Beijing aimed at revitalizing the struggling sector. Guangzhou became the first major city to lift all home purchase restrictions, while Shanghai and Shenzhen announced eased curbs for non-local buyers and reduced down payment requirements to at least 15% for first-time homebuyers. This supportive environment led to rapid sales in major cities, with developers like Shui On Land and Longfor Group quickly selling out new high-end projects. Beijing also relaxed its regulations, allowing non-residents to buy homes in core areas after three years of social insurance or income tax payments, down from five years, and cutting down payment ratios for first and second homes. These changes are set to take effect from 1 October, coinciding with a national holiday. The move by major cities follows a broader government initiative to stabilize the property market, which included lowering mortgage borrowing costs and easing down payment requirements. China’s leaders are increasingly focused on halting the decline in the real estate sector, which has seen new-home prices drop at the fastest rate since 2014. Dollar bonds of Chinese developers have seen almost double digits returns in the past week, as seen in chart above:

For more details, click here

Go back to Latest bond Market News

Related Posts: