This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China’s Reports Softer Than Expected PMIs

December 1, 2025

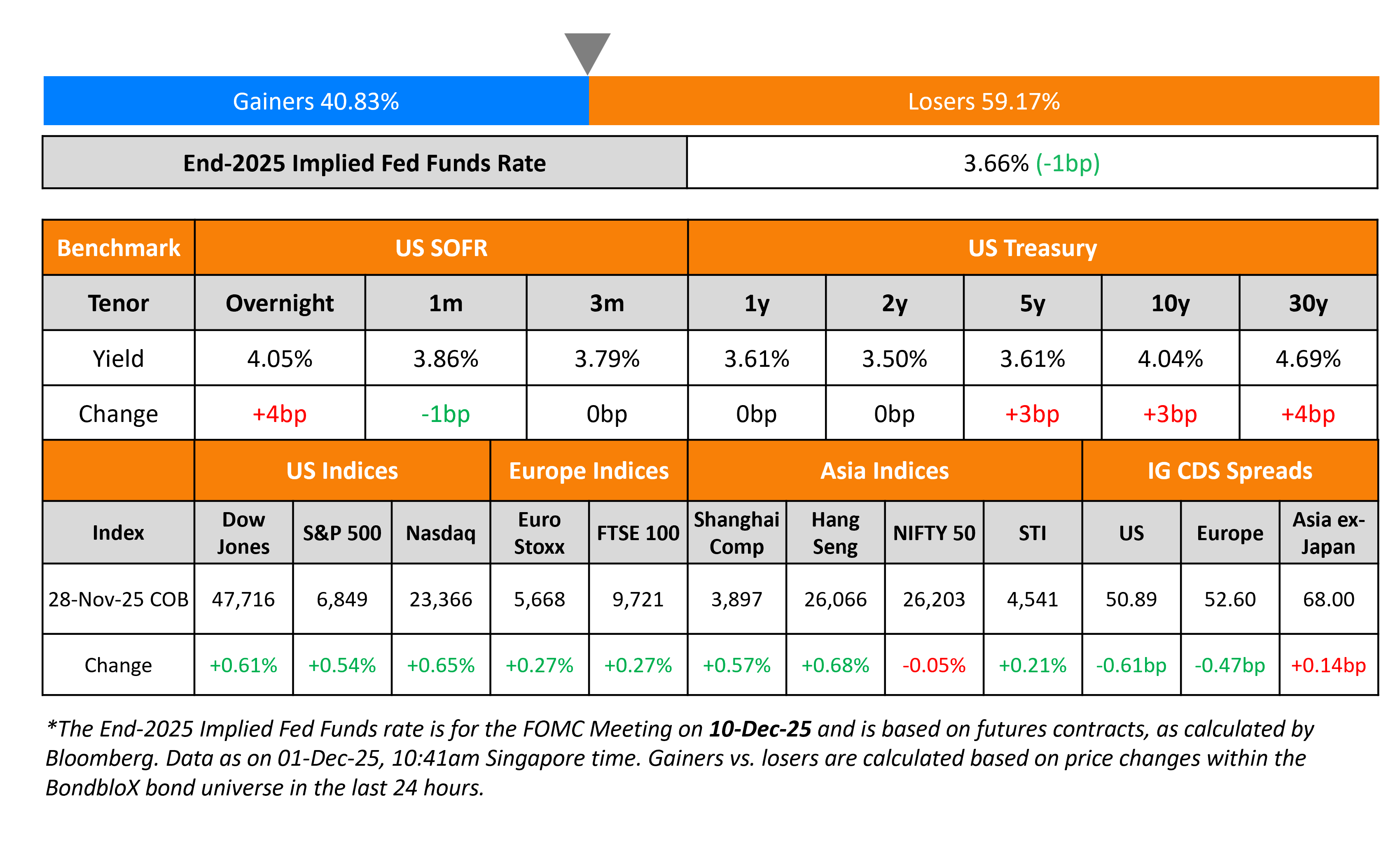

US Treasury yields have ticked higher by 3-4bp. There were no major macro data points on Friday, with a shortened trading session due to the Black Friday festive. This week is set to begin with ISM Manufacturing PMIs due later today. Looking at US equity markets, the S&P and Nasdaq were higher by 0.5% and 0.7% respectively on Friday. US IG and HY CDS spreads tightened by 0.6bp and 3.1bp respectively. European equity indices ended higher too, similar to US bourses. The iTraxx Main CDS and Crossover CDS spreads were 0.5bp and 2.2bp tighter respectively. Asian equity markets have opened broadly higher this morning. Asia ex-Japan CDS spreads were 0.1bp wider. Separately, China’s Manufacturing PMI for November came-in at 49.2, slightly worse than the estimated 49.4, albeit better than the prior month’s 49.0 print. The reading continued to remain in contraction territory for the eighth consecutive month. The Non-Manufacturing PMI fell to 49.5, missing expectations of 50.0 and lower than the prior month’s 50.1.

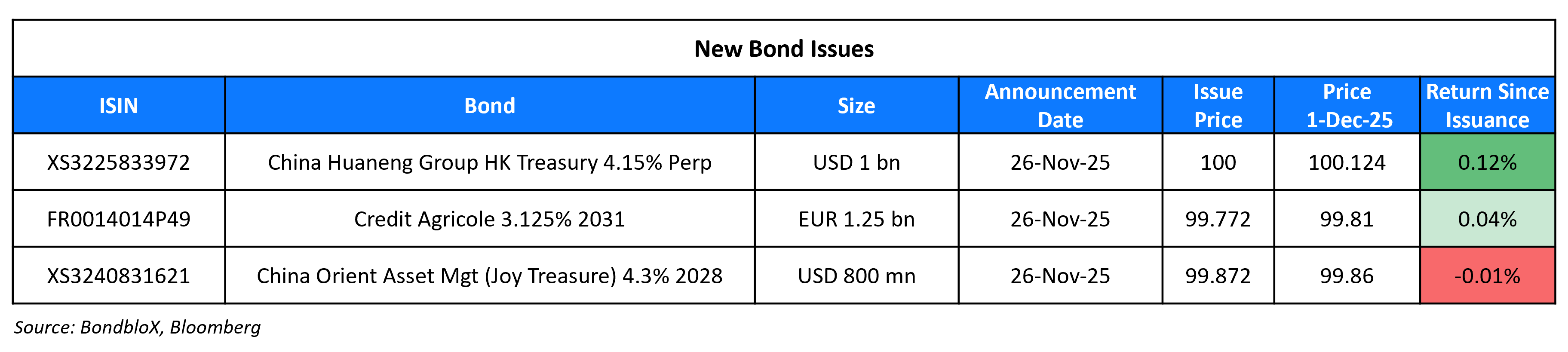

New Bond Issues

- Agricultural Bank of China (Tokyo) 3Y FRN at SOFR+100bp area

Rating Changes

- Fitch Upgrades Banco Comercial Portugues to ‘BBB+’; Outlook Positive

- Moody’s Ratings upgrades British Airways, Plc to Baa2 from Baa3; outlook stable

- Ratings On Two Uzbekistan-Based Banks Raised To ‘BB’ Following Similar Action On Sovereign; Outlook Stable

- Fitch Upgrades Zambia to ‘B-‘; Outlook Stable

- Moody’s Ratings upgrades IAG to Baa2 from Baa3; outlook stable

- U.K.-Registered Tullow Oil Downgraded To ‘CCC-‘ On Debt Restructuring Risk; Outlook Negative

- Fitch Revises TBC Bank JSC’s Outlook to Stable; Affirms at ‘BB’

Term of the Day: Viability Ratings (VRs)

Viability Ratings (VRs) are ratings assigned by Fitch to be internationally comparable and show their view of the intrinsic creditworthiness of an issuer. VRs are a key component of a bank’s Issuer Default Rating (IDR), as per Fitch. VRs are assigned primarily to banking companies with certain factors that could be indicative of a bank likelihood of failing or becoming non-viable. These factors include defaulting on senior obligations, entering a resolution regime/bankruptcy/administration receivership etc., triggering non-viability clauses embedded in the instrument, execution of a distressed debt exchange as defined by Fitch’s criteria and receiving extraordinary support such that a default or other event of non-viability is avoided.

Banco Comercial Português’ (BCP) viability rating was raised to bbb+ from bbb.

Talking Heads

On Some EMs Looking Safer Than the US To Bond Investors

James Athey, Marlborough Investment Management

“If I want fiscal conservatism and policy orthodoxy, I go to the emerging-market world currently, not developed markets”

Marco Ruijer, William Blair

“It’s ironic that EMs, once seen as serial defaulters, are now the ones with primary surpluses and inflation under control, while developed markets are running persistent fiscal deficits”

On South Africa’s ‘Everything Rally’ Hinging on Economic Promises

Hendrik du Toit, Ninety One Plc

“The question is job creation, job creation and job creation. Without it, you simply will not sustain momentum. “

Daniel Pinto, JPMorgan Chase

“Structural reforms that create jobs are essential. The government is doing some of the right things, and if reform deepens, the informal economy will shrink”

David Austerweil, Van Eck Associates Corp.

“We’ve moved to market weight in South African government bonds after having been very overweight all year”

On Interest Rates Being at Correct Level – ECB President, Christine Lagarde

“The interest rates we settled on at the last meetings are, in my view, set correctly. I keep saying that we’re in a good position given the inflation cycle, which we’ve managed to get under control… The situation has exceeded our expectations”

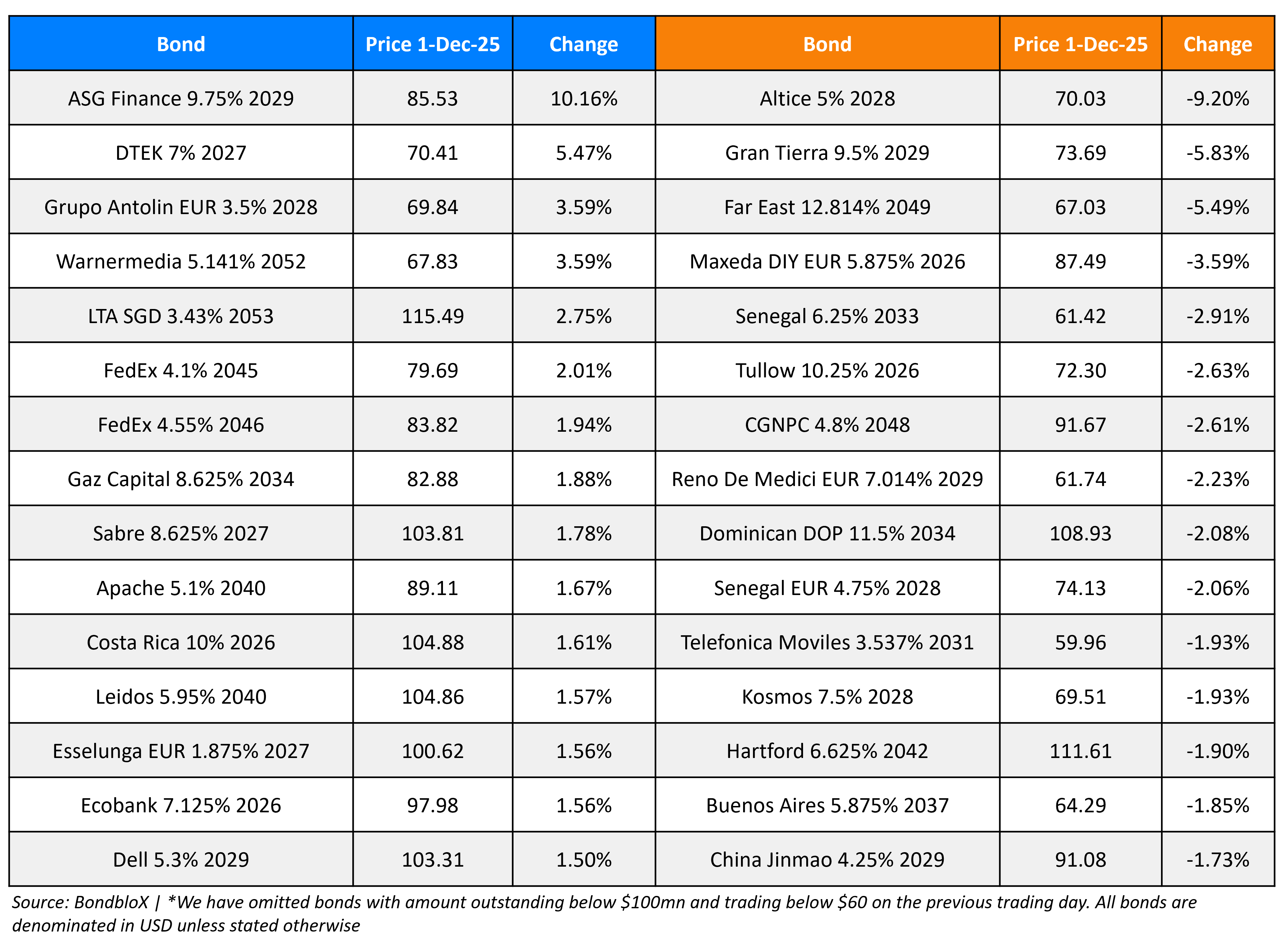

Top Gainers and Losers- 01-Dec-25*

Go back to Latest bond Market News

Related Posts: