This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China’s New Dollar Bonds Yield Lower Than US Treasuries

November 15, 2024

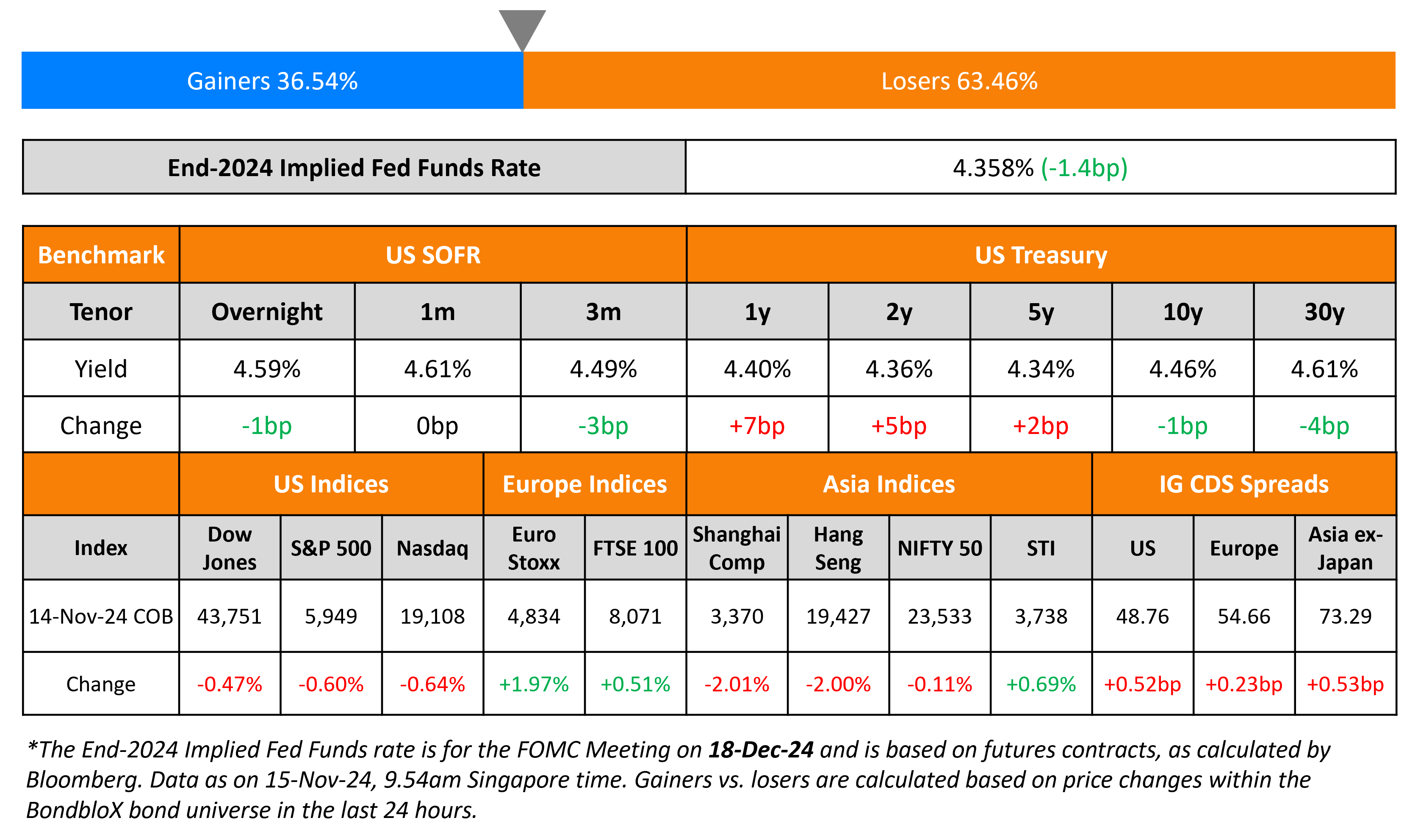

US short-end Treasury yields rose by over 5bp while the long-end yields inched lower. US PPI for October came-in marginally higher than expected. The annualized PPI reading came-in at 2.4% (vs. 1.9% last month), and the core value came-in at 3.1% (vs. 2.9% last month). Separately, the initial jobless claims for this week came-in stronger than expectations at 217k, signaling a steady US labor market. The Federal Reserve’s Jerome Powell and Adriana Kugler remarked that the Fed must proceed with caution with respect to rate cuts and not rush them. Traders have begun paring back their expectations for a rate cut at the FOMC’s December meeting to about 65% from over 80%. US IG and HY CDS spreads widened by 0.5bp and 4.6bp respectively. In terms of US equity markets, the S&P and Nasdaq and S&P both closed 0.6% lower.

European equities closed broadly higher. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.2bp and 1.5bp respectively. Asian equities have opened mixed this morning. Asia ex-Japan CDS spreads widened by 0.5bp.

Following China’s $2bn two-part dollar bond issuance yesterday, its new notes are currently yielding lower than comparable US Treasuries in secondary markets.

- China’s newly issued $1.25bn 4.125% 2027s currently yield 4.06% while the comparable US 3Y Treasury note yields 4.33%. To recall, the new notes were issued at T+1bp vs. an initial guidance of T+25bp area.

- Its newly issued $750mn 4.25% 2029s currently yield 4.04% while the comparable US 5Y Treasury note yields 4.34%. To recap, the new notes were issued at T+3bp vs. an initial guidance of T+30bp area.

The combined orders exceeded $40bn for the bond issuance, 20x the issue size. Traders said this was partly due to demand by Chinese investors, who can benefit from tax exemptions on the nation’s sovereign debt, hunting for higher returns globally as local rates have moved lower.

Deutsche Bank raised €1.5bn via PerpNC7 AT1 bond at a yield of 7.375%, 62.5bp inside initial guidance of 8% area. The junior subordinated notes are rated Ba2/BB. The bond is callable from 30 October 2031 to 30 April 2032 and if not called by then, the coupon resets to the 5Y Euribor ICE Swap Rate plus 511bp. A trigger event would occur if the issuer’s CET1 ratio falls below 5.125%.

New Bond Pipeline

- San Miguel Global Power hires for $ bond

- Tata Capital hires for $ bond

Rating Changes

-

Turkcell Iletisim Hizmetleri A.S. Upgraded To ‘BB’ After Sovereign Action; Outlook Stable

-

Turk Telekom Upgraded To ‘BB’ After Sovereign Action; Outlook Stable

-

CaixaBank S.A. Upgraded To ‘A’ From ‘A-‘ On Stronger Subordinated Bail-Inable Debt Buffer; Outlook Stable

-

Fitch Upgrades Bank of China (Hong Kong) to ‘A+’; Stable Outlook

-

Echostar Corp. Upgraded To ‘CCC+’ On Exchange At Subsidiary Dish Network Corp, Outlook Negative; Other Actions Taken

-

Celanese Corp. Ratings Lowered One Notch To ‘BB+’ On Weak Demand, Slow Deleveraging

-

Moody’s Ratings changes Mexico’s outlook to negative from stable, affirms Baa2 ratings

-

Frasers Logistics & Commercial Trust Outlook Revised To Negative On Stressed Credit Metrics; ‘BBB+’ Rating Affirmed

Term of the Day

Trigger Event

Triggers, or trigger events are an important feature of contingent convertible (CoCo) or additional tier 1 (AT1) bonds and define when the loss absorption mechanism is activated. Triggers can either be mechanical or discretionary. Mechanical triggers are numerically defined and most commonly refer to the bank’s capital ratio level. Discretionary triggers, also known as point of non-viability (PONV) triggers are based on supervisors’ judgement of the bank’s solvency position. On occurrence of a trigger event, an AT1’s loss absorption mechanism kicks in, which may include a conversion to equity and/or a principal write-down, both of which boost the bank’s capital position.

Talking Heads

On Fed Must Focus on Both Inflation and Jobs Goals – Fed Governor Adriana Kugler

“This combination of a continued but slowing trend in disinflation and cooling labor markets means that we need to continue paying attention to both sides of our mandate”

On Private Credit Broken a Junk Bond Barometer – Ed Altman, NY Stern School of Business

“Private credit has been a relatively new competitor for more traditional leveraged finance. Whenever there’s competition, there’s usually an impact on prices or, in this case, spreads… spreads could change due to a number of factors out there”

On Europe’s ‘Ugly’ Economy Risks Driving Euro Lower – Mohammed El-Erian

“If you look at the good, the bad and the ugly of the global economy, unfortunately Europe is the ugly”

Top Gainers and Losers- 15-November-24*

Go back to Latest bond Market News

Related Posts: