This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China, Santos, Santander, Westpac Launch Bonds

November 5, 2025

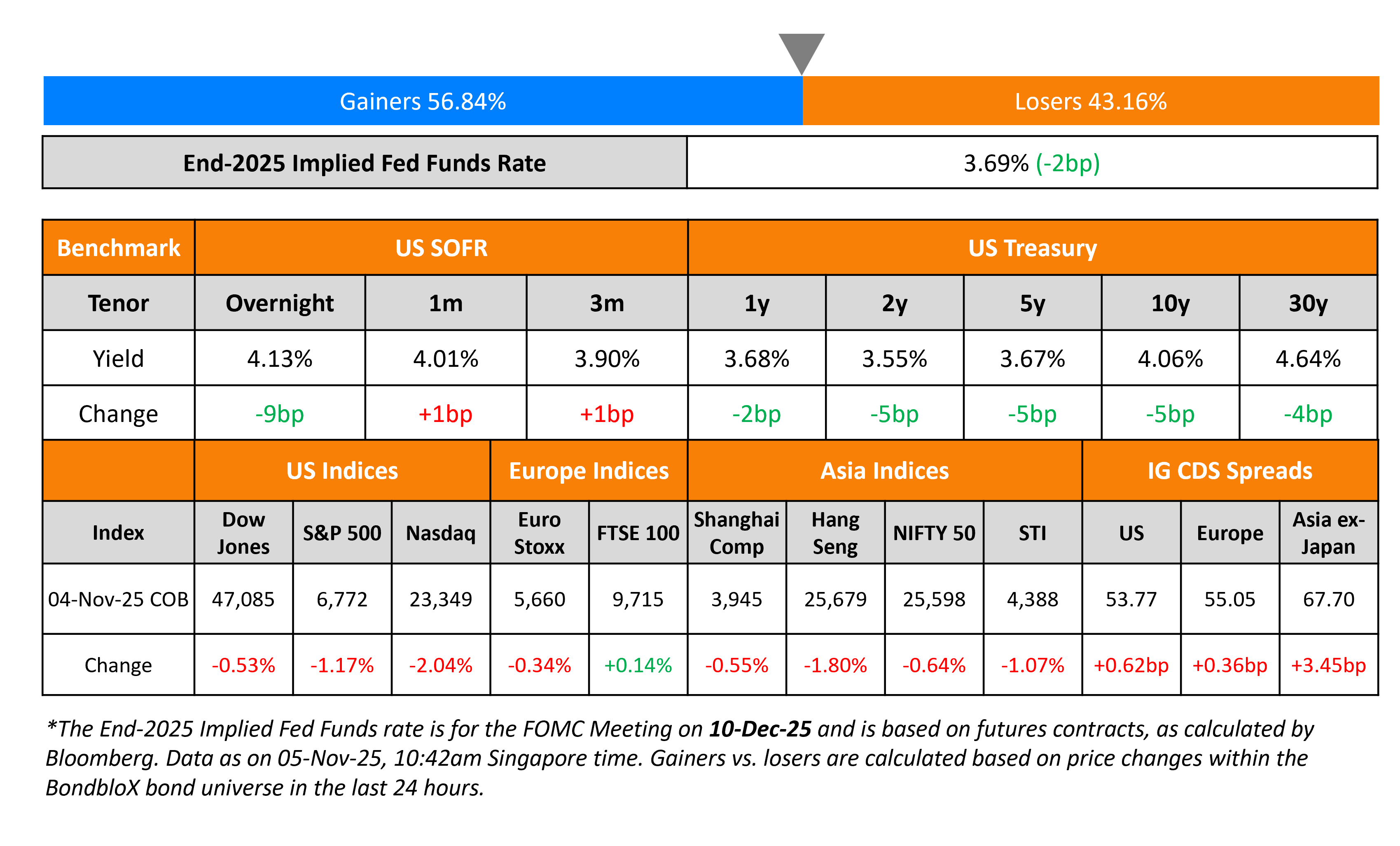

US Treasury yields eased by 4-5bp on Tuesday as the risk sentiment took a backfoot. The move came as equity markets dropped amid several comments by strategists and Wall Street executives regarding potential overvaluation concerns, especially in the technology sector. The Nasdaq fell by over 2% with NVIDIA falling by 4%, Oracle lower by 3.8% amongst others. The Dow and S&P ended lower by 0.5% and 1.2% respectively.

US IG and HY CDS spreads widened by 0.6bp and 3.9bp respectively. European equity indices ended mixed. The iTraxx Main CDS spreads were 0.4bp wider while the Crossover CDS spreads were wider by 1bp. Asian equity markets have opened in the red today. Asia ex-Japan CDS spreads widened by 3.5bp. China’s Services PMI in October rose by its slowest pace in three months to 52.6 from 52.9.

New Bond Issues

- China 3Y/5Y at T+25/T+30bp areas

-

Santos Finance $ 10Y at T+200bp area

-

Santander S$ 6NC5 at 2.55% area

-

KEPCO $ 3Y FRN/5Y sustainability at SOFR+95bp/T+80bp areas

-

Westpac A$ 5Y FRN/5Y/20Y Tier-2 at 3m BBSW+80bp/ASW+80bp/ASW+175bp areas

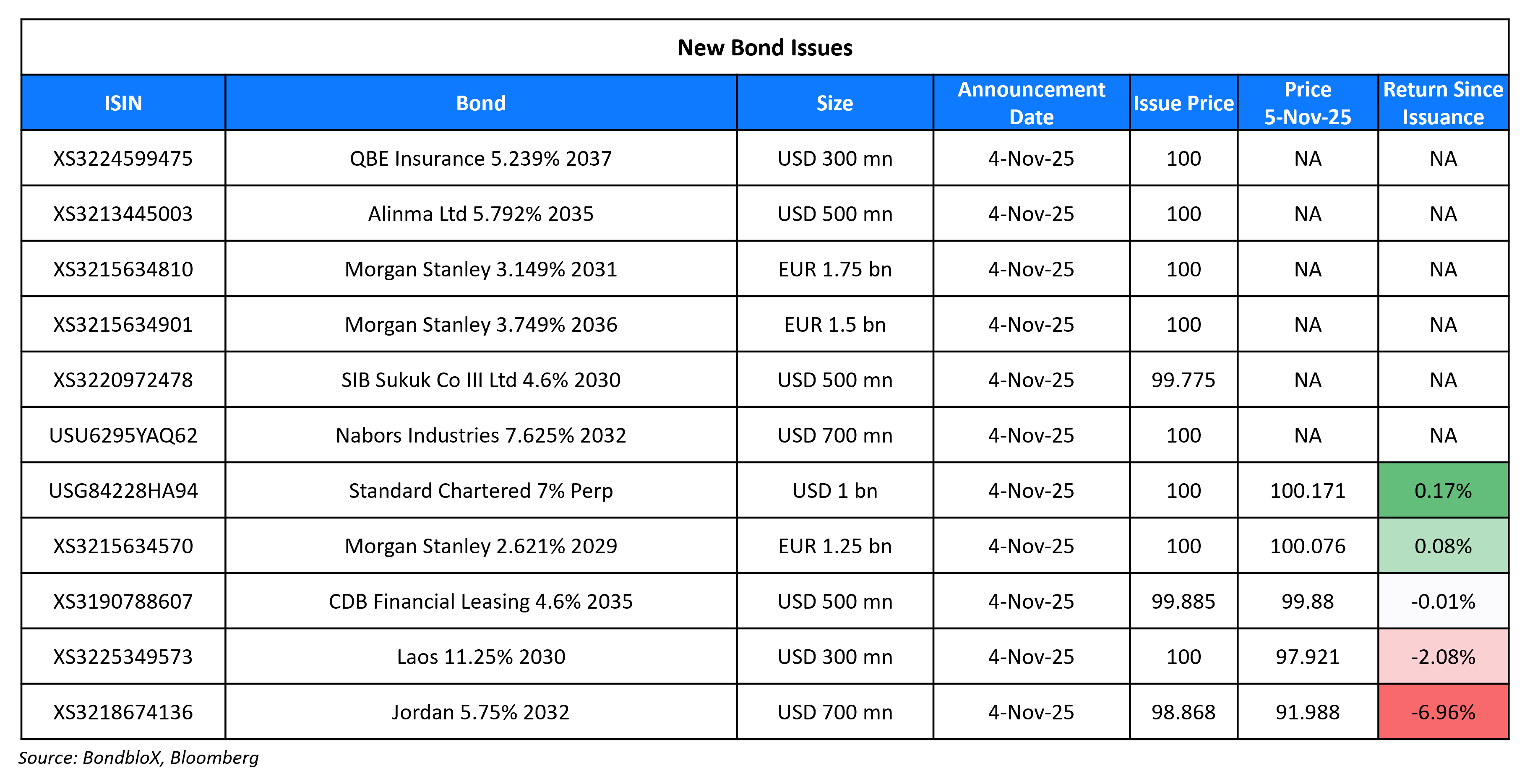

StanChart raised $1bn via a PerpNC10 AT1 bond at a yield of 7.00%, 37.5bp inside initial guidance of 7.375% area. The junior subordinated preferred note is rated Ba1/BB-/BBB- (Moody’s/S&P/Fitch). If not called by 14 May 2036, the coupon will reset to the US 5Y Treasury yield plus 287.3bp. Net proceeds will be used for general corporate purposes. A trigger event will occur if the CET1 ratio of the bank falls below 7.00%. Below is a comparison of the new issuance with its peers.

Jordan raised $700mn via a 7Y bond at a yield of 5.95%, 42.5bp inside initial guidance of 6.375% area. The senior unsecured note is rated Ba3/BB-. Proceeds will be used to finance the purchase of any/all of its outstanding 6.125% 2026s, tendered and accepted for purchase under its concurrent offer. Any remaining proceeds will be used for permitted purposes under its debt management law.

QBE raised $300mn via a 12NC7 Tier-2 bond at a yield of 5.239%, 35bp inside initial guidance of T+170bp area. The subordinated note is rated BBB+/BBB+ (S&P/Fitch), and received orders of over $4.2bn, 14x issue size.

Sharjah Islamic Bank raised $500mn via a 5Y sukuk at a yield of 4.651%, 30bp inside initial guidance of T+125bp area. The senior unsecured note is rated A- by S&P, and received orders of over $1.3bn, 2.6x issue size. The issuer of the sukuk is SIB Sukuk Co III Ltd.

Nabors raised $700mn via a 7NC3 bond at a yield of 7.625% vs. initial guidance of 7.5-7.75% area. The senior priority guaranteed notes are rated Ba3/B+/BB-. Proceeds, together with cash on hand, will be used to redeem its outstanding 7.375% 2027s. The company was upgraded to B, by both, S&P and Fitch.

Alinma raised $500mn via a 10NC5 Tier-2 bond at a yield of 5.792%, 30bp inside initial guidance of T+240bp area. The subordinated note is rated BBB (Fitch), and received orders of over $1.2bn, 2.4x issue size. Proceeds will be used for general corporate purposes, including the repayment of commercial paper.

Morgan Stanley raised €4.5bn via a three-tranche offering. It raised:

- €1.25bn via a 3.5NC2.5 FRN at 3m Euribor+60bp, 25bp inside initial guidance of 3m Euribor+85bp area

- €1.75bn via a 6NC5 at a yield of 3.149%, 25bp inside initial guidance of MS+105bp area

- €1.5bn via a 11NC10 bond at a yield of 3.749%, 25bp inside initial guidance of MS+135bp area

The senior unsecured notes are rated A1/A-/A+ (Moody’s/S&P/Fitch). Proceeds will be used for general corporate purposes.

CDBL Financing Leasing raised $500mn via a 10NC5 sustainability Tier-2 bond at a yield of 4.626%, 47bp inside initial guidance of T+140bp area. The subordinated note is rated BBB+ by Fitch. Proceeds will be used to boost the Tier-2 capital of the issuer, and to finance and/or refinance, in whole or in part, eligible projects under its sustainability framework.

Laos raised $300mn via a 5Y bond at a yield of 11.25%, unchanged from initial guidance. The notes are rated CCC+/CCC+ (S&P/Fitch). The bond has an amortizing structure — 50% of the outstanding principal will be amortized in November 2029 and 100% of the remaining outstanding principal in November 2030. Proceeds will be used to repay government debt, including commercial and bilateral obligations, and for general governmental purposes.

New Bonds Pipeline

- Hong Kong CNH/HKD/EUR/USD Digitally Native Green Notes

Rating Changes

- Moody’s Ratings upgrades Bharti’s ratings to Baa2; outlook stable

- Fitch Upgrades Nabors’ IDRs to ‘B’; Rates Proposed Senior Priority Guaranteed Notes ‘BB-‘/’RR2’

- Nabors Industries Ltd. Upgraded To ‘B’ On Refinancing And Debt Reduction; New Debt Rated ‘B+’

- Fitch Upgrades Fibabanka to ‘B+’; Outlook Stable

- Fitch Upgrades the Province of Neuquen to ‘CCC-‘

- Moody’s Ratings downgrades Canacol’s ratings to Ca; negative outlook

- Moody’s Ratings downgrades OPI’s CFR to Ca following Chapter 11 filing; stable outlook

- Fitch Revises Outlook on Adani Ports to Stable; Affirms at ‘BBB-‘

- SM Energy Co. ‘BB-‘ Ratings Placed On CreditWatch Positive On Announced Civitas Merger

- Fitch Places SM Energy’s Ratings on Positive Watch following Civitas Merger Announcement

Term of the Day: Risk-Off

Risk-off is an indication of global market sentiment wherein investors switch out from risky assets (i.e. risk-off) into safer assets on the back of increased uncertainty. This can be due to geopolitical risk, poor economic data or a crisis. Most typically, during a risk-off environment, US Treasuries and gold tend to perform better as they are considered haven assets. On the other hand, risk-on indicates positive investor sentiment wherein investors switch into risky assets (i.e. risk-on) from safer assets on improved prospects of economic growth. This can be due to improved political environment, strong economic data, strong corporate earnings, or a recovery from a crisis.

Talking Heads

On Wall Street heavyweights flagging risk of pullback in equity markets

Ted Pick, Morgan Stanley CEO

“We should welcome the possibility that there would be drawdowns, 10% to 15%, that are not driven by some sort of macro cliff effect”

David Solomon, Goldman CEO

“When you have these cycles, things can run for a period of time. But there are things that will change sentiment and will create drawdowns, or change the perspective on the growth trajectory… Technology multiples are full”

Jamie Dimon, JPMorgan CEO

“I am far more worried about that than others”… “lot of things out there” are creating an atmosphere of uncertainty

On Money-Market Stress Persisting Ahead of Fed’s QT Pivot

Mark Cabana, BofA

“The Fed is out of time and it seems like they’re scrambling. Dec. 1 was the only compromise they could achieve. I suspect the markets will force them to react soon.”

Joseph Abate, SMBC Nikko Securities America

“We suspect that markets may be more vulnerable to overnight funding rate pressure than they were in 2019”

John Velis, BNY

“We don’t think that temporary open market operations would be out of the question if this funding market stress continues”

On Treasuries Gaining across the Curve as US Stocks Tumble From Records

Ian Lyngen, BMO Capital Markets

“There are enough competing opinions on the Federal Open Market Committee that Powell wants to avoid the conversation about a 50bp move”

Aoifinn Devitt, Moneta Group

“Things really are priced for perfection currently, particularly when it comes to tech stocks”

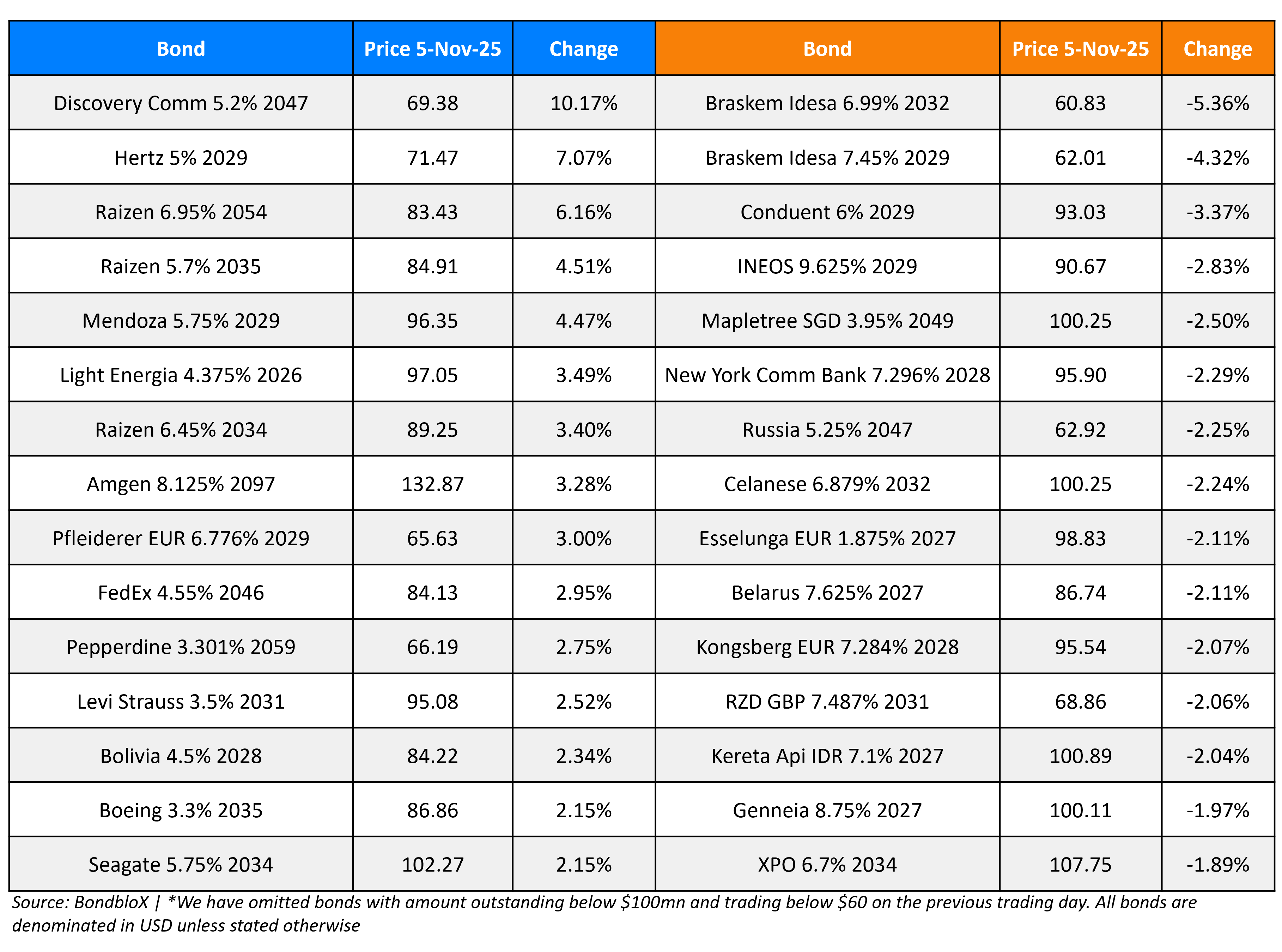

Top Gainers and Losers- 05-Nov-25*

Go back to Latest bond Market News

Related Posts: