This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China Orient, Huaneng, Credit Agricole Price Bonds

November 27, 2025

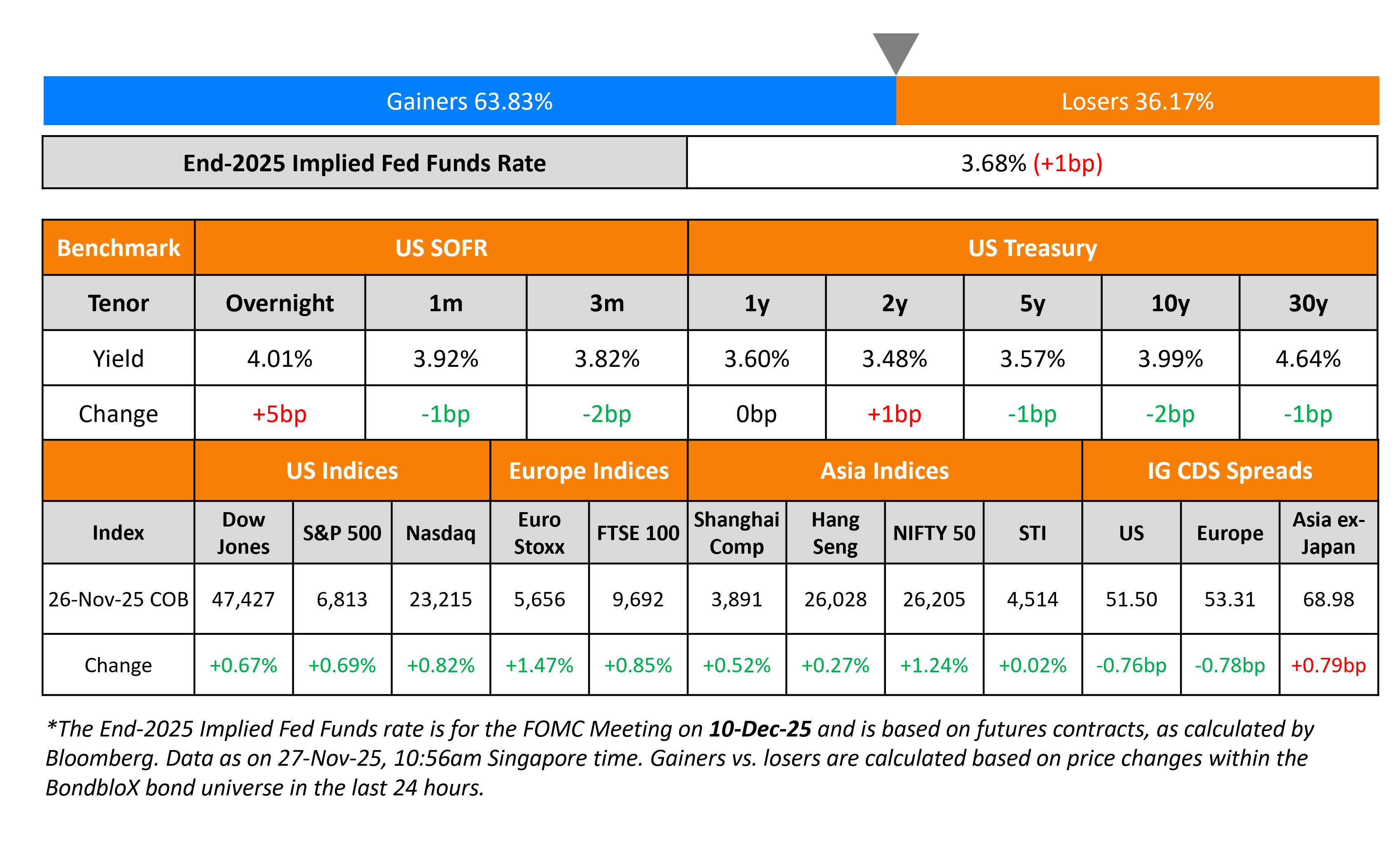

US Treasuries were broadly stable across the curve, with the 10Y yield going below the 4%-mark after a month. US Durable Goods Orders for September showed a 0.5% rise, inline with expectations, however, decelerating as compared to August’s 3.0% print. Separately, the Fed’s November Beige Book showed that consumer spending fell since October and that employment had declined slightly. It added that prices rose moderately led by input cost pressures among the manufacturing and retail space. Initial jobless claims for the previous week came-in at 216k, better than expectations of 225k.

Looking at the equity markets, the S&P and Nasdaq closed higher by 0.7% and 0.8% respectively. US IG and HY CDS spreads were tighter by 0.8bp and 4.4bp respectively. European equity indices ended higher too. The iTraxx Main CDS and Crossover CDS spreads were 0.8bp and 2.7bp tighter respectively. Asian equity markets have opened in the green this morning. Asia ex-Japan CDS spreads were 0.8bp wider.

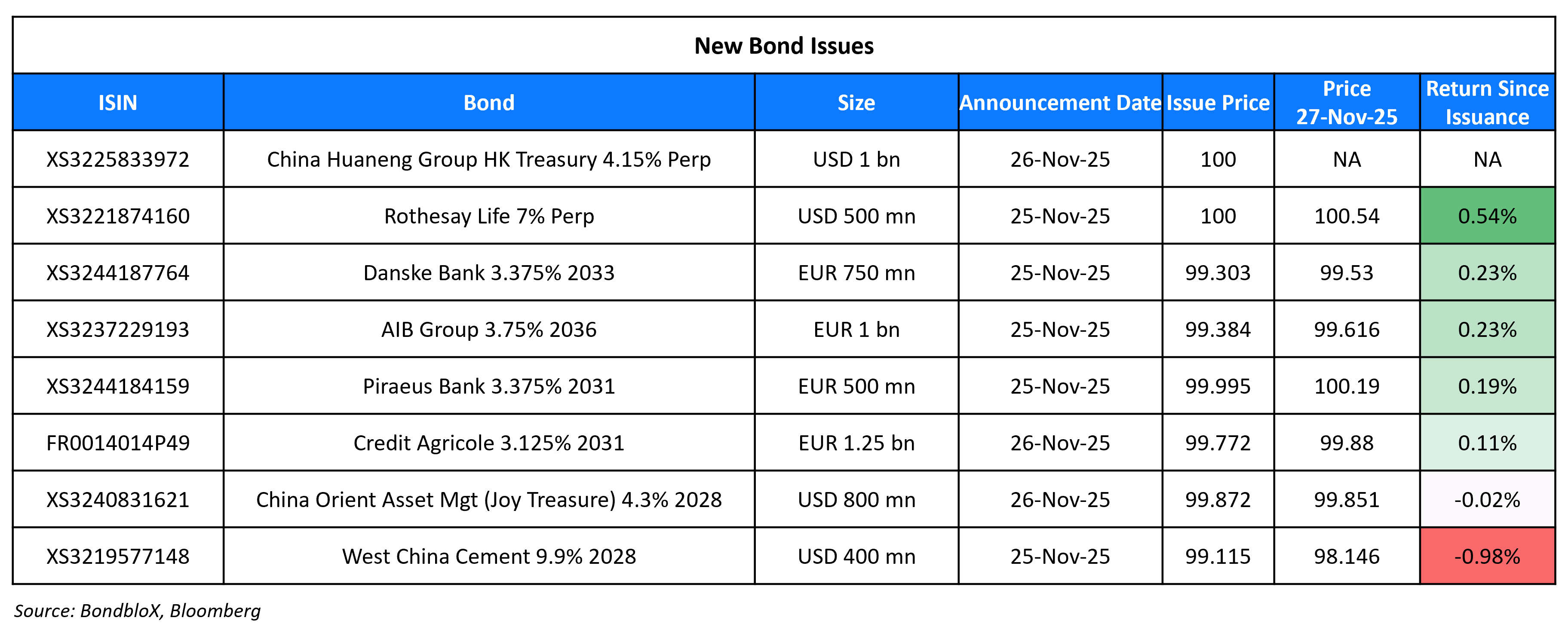

New Bond Issues

China Huaneng Group raised $1bn via a PerpNC3 bond at a yield of 4.15%, 55bp inside initial guidance of 4.70% area. The subordinated note is rated A3 by Moody’s. If not called by 3 December 2028, the coupon will reset to the US 3Y Treasury yield plus 367bp. The note has a 300bp coupon step-up upon the occurrence of any of the following events if the note is not redeemed — change of control, breach of covenant, relevant indebtedness default, dividend stopper breach. If any of the above events are remedied, the coupon step-up will be reversed. There will be no increase or decrease in the step-up upon any of these events after the first call date.

China Orient Asset Management raised $800mn via a 3Y bond at a yield of 4.346%, 52bp inside initial guidance of T+140bp area. The senior unsecured note is rated BBB/BBB+ (S&P/Fitch). The note has a change of control put at 101. Proceeds will be used for the payments due under its existing offshore notes.

Credit Agricole raised €1.25bn via a long 5NC4 social bond at a yield of 3.182%, 33bp inside initial guidance of MS+105bp area. The senior non-preferred note is rated A3/A-/A+, and received orders of over €2.5bn, 2x issue size. Proceeds will be used to finance and/or refinance, in whole or in part, eligible social assets under its framework.

Rating Changes

- Moody’s Ratings upgrades Bombardier’s CFR to Ba3; outlook positive

- Steel Tube Producer Vallourec Upgraded To ‘BBB-‘ On Sustainable Improvement In Margins; Outlook Stable

- Fitch Downgrades Braskem Idesa to ‘RD’

- Fitch Downgrades Casino to ‘CCC-‘ on Proposed Restructuring; on Rating Watch Negative

- Block Communications Inc. Downgraded To ‘B’ On Weak Operating Performance, Outlook Negative; Debt Ratings Lowered

- Moody’s Ratings downgrades BRB’s ratings to B3; ratings placed on review for further downgrade

- Uber Technologies Inc. Outlook Revised To Positive On Organic Business Prospects And Cash Flow Growth; Rating Affirmed

- Micron Technology Inc. Outlook Revised To Positive On AI-Driven Scale And Growth Enhancement; ‘BBB-‘ Rating Affirmed

- Spain-Based Bankinter Outlook Revised To Positive On Potential For Higher ALAC Buffer; ‘A-/A-2’ Ratings Affirmed

Term of the Day: Keepwell Provision

A keepwell provision is a legal agreement between a parent company and a subsidiary to ensure solvency and financial stability of the subsidiary for the duration of the agreement. Keepwell provisions are included in bond terms to offer bondholders confidence on the issuer’s ability to repay. The keepwell structure emerged around 2012-2013 to assuage concerns of investors over a bond issuer’s creditworthiness. However, it is important for investors to understand that keepwells are not a guarantee that the parent company will support the subsidiary in the event of a default, and there has previously been no precedent on the enforcement of keepwell structures. Vanke’s offshore bonds have keepwell provisions in place.

Talking Heads

On Wall Street’s Macro Traders Eyeing Biggest Haul in 16 Years

Nikhil Choraria, Goldman Sachs

“Central bank rates are normalizing policy rates and their balance sheets but what hasn’t normalized is the sheer amount of issuance”

Michael Karp, Options Group

“Expectations versus reality will be a mismatch”

Moritz Westhoff, Nomura Holdings

“With all the infrastructure and AI-type investment, how much of that could be rates hedged over time? They tend to be very large investments and they have to be financed.

On Fidelity International, Amundi Seeing at Least Two ECB Cuts

Salman Ahmed, Fidelity’s

“Once the Fed becomes more dovish under the new chair, the ECB won’t be able to hold… We are playing the first leg of the trade. That’s the way the pressure comes on ECB to cut.”

Amaury d’Orsay, Amundi

“Our view is that there is a high likelihood that the ECB will resume cuts… For me, this is a pressure on prices in the long-term”

On Funds Trimming UK Bonds Exposure Ahead of Budget

Laura Cooper, Nuveen

Spike in government bond yields “captures the need for them to take that very credible, unpopular stance… Maybe that’s a bit more of a wake-up call to what is actually needed to avoid another Liz Truss moment”

Fahad Kamal, Coutts & Co.

“Slow growth and ongoing inflation progress mean we expect interest rate cuts to support gilt markets moving forward”

Top Gainers and Losers- 27-Nov-25*

Go back to Latest bond Market News

Related Posts:.png)