This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China Minmetals Launches $ Perp; US PCE for Sep Inline with Expectations

December 8, 2025

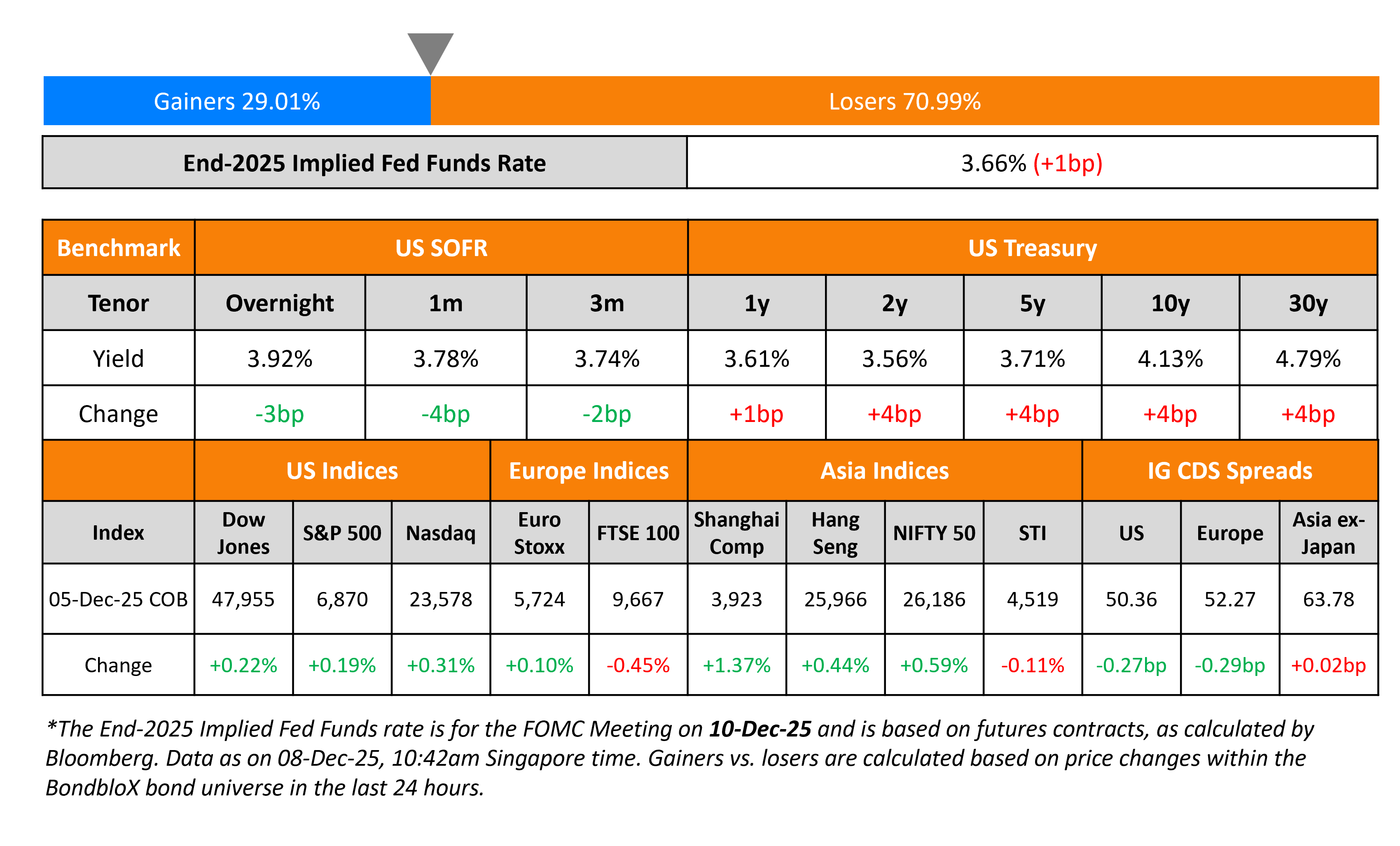

US Treasury yields ticked higher by 4bp. The delayed September PCE inflation report came in-line with expectations. The Headline and Core prints both, came-in at 2.8% each. Separately, the preliminary December University of Michigan Consumer Sentiment Index rose to 53.3, from 51.0 in November. This was the reading’s first increase in five months.

Looking at US equity markets, the S&P and Nasdaq closed higher by 0.2% and 0.3% respectively. US IG CDS spreads were 0.3bp tighter and HY spreads tightened by 1.1bp. European equity indices ended mixed. The iTraxx Main CDS spreads tightened by 0.3bp while the Crossover CDS spreads were 1.7bp tighter. Asian equity markets have opened weaker this morning. Asia ex-Japan CDS spreads were nearly unchanged.

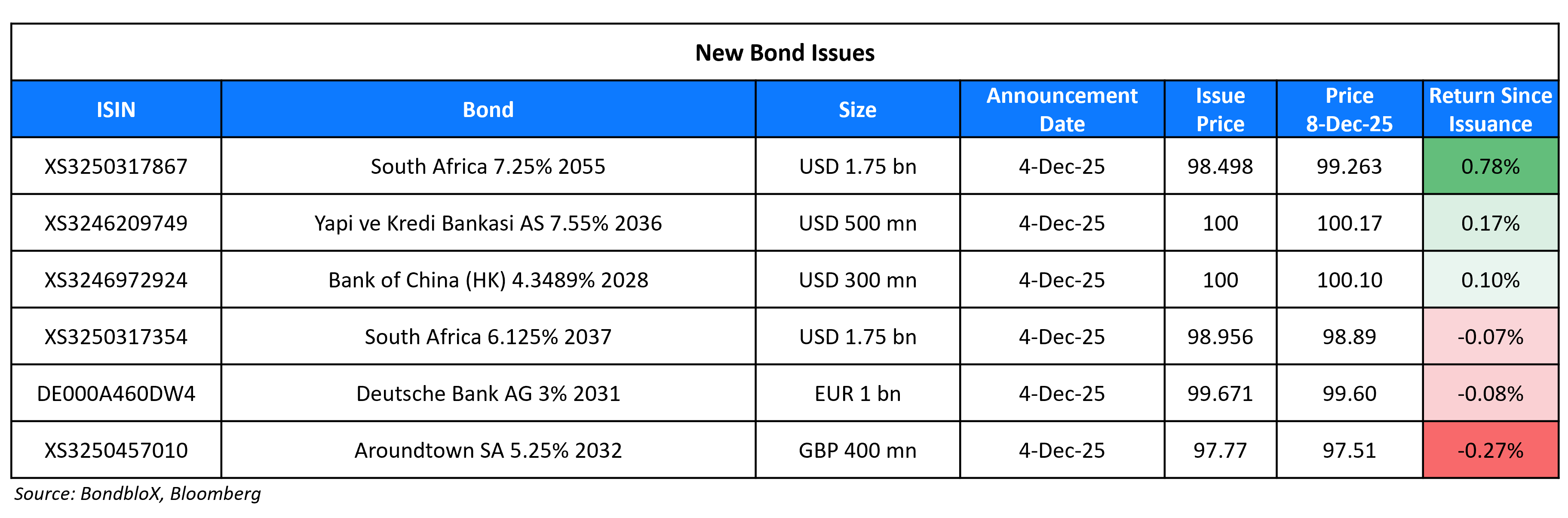

New Bond Issues

- China Minmetals $ PerpNC3.5 at 4.8% area

New Bonds Pipeline

- Chengdu Xincheng Investment $ 3Y bond

Rating Changes

- Fitch Upgrades Banco BPM to ‘BBB’; Outlook Stable

- Fitch Upgrades Xiaomi to ‘BBB+’; Outlook Stable

- Fitch Upgrades BPER to ‘BBB’; Outlook Positive

- Altice International S.a.r.l. Downgraded To ‘CCC’ On Increasing Likelihood Of A Distressed Exchange; Outlook Negative

- Petra Diamonds Ltd. Downgraded To ‘SD’ On Distressed Exchange; Debt Ratings Lowered To ‘D’

- ABN AMRO Bank N.V. Outlook Revised To Positive; ‘A/A-1’ Ratings Affirmed

- Azerbaijan Outlook Revised To Positive; ‘BB+/B’ Ratings Affirmed; Ratings Withdrawn At Issuer’s Request

- Fitch Revises Hungary’s Outlook to Negative; Affirms at ‘BBB’

Term of the Day: Debtor-in-Possession Financing

Debtor-in-possession (DIP) Financing is a funding option available to distressed companies that have filed for bankruptcy protection, where lenders believe that the company has a realistic chance of turning itself around. DIP financing is not an option available to distressed companies that simply want to liquidate the company. DIP financing can be a lifeline for distressed companies as it may find it hard to borrow from typical channels after filing for Chapter 11.

From a lender’s perspective, DIP financing can be attractive given the special treatment of such financing under US bankruptcy laws, which dictate that DIP lenders are to be paid before other creditors. DIP financing is subject to court approval wherein the distressed borrower must prove to the courts that the existing or older creditors will not be made worse by the new financing.

Talking Heads

On Investors to Double Down on Frontier Markets After Banner Year

Ruchir Desai, Asia Frontier Capital

“The frontier story is only beginning now. These countries have had to restructure the whole economy, the whole thought process of running the country”

Mohammed Elmi, Federated Hermes

“Frontier bonds have high income return component and capital appreciation opportunities, making them an attractive total return play in 2026… much more idiosyncratic in nature and less correlated to overall risk markets”

Daniel Wood, William Blair Investment Management

“We like a diversified basket of frontier countries that are uncorrelated with one another “

On Pinebridge Seeing EM Rally Tilting Toward Bonds

“We still believe in the carry trade but we are more pro bond trades… Growth acceleration in the US earlier in the year and growth differentials should support the dollar”… Hungarian bonds and currency as the “best bet”… “Turkey is also a standout”

On Economists Seeing Two Fed Rate Cuts in 2026 Following December Move

Dennis Shen, Scope Ratings

“Fed doves appear to slightly be in primacy over the hawks… If the Federal Reserve does ease again, we would expect Powell to emphasize a temporary pause afterward, awaiting further economic signals”

Thomas Simons, Jefferies

“Waller has institutional knowledge and experience as a Fed governor. It is also likely that he has better working relationships with other FOMC members… no reason to think that Hassett is a bad choice”

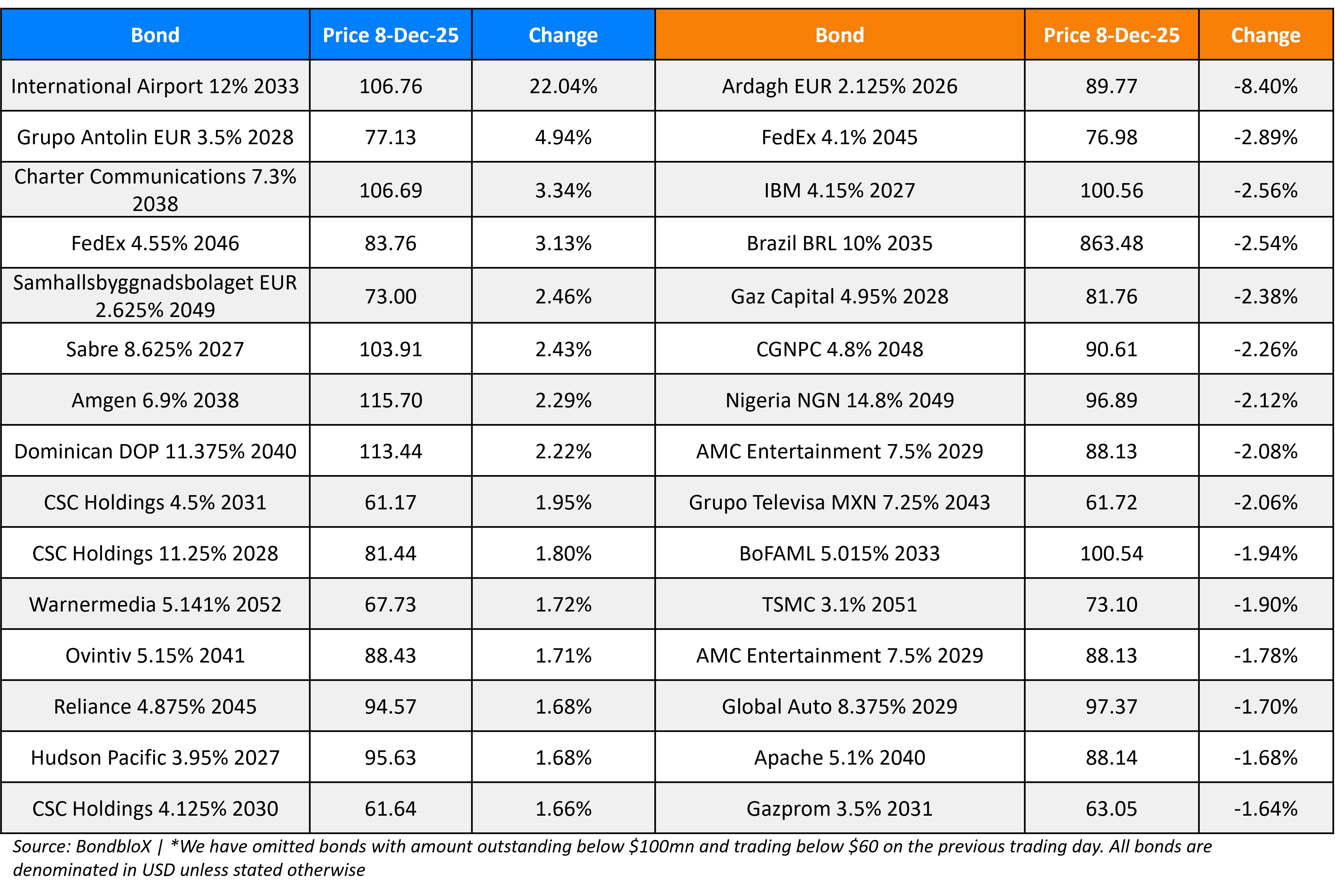

Top Gainers and Losers- 08-Dec-25*

Go back to Latest bond Market News

Related Posts: