This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China Launches € Bonds; Amazon, Enbridge, Commerzbank Price Bonds

November 18, 2025

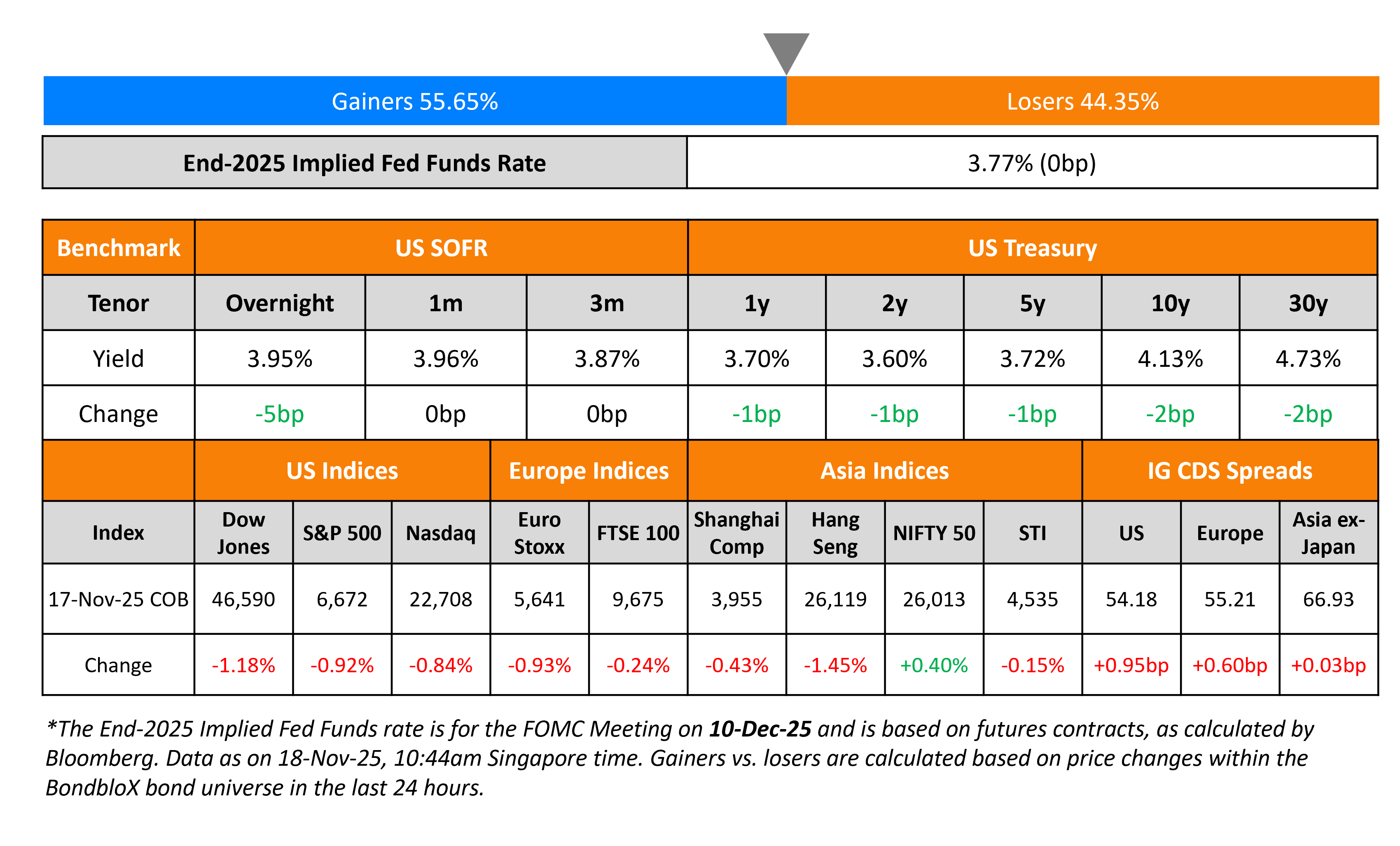

US Treasury yields eased by 1-2bp across the curve. Federal Reserve Vice Chairman Philip Jefferson said that the Fed needs to “proceed slowly” with any further interest rate cuts as they approach the neutral rate. On the other hand, Fed Governor Christopher Waller reiterated his view that they should cut rates again in December. Markets await Nvidia’s earnings release tomorrow amid the recent market sentiment over high AI valuations.

Looking at the equity markets, the S&P and Nasdaq closed lower by 0.9% and 0.8% respectively. US IG and HY CDS spreads were wider by 1bp and 5.8bp respectively. European equity indices ended lower too. The iTraxx Main CDS and Crossover CDS spreads were 0.6bp and 2.7bp wider respectively. Asian equity markets have opened in the red today. Asia ex-Japan CDS spreads were flat.

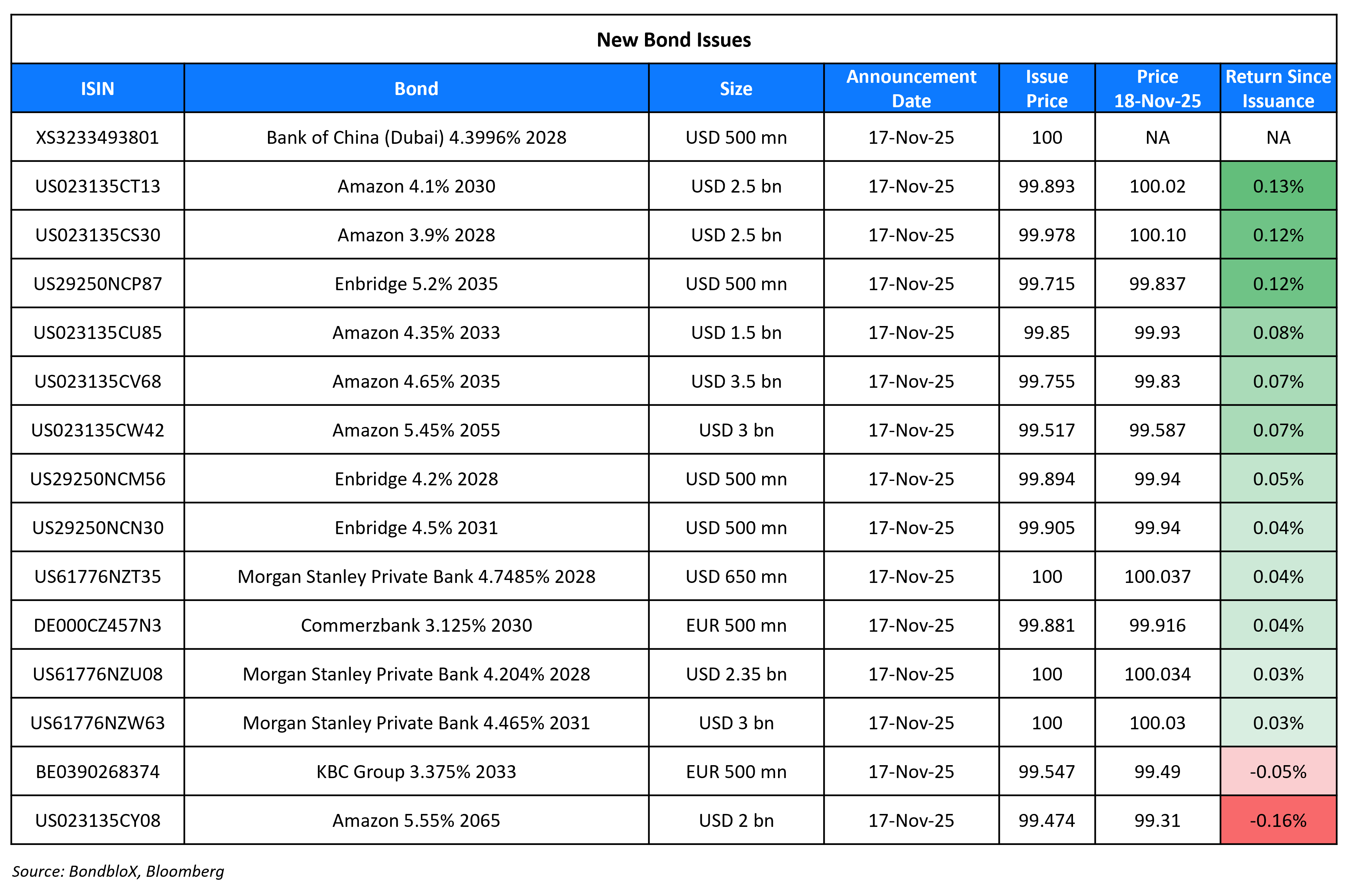

New Bond Issues

- China € 4Y/7Y at MS+28/38bp areas

-

Hong Kong Mortgage Corp $ 5Y at T+50bp area

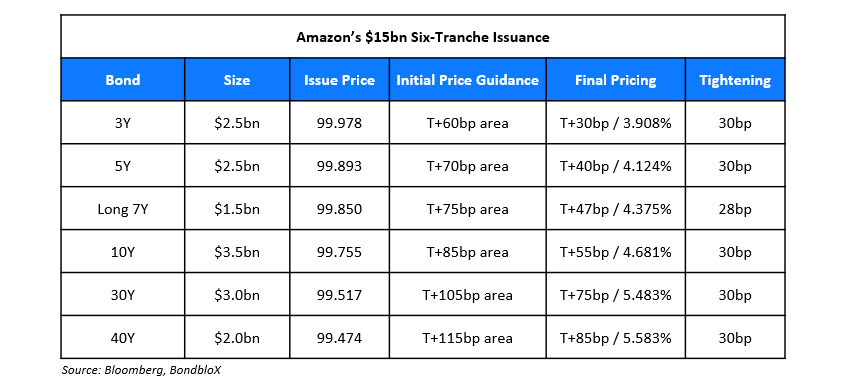

Amazon raised $15bn via a six-trancher.

The senior unsecured notes are rated A1/AA/AA-. Proceeds will be used for general corporate purposes, including debt repayment, acquisitions, investments, working capital, capital expenditures, and share buybacks.

Morgan Stanley Private Bank raised $6bn via a three-trancher. It raised:

- $2.35bn via a 3NC2 bond at a yield of 4.204%, 20bp inside initial guidance of T+80bp area.

- $650mn via a 3NC2 FRN at a SOFR+78bp vs. inside initial guidance of SOFR equivalent area.

- $3.00bn via a 6NC5 bond at a yield of 4.465%, 20bp inside initial guidance of T+95bp area.

The senior bank notes are rated Aa3/A+/AA-. Proceeds will be used for general corporate purposes.

Enbridge raised $1.5bn via a three-trancher. It raised:

- $500mn via a 3Y bond at a yield of 4.238%, 32bp inside initial guidance of T+95bp area.

- $500mn via a long 5Y bond at a yield of 4.522%, 30bp inside initial guidance of T+110bp area.

- $500mn via a 10Y bond at a yield of 5.237%, 30bp inside initial guidance of T+140bp area.

The senior unsecured notes are rated Baa2/BBB+/BBB+. Proceeds will be used to reduce existing debt, to finance future growth opportunities, including acquisitions if any, capital expenditures or for general corporate purposes.

StarHub raised S$300mn via a 10Y bond at a yield of 2.55%, 25bp inside initial guidance of 2.80% area. The senior unsecured note is unrated. Net proceeds will be used for financing general corporate funding requirements or investments (including financing new acquisitions, refinancing existing debt, working capital and capital expenditure).

Commerzbank raised €500mn via a 5NC4 bond at a yield of 3.157%, ~27.5bp inside initial guidance of MS+105/110bp area. The senior non-preferred note is rated Baa1/BBB, and received orders of over €2.5bn, 5x issue size.

KBC raised €500mn via an 8NC7 bond at a yield of 3.449%, 27bp inside initial guidance of MS+115bp area. The senior unsecured note is rated A3/A-/A. Proceeds will be used for general corporate purposes.

Bank of China (Dubai) raised $500mn via a 3Y FRN at SOFR+43bp, 57bp inside initial guidance of SOFR+100bp area. The senior unsecured note is rated A1/A/A. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- West China Cement $ bond

-

Bangkok Bank $ 5Y/10Y senior notes

Rating Changes

- Bharti Airtel Ltd. Ratings Raised To ‘BBB’ On Strong Earnings Momentum; Outlook Positive

- Fitch Upgrades 3 Turkish Banks’ IDRs on Government Support Rating Upgrades; Outlooks Stable

- Fitch Upgrades 4 Turkish Banks on Upward Revision of Operating Environment

- Cheniere Energy Inc. Upgraded To ‘BBB+’ From ‘BBB’ On Strong Stage 3 Progress; Outlook Stable

- Moody’s Ratings upgrades Thermo Fisher to A2/P-1; outlook is stable

- Moody’s Ratings upgrades Danaher to A2/P-1; outlook is stable

- Moody’s Ratings upgrades TUI Cruises’ CFR to Ba2 from Ba3, outlook stable

- Longfor Downgraded To ‘BB-‘ From ‘BB’ On Weakening Sales And Margins; Outlook Stable

- Celanese Corp. Ratings Lowered One Notch To ‘BB’ On Elevated Debt; Outlook Negative

- Fitch Downgrades Fingrid Oyj to ‘A’; Stable Outlook

- Adecco Group AG Downgraded To ‘BBB’ On Persistently High Leverage Despite Improving Trend; Outlook Stable

- Moody’s Ratings places CSN’s ratings on review for downgrade

Term of the Day: Forbearance

A forbearance or moratorium is a temporary suspension on debt wherein the borrower does not have to make any repayments. It is a waiting period with some protections for the borrower before repayments begin. Typically interest is accumulated until the end of the moratorium period and the accrued interest is then added to the principal amount of the debt.

Talking Heads

On Warning of ‘Garbage Lending’ as Private Credit Booms – Jeffrey Gundlach, DoubleLine Capital

“The health of the equity market in the United States, it’s among the least healthy in my entire career… One has to be very careful about momentum investing during mania periods — I feel like that’s where we are right now… There’s only two prices for private credit — 100 or zero… It looks like it’s safe because you could sell it any day, but it’s not safe because the price at which you sell will be gapping lower day after day”

On selling credit derivatives on Big Tech as AI risks grow

Jim Reid, Deutsche Bank

“Some of this is concern about AI corporate bond supply over the next few quarters after a surprise surge in recent weeks. However, it seems that they are also being used as a general hedge for all sorts of positive AI positions”

Michael Hartnett, BofA

“Best short is AI hyperscaler corporate bonds”

On Gold Declining for Fourth Day as US Rate-Cut Expectations Weaken

Lina Thomas, Goldman Sachs

“We continue to see elevated central-bank gold accumulation as a multiyear trend, as central banks diversify their reserves to hedge geopolitical and financial risks”

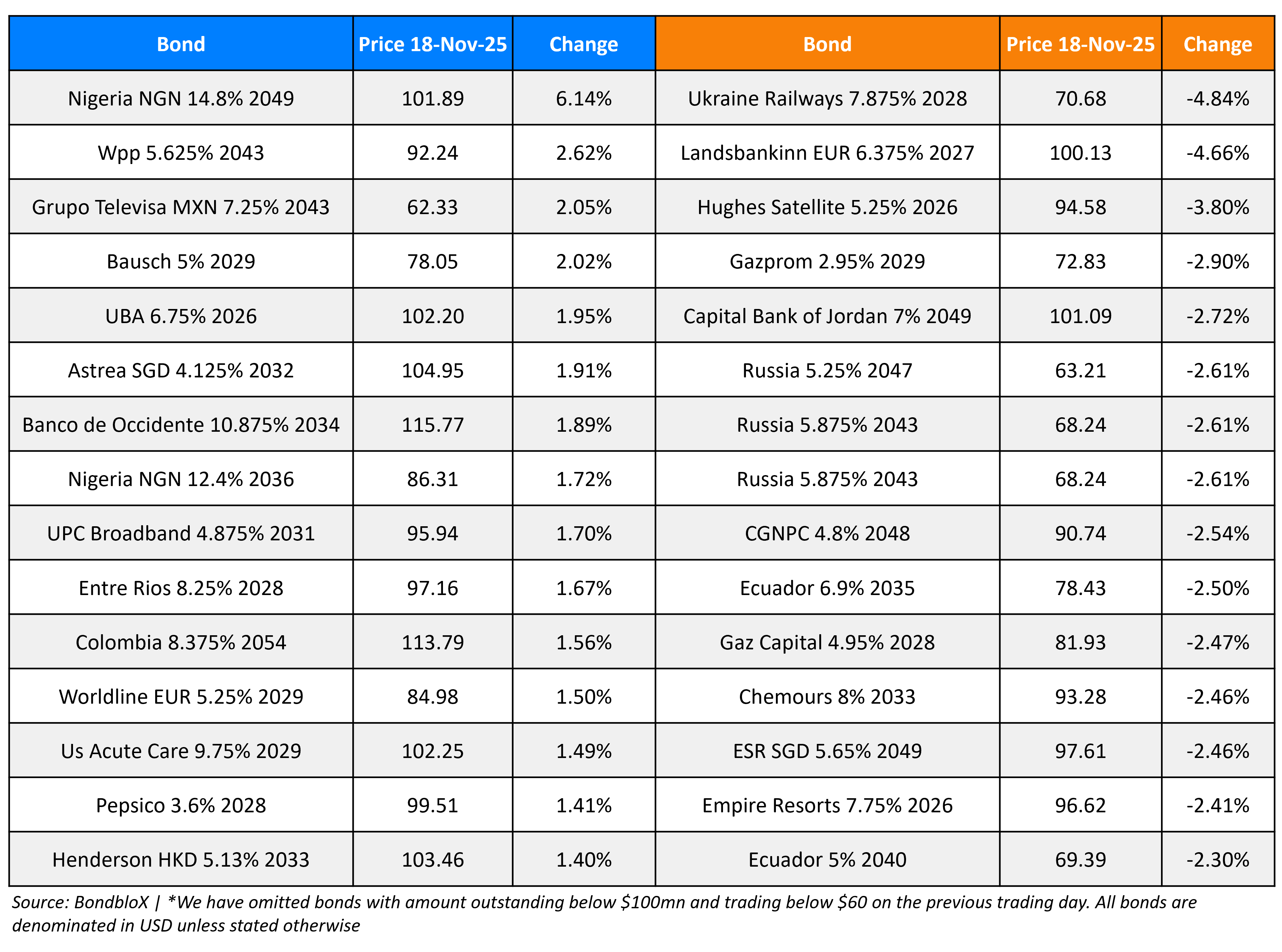

Top Gainers and Losers- 18-Nov-25*

Go back to Latest bond Market News

Related Posts: