This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China Cinda, NAB Launch Bonds; Santander, China, Nigeria and Others Price Bonds

November 6, 2025

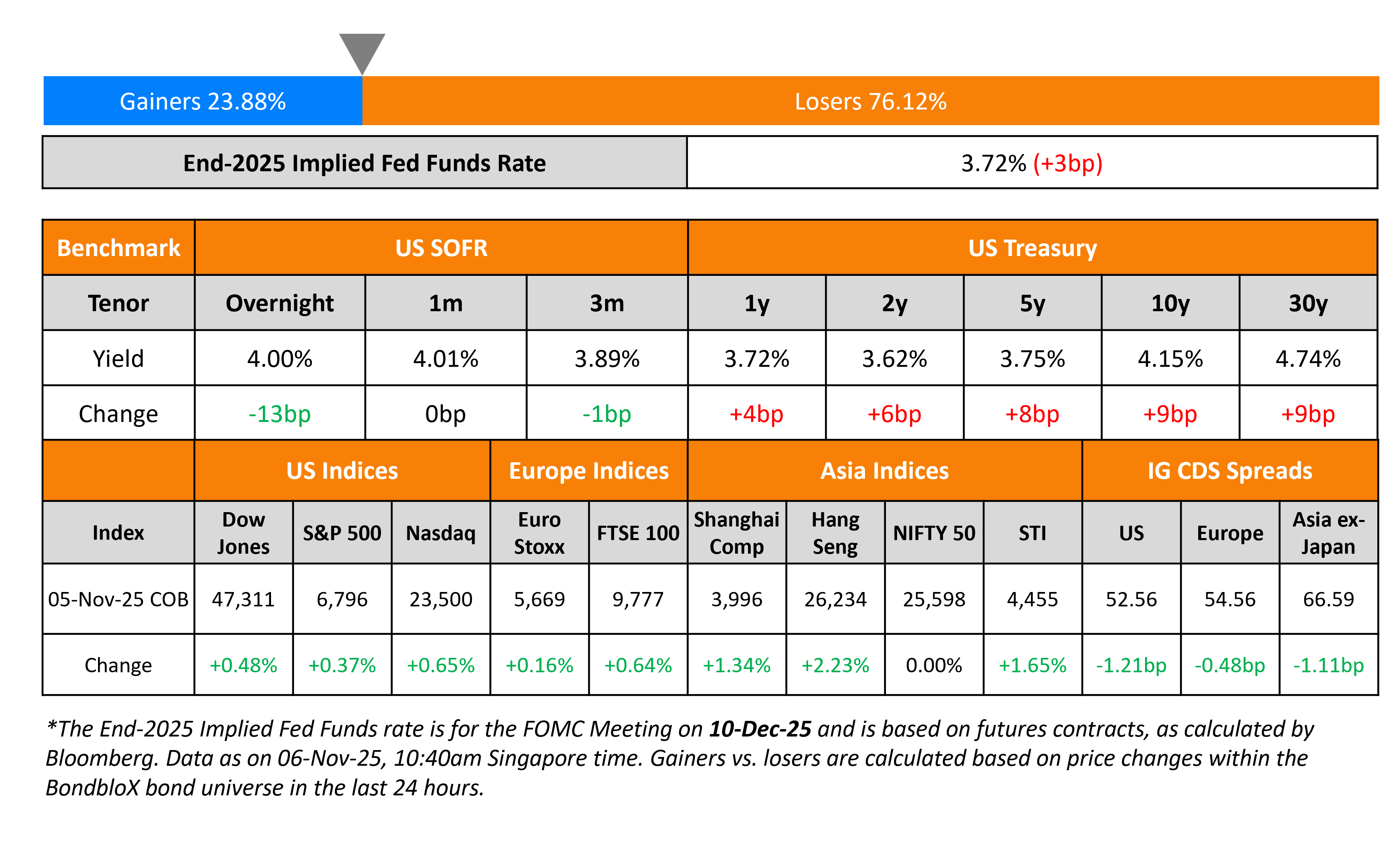

US Treasury yields surged by over 6-9bp on Wednesday on the back of positive data. First, the ADP report showed that private payrolls rose by 42k in October, better than expectations of 30k and the prior month’s 29k drop. Also, the ISM Services reading came in at 52.4, better than expectations of 50.8 and the prior reading of 50.0. The was helped by a jump in the New Orders sub-component to 56.2 from 50.4 priorly.

Looking at equity markets, the S&P and Nasdaq jumped higher by 0.4% and 0.7% respectively. US IG and HY CDS spreads tightened by 1.2bp and 6.2bp respectively. European equity indices ended higher. The iTraxx Main CDS spreads were 0.5bp tighter and the Crossover CDS spreads were tighter by 2.3bp. Asian equity markets have opened in the green today. Asia ex-Japan CDS spreads tightened by 1.1bp.

New Bond Issues

-

China Cinda HK $ 3Y/5Y FRN at T+130bp/SOFR+150bp areas

- NAB A$ subordinated 10NC5 at ASW+140/145bp area

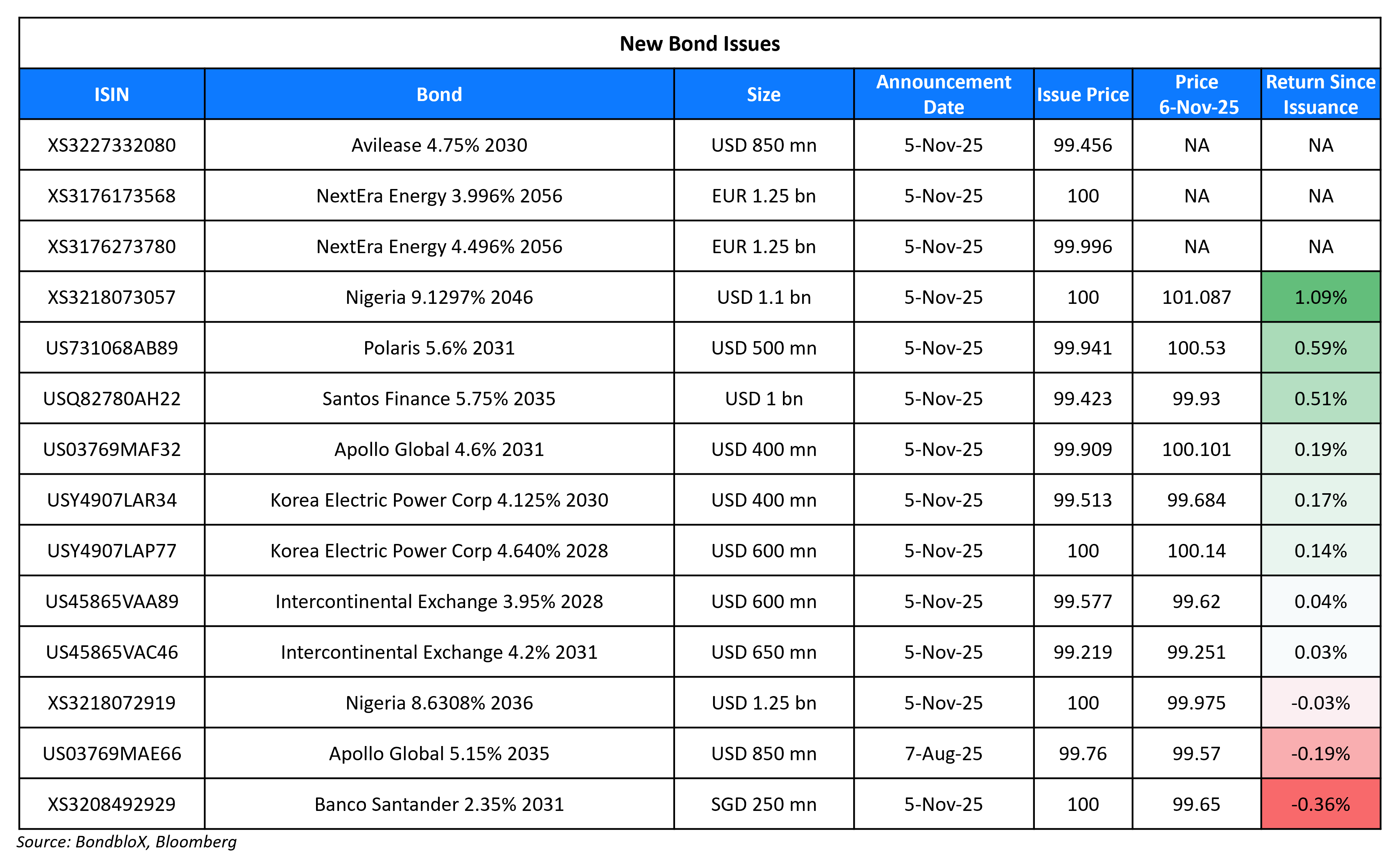

Santander raised S$250mn via a 6NC5 bond at a yield of 2.35%, 20bp inside initial guidance of 2.55% area. The senior non-preferred note is rated Baa1/A-/A (Moody’s/S&P/Fitch). Proceeds will be used for general corporate purposes.

China raised $4bn via a two-trancher. It raised $2bn via a 3Y bond at a yield of 3.646%, 25bp inside initial guidance of T+25bp area. It also raised $2bn via a 5Y bond at a yield of 3.787%, 28bp inside initial guidance of T+30bp area. The senior unsecured notes are unrated, and received orders of $121bn, ~30x issue size. Net proceeds will be used for general governmental purposes.

Santos Finance raised $1bn via a 10Y bond at a yield of 5.827%, 32bp inside initial guidance of T+200bp area. The senior unsecured notes are rated Baa3/BBB-/BBB (Moody’s/S&P/Fitch). The bond has a change of control put at 101. Proceeds will be used for general corporate purposes. The bond has restrictive covenants that include a limitation on liens and a consolidation, merger and sale of assets.

Nigeria raised $2.347bn via a two-trancher. It raised $1.247bn via a 10Y bond at a yield of 8.625%, 50bp inside initial guidance of 9.125% area. It also raised $1.1bn via a 5Y bond at a yield of 9.125%, 50bp inside initial guidance of 9.625% area. The senior unsecured notes are rated B3/B-/B, and received orders of over $12.4bn, ~5.3x issue size. Proceeds will be used to fund its 2025 fiscal deficit or to refinance outstanding debt.

AviLease Capital Limited raised $850mn via a 5Y bond at a yield of 4.874%, 30bp inside initial guidance of T+140bp area. The senior unsecured notes are rated Baa2/BBB (Moody’s/Fitch). Proceeds will be used for general corporate purposes.

KEPCO raised $1bn via a two-part sustainability offering. It raised $600mn via a 3Y FRN at SOFR+62bp, 33bp inside initial guidance of SOFR+95bp area. It also raised $400mn via a 5Y bond at a yield of 4.234%, 33bp inside initial guidance of T+80bp area. The senior unsecured notes are rated Aa2/AA (Mooody’s/S&P). Proceeds will be used to finance/refinance, in whole or in part, its existing and future development and operations of eligible green projects.

Apollo Global raised $750mn via a two-part offering. It raised $400mn via a 5Y bond at a yield of 4.617%, 25bp inside initial guidance of T+110bp area. It also raised $350mn via a tap of its 5.15% 2035s at a yield of 5.258%, 20bp inside initial guidance of T+130bp area. The senior unsecured notes are unrated. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Hong Kong CNH/HKD/EUR/USD Digitally Native Green Notes

Rating Changes

- Damac Real Estate Development Ltd. Upgraded To ‘BB+’ On Strong Order Book And Business Performance; Outlook Stable

- Xerox Holdings Corp. Downgraded To ‘CCC+’ From ‘B-‘ On Weaker Free Cash Flows; Outlook Negative

- China Vanke Downgraded To ‘CCC’ On Deteriorating Sales And Liquidity; Outlook Negative

- Fitch Downgrades Nielsen’s 1L Debt to ‘BB-‘ from ‘BB’; Affirms IDR at ‘B+’

- Husky Technologies Ltd. Ratings Placed On CreditWatch Positive Following Announced Business Combination With CompoSecure

- Civitas Resources Inc. ‘BB-‘ Ratings Placed On Credit Watch Positive On Announced SM Energy Merger

- AngloGold Ashanti PLC Outlook Revised To Positive On Cost Discipline; Ratings Affirmed

Term of the Day: Change of Control Put

Change of control put is a common covenant in bond offerings, mentioned in the bond’s prospectus. Bonds that carry a change of control put offer bondholders the option to sell the bonds back to the issuer at a pre-defined price upon the occurrence of a change of control event, which is typically a change in ownership of the issuer. The option to redeem the bonds in this case lies with the bondholder, as against a call option, which lies with the issuer, not the bondholder.

Talking Heads

On Fed Making It Easier for Banks to Get ‘Well Managed’ Rating

Michelle Bowman, Vice Chair for Supervision

“Bank ratings should reflect overall safety and soundness, not just isolated deficiencies in a single component”

Michael Barr, Fed Governor

“This rule would undermine oversight of the largest 36 banks in the country by allowing poorly managed large banks to be treated as well managed “

On Argentina may not need bank loan, Fed will likely remain independent – Jamie Dimon, JPMorgan CEO

“There is around $100bn of foreign capital that may well come back to Argentina… You have major companies that want to invest there now… If Milei could continue to implement his policies for the rest of this term, and maybe for a second term, you could turn Argentina… (US) president has made clear he believes in Fed independence. He’s also made it clear he’s going to speak his mind freely”

On recommending a barbell strategy – Salman Niaz, GSAM

“Growth in the US economy will likely pick up in 2026 as fiscal tailwinds come into play, and monetary easing will also be supportive… Rate cuts should support the US economy, and we’re expecting four reductions of 25 basis points each during the next 12 months… The barbell comprises short-dated securitised credit, trading at premium spreads to equivalent rated vanilla corporate bonds, and Asia high yield”

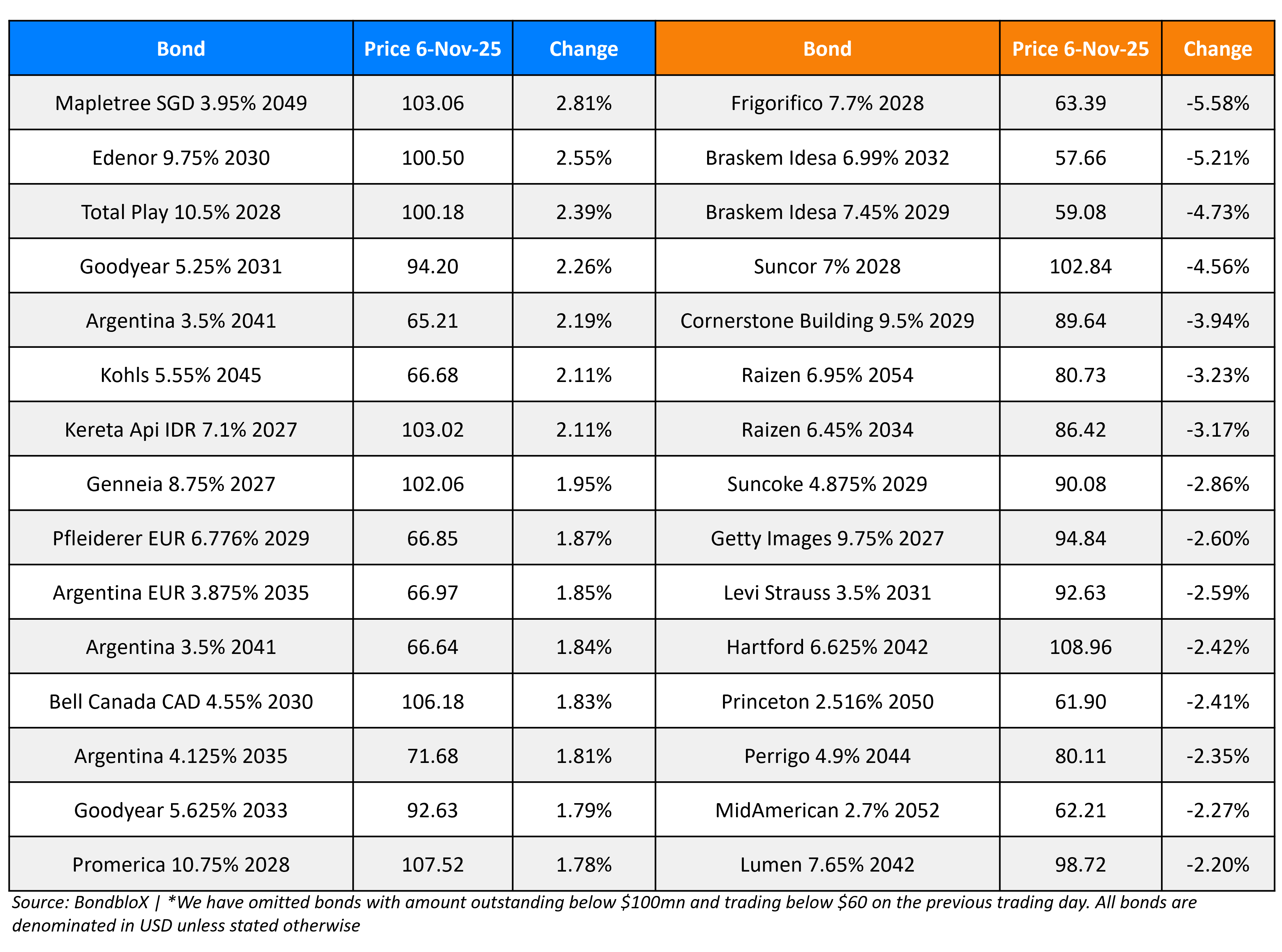

Top Gainers and Losers- 06-Nov-25*

Go back to Latest bond Market News

Related Posts: