This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Central China Suspends Offshore Debt Payments

June 26, 2023

Central China Real Estate (CCRE) announced that it will suspend all of its offshore debt payments. It cited the weakening Chinese property market amid falling contracted sales and tight liquidity as reasons. This comes after it failed to pay the coupon on its 7.75% 2024s as its grace period ended on Friday. The notes’ covenants allow the possibility of bondholders demanding accelerated debt repayment and hence CCRE is exploring solutions to prevent it. With China’s home prices rising at the slowest pace in four months in May and soft contracted sales, analysts note that the sector’s woes will likely continue. Its 7.75% 2024s are trading at deeply distressed levels of 16 cents on the dollar.

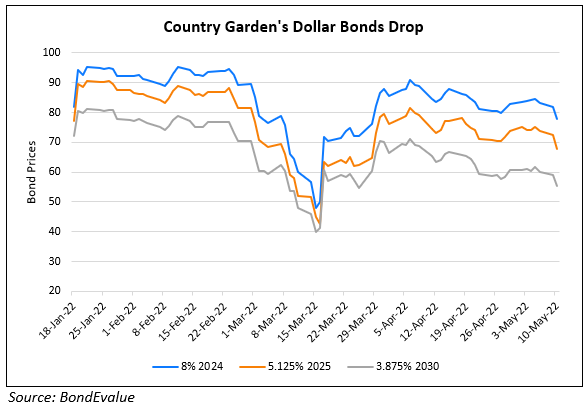

Separately, dollar bonds of COGARD, Road King and Seazen were down 7-10% last week, reversing gains seen in the week prior. Market participants have been awaiting details from Beijing regarding policies that are expected to ease pressures in the sector. However, no such details have emerged yet since the beginning of the month when rumors came out regarding such policy measures.

Go back to Latest bond Market News

Related Posts: