This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

CDL, Saudi National Bank Launch S$ Bonds

November 24, 2025

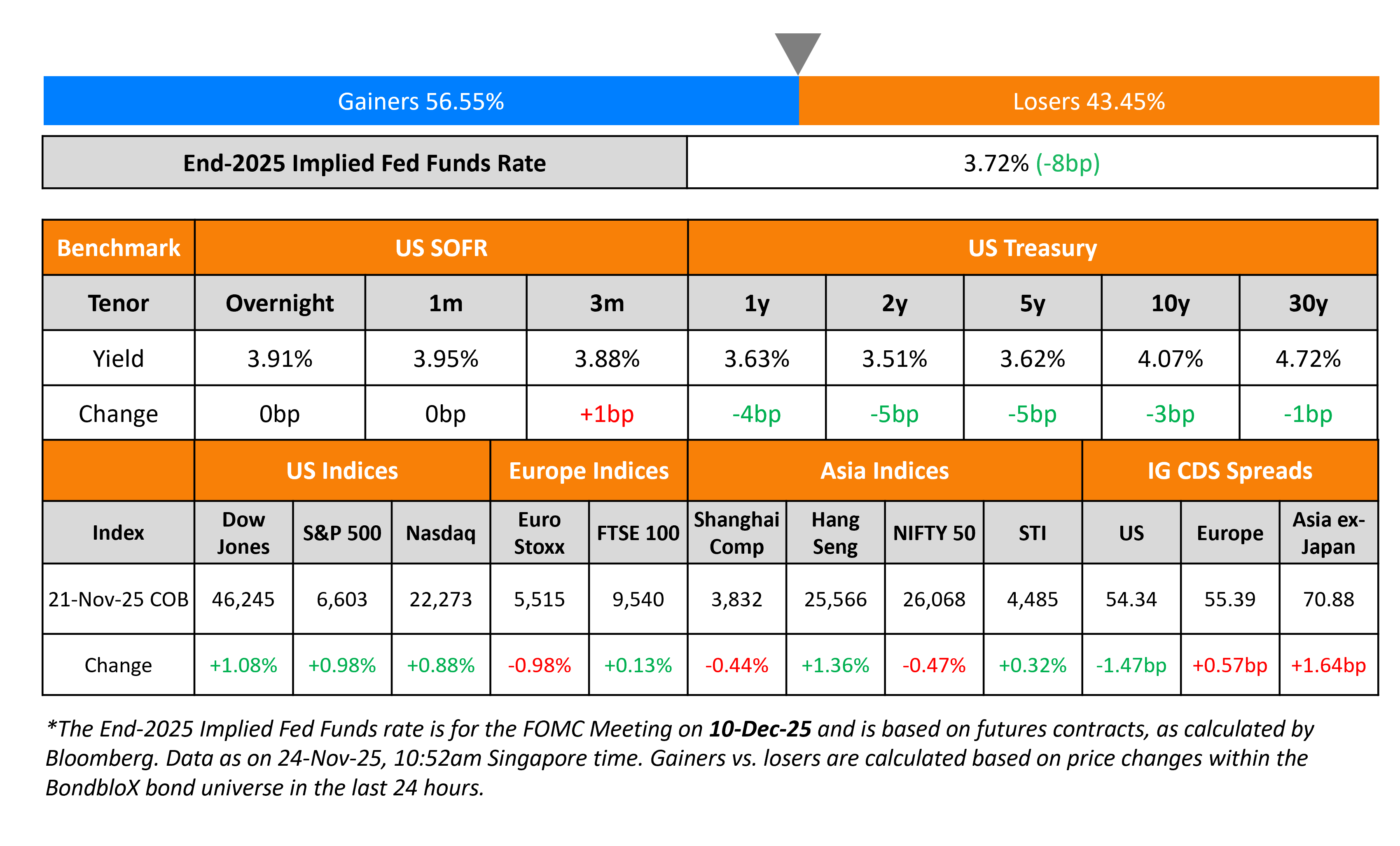

US Treasury yields eased by 3-5bp across the curve after dovish comments by New York Fed President John Williams. He said that there was room to lower rates again in the near-term as the labor market softens, in his view. Meanwhile, Fed governor Stephen Miran said that he would vote for a 25bp rate cut in December if his vote were a marginal vote. However, Boston Fed President Susan Collins said that the Fed’s current policy was slightly restrictive and “very appropriate”. On the back of Williams’ comments, markets are now pricing-in a 67% chance of a 25bp rate cut as compared to 44% a week ago.

On the data front, The University of Michigan Consumer Sentiment Index came-in at 51.0 for November, better than expectations of 50.6. The preliminary reading of the S&P Manufacturing PMI for November came-in at 51.9 vs. expectations of 52.0. However, the Services PMI reading came-in at 55.0, better than expectations of 54.6.

Looking at the equity markets, the S&P and Nasdaq closed higher by 0.9-1.0%. US IG and HY CDS spreads were tighter by 1.5bp and 10.3bp respectively. European equity indices ended mixed. The iTraxx Main CDS and Crossover CDS spreads were 0.6bp and 1.3bp wider respectively. Asian equity markets are trading mixed today. Asia ex-Japan CDS spreads were 1.6bp wider.

New Bond Issues

- Guangzhou Development District $ 2Y green at 4.9% area

- Saudi National Bank S$ 10NC5 Tier-2 at 3.7% area

- City Developments Ltd S$ 5Y at 2.4%

New Bonds Pipeline

-

Arabian Centres (Cenomi) $ 5NC2 sukuk

-

BDO Unibank $ 5Y bond

Rating Changes

- Moody’s Ratings upgrades Italy’s ratings to Baa2, changes outlook to stable

- Kuwait Upgraded To ‘AA-/A-1+’ On Reform Progress; Outlook Stable

- Uzbekistan Upgraded To ‘BB’ On Strong Growth And Economic Reforms; Outlook Stable

- Fitch Upgrades Ecuador’s LT Instruments at ‘B-‘; Assigns a Recovery Rating of ‘RR3’; Removes UCO

- Zambia Foreign Currency Ratings Raised To ‘CCC+/C’ On Improved Creditworthiness; Outlook Stable

- Lansforsakringar AB And Lansforsakringar Bank Upgraded To ‘A+’ On Enhanced Earnings Diversification; Outlook Stable

- Bahrain Rating Lowered To ‘B’ On Challenging Fiscal And Debt Dynamics; Outlook Stable

- FXI Holdings Inc. Downgraded To ‘D’ From ‘CC’ On Distressed Exchange; Notes Ratings Lowered And Withdrawn

- Fitch Revises Cyprus’s Outlook to Positive; Affirms at ‘A-‘

Term of the Day: Dovish

A dovish stance is a central banking policy stance which is accommodative, in favour of maintaining interest rates at low levels and generally not worried about inflation. This stance is generally taken to ease financial conditions from the monetary policy side to stimulate the economy.

Talking Heads

On US Inflation Traders Using Untested Fallbacks for Missing CPI

Jon Hill, Barclays Capital

“Even before the announcement, it was general consensus that the fallback would be activated for October, so the market had largely already priced this in”

On Big Tech’s Debt Binge Raises Risk in Race to Create an AI World

Lisa Shalett, Morgan Stanley Wealth Management

“I view this as the AI story maturing and entering a new phase, one that is likely to be marked by more volatility and additional risk… seen an expansion of the ecosystem to include companies with weaker balance sheets like Oracle and CoreWeave, more debt”

Arnim Holzer, Easterly EAB

“To see Oracle’s CDS go up shouldn’t be surprising. These companies are investing massive amounts and committing to massive amounts of capex, some of which will be financed with debt”

Bob Savage, BNY

“When companies that don’t need to borrow are borrowing to make investments, that sets a bar for the returns on those investments”

On Monetary Policy Not Solving Debt Problems – Christine Lagarde, ECB President

“There is always the concern that a short-sighted government may be tempted to try to force the hand of a central bank to finance its debt…. The goal should be to foster a virtuous circle in which productive spending raises productivity growth”

Top Gainers and Losers- 24-Nov-25*

Go back to Latest bond Market News

Related Posts:

.png)