This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

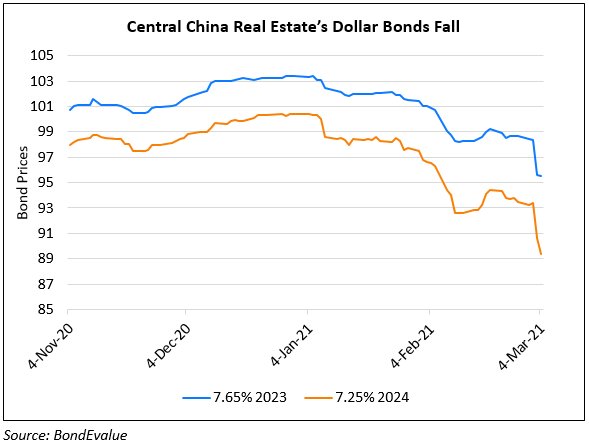

CBIRC Chairman Warns of Bubble in China Property Market; Central China’s Bonds Fall 3-4 Points

March 4, 2021

The Chairman of China Banking and Insurance Regulatory Commission (CBIRC), China’s banking regulator said that risks in the property sector are increasing and called it a “bubble”. Mr. Guo Shuqing, the Chairman said, “Many people buy homes not to live in, but to invest or speculate. This is very dangerous” and noted that his worry was focused on a steep fall in property prices. As WSJ reports, roughly a fifth of bank loans are in the form of home loans and most credit is collateralized by real estate. Authorities have taken steps like capping bank lending to the sector, making restrictions on home purchases etc. yet home prices have moved higher 3.9% YoY in January. Average new home prices in 70 major cities increased 0.3% in January from a month earlier, the fastest growth since September. Mr. Guo said that Chinese banks had disposed CNY 3.02tn ($470bn), in bad debt last year and a total of CNY 8.8tn ($1.4tn) between 2017 and 2020 – roughly equal to the previous 12 years combined.

For the full story, click here

Separately, Chinese developer Central China Real Estate saw some of its dollar bonds trade 3-4 points lower on Wednesday. Their 7.9% 2023s were down almost 3 points to 94.63. Their 7.65% 2023s were down a similar margin to 95.5.

Go back to Latest bond Market News

Related Posts: