This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

CBA Prices $5bn Five-Trancher; Trump Delays Tariffs

March 7, 2025

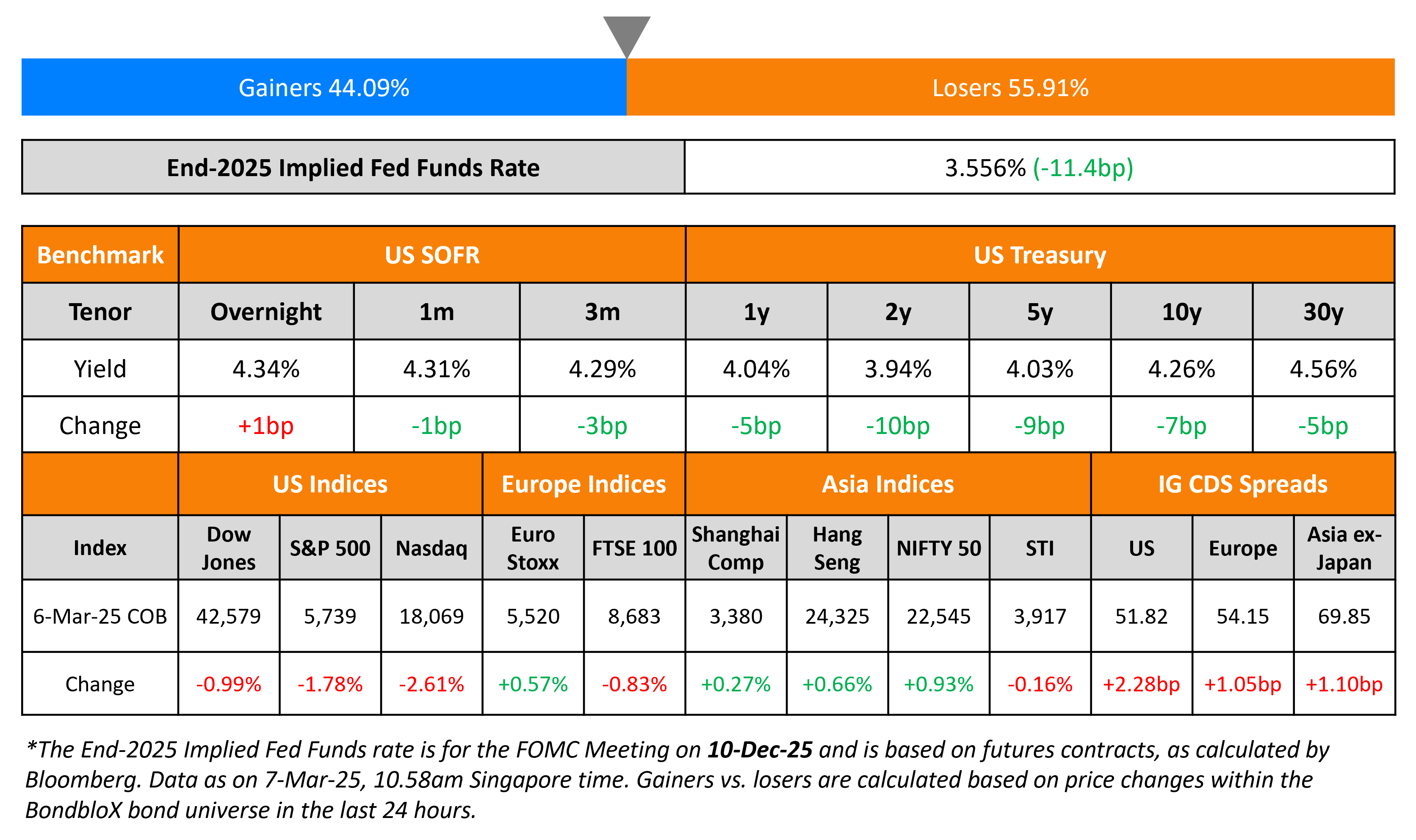

US Treasuries continued to remain volatile, with yields lower across the curve by 7-10bp. US President Donald Trump delayed the 25% tariffs he imposed this week on most goods from Canada and Mexico until April 2. Markets await the February non-farm payrolls print later today, with expectations for a 160k reading.

US equity markets saw the S&P and Nasdaq drop sharply by 1.8% and 2.6% respectively. Looking at credit markets, US IG and HY spreads CDS spreads widened 2.3bp and 17bp respectively. European equity markets ended mixed. The iTraxx Main and Crossover CDS spreads widened by 1.1bp and 43.6bp respectively. The ECB cut its policy rates as expected, by 25bp. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were wider by 1.1bp.

New Bond Issues

Commonwealth Bank of Australia (CBA) raised $5bn via a five-part offering.

The senior bank notes are rated Aa2/AA-/AA- and the 21NC10 subordinated Tier 2 note is rated A2/A-/A-. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Central Nippon Expressway hires for $ 1Y bond

Rating Changes

-

Moody’s Ratings upgrades SIG Group’s rating to Baa3, outlook stable

-

Fitch Downgrades Eutelsat SA to ‘BB’ and Eutelsat Communications to ‘B’; Outlook Negative

-

Global Carmaker Stellantis Downgraded To ‘BBB’ On Weak Margin Prospects; Outlook Stable

-

Fitch Downgrades Sunnova’s IDR to ‘CCC-‘

-

ELO Downgraded To ‘BB-‘ On Higher Leverage Due To Restructuring Costs And Continuous Challenges In Retail; Outlook Stable

-

Fitch Revises Colombia’s Outlook to Negative; Affirms IDR at ‘BB+’

-

Posco Holdings, Posco, And Posco International Outlook Revised To Negative On Weak Profitability; Ratings Affirmed

Term of the Day: Tuna Bonds

Tuna Bonds were bonds issued by Mozambique in 2013 to finance Mozambican state-owned fishing company EMATUM’s plans to develop tuna fishing. Credit Suisse, which helped facilitate the transaction had faced a trial after funds from the tuna bond issuances were used for purchasing military equipment instead. In a latest update, former Credit Suisse banker who pleaded guilty to engaging in a $2bn fraud and money-laundering scheme in Mozambique avoided a prison term.

Talking Heads

On Junk Bonds Are Set to Outperform ‘Riskier’ Stocks – Author and High Yield Guru, Marty Fridson

“It is worthy of consideration by asset allocators that high yield’s expected 5Y annualized return is substantially higher than that of equities, a riskier asset class… Beginning yield does have a bearing on future returns”

On Fed may need to stay patient on rates until summer – Atlanta Fed’s Raphael Bostic

“There’s a lot of transition that’s happening, and in the midst of this transition it’s hard to know exactly where things are going to land… I’d be surprised if we got a lot of clarity before the late spring or into the summer. We’ll have to just sort of really be patient.”

On Potential for Two to Three Cuts in 2025 – Fed Governor Christopher Waller

“If the labor market, everything, seems to be holding, then you can just kind of keep an eye on inflation. If you think it’s moving back towards target, you can start lowering rates. I wouldn’t say at the next meeting, but could certainly see going forward”

Top Gainers and Losers- 07-March-25*

.png)

Go back to Latest bond Market News

Related Posts: