This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

CBA, Equinix Launch Bonds; Treasury Yields Continue to Inch Higher

March 6, 2025

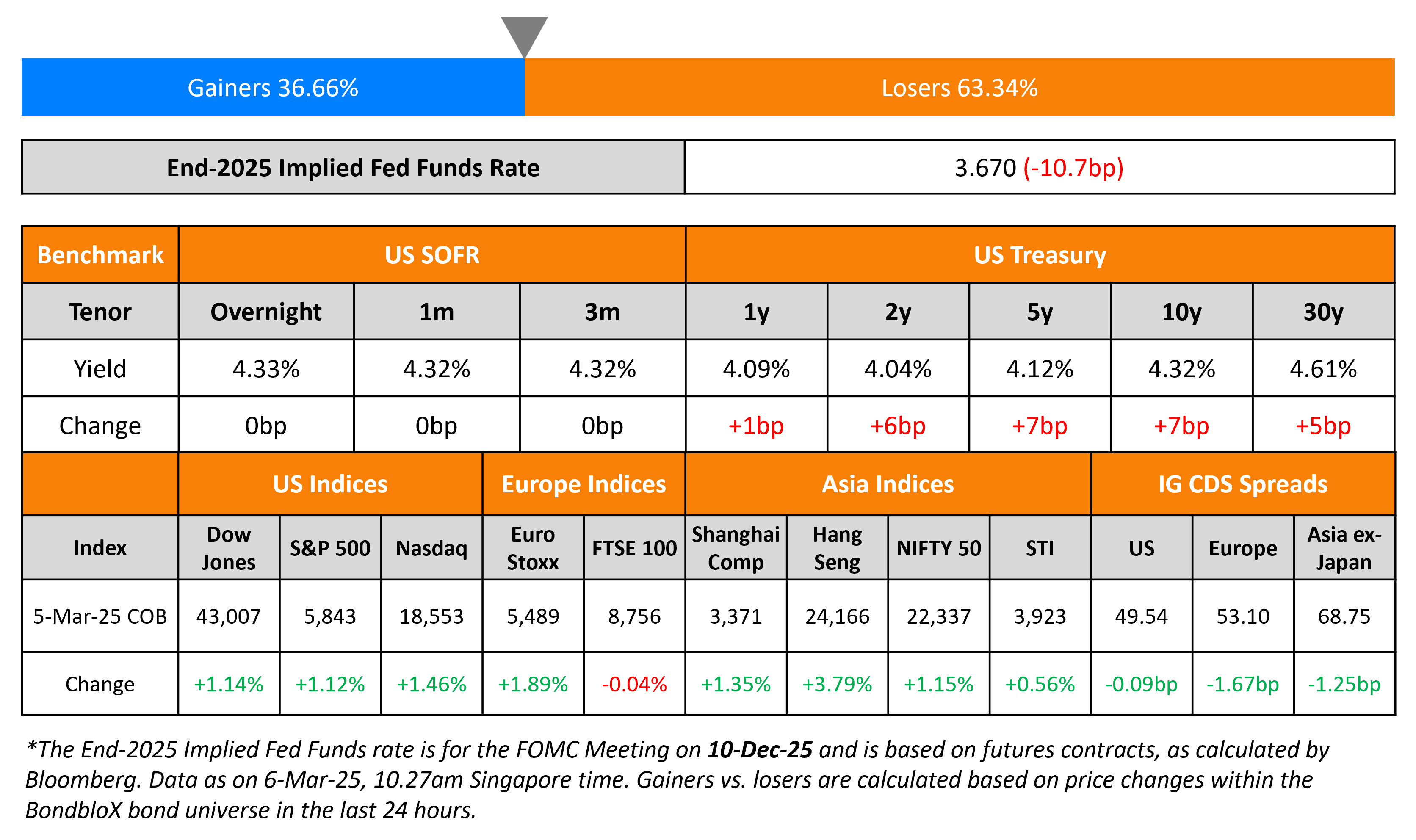

US Treasury yields continued to rise across the curve, higher by 6-7bp. The US ISM Services Index for February rose to 53.5, higher than the prior 52.8 print and also above expectations of 52.5. This was driven by expansion in New Orders, Employment and Prices Paid sub-components. However, the ADP report showed that private payrolls slowed to 77k in February, worse than expectations of 140k and the prior month’s 186k print.

US equity markets saw the S&P and Nasdaq end higher by 1.1% and 1.5% respectively. Looking at credit markets, US IG and HY spreads CDS spreads tightened 0.1bp and 2bp respectively. European equity markets ended broadly higher. The German bund yield continued to rise after a spike of nearly 30bp after reports that potential future German Chancellor Friedrich Merz is set to overhaul Germany’s borrowing rules for infrastructure and military spending. The iTraxx Main and Crossover CDS spreads tightened by 1.7bp and 4.4bp respectively. Asian equity markets have opened in the green this morning. Asia ex-Japan CDS spreads were tighter by 1.3bp.

New Bond Issues

- Equinix Asia S$ 5Y green at 3.75% area

-

CBA $ 3Y/3Y FRN/5Y/5Y FRN/21NC20 at T+65/SOFR eq/T+75/SOFR eq/T+160bp areas

Ras Al-Khaimah raised $1bn via a 10Y sukuk at a yield of 5.038%, 40bp inside initial guidance of T+120bp area. The senior unsecured note is unrated, and received orders of over $4.1bn, 4.1x issue size. Proceeds will be used for general government and budgetary purposes.

Cikarang Listrindo raised $350mn via a 10Y bond at a yield of 5.65%, 47.5bp inside initial guidance of 6.125% area. The senior unsecured note is rated Baa3/BBB-. Net proceeds, together with cash on hand, will be used to redeem its outstanding 2026s in full.

Mars raised $26bn via an 8-part offering. Details are given in the table below:

The senior unsecured notes are rated A2/A. Proceeds will be used together with borrowings under its ‘New Delayed Draw Term Facility’, along with proceeds from its new private placement offering and cash on hand, to fund the acquisition of Kellanova and pay related fees and expenses.

Rating Changes

-

Fitch Upgrades AerCap Holdings N.V. to ‘BBB+’; Outlook Stable

-

Kirby Corp. Outlook Revised To Positive From Stable On Strong Credit Metrics; ‘BBB’ Ratings Affirmed

Term of the Day: Asset Backed Security

Asset Backed Securities (ABS) are securities that are collateralized or backed by a pool of assets. This pool of assets are made by a process of securitization and could be in the form of loans, credit card debt, mortgages etc. with each security backed by a fraction of the total pool of underlying assets. Thus, an investor gets interest and principal payments while also assuming the risk of the underlying assets. The underlying pool of assets are structured in different tranches with the highest priority of repayment going to the top tranche and then to the second tranche and so on.

Talking Heads

On Banks Offering More Russia-Linked Trades

Paul McNamara, GAM UK Ltd

“NDFs [for Russia-linked assets] have been trading off and on, but the banks are certainly publishing quotes these days in a way that they hadn’t been before”

Pavel Mamai, Promeritum Investment

“People are massively over-estimating the upside for Russia-related assets”

On Debt-Limit Dynamics Disrupting Money Markets

Roberto Perli, Federal Reserve Bank of New York

“The longer the balance-sheet runoff continues while the debt ceiling situation persists, the higher the risk that, upon the resolution of the debt ceiling, reserves could rapidly decline to levels that could result in considerable volatility in money markets”

On Recent Price Surge Impacting Inflation Control

Ben Bernanke, US Federal Reserve

“The inflation (surge) has made inflation control a little harder going forward…firms will maybe find it easier to raise prices, you may see less consumer resistance, people might become more sensitive to inflation and their expectations may adjust”

Top Gainers and Losers- 06-March-25*

Go back to Latest bond Market News

Related Posts: