This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

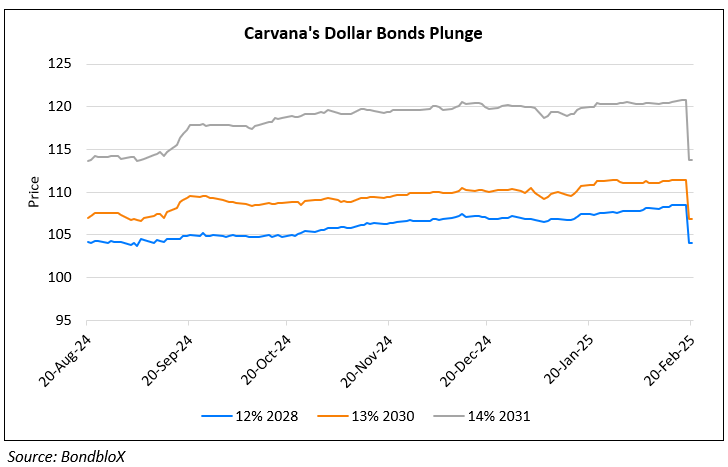

Carvana’s Dollar Bonds Drop On Margin Miss

February 20, 2025

Carvana’s dollar bonds plunged by 4-7 points after the company reported a decline in gross profit per vehicle and a reduction in wholesale volumes for the latest quarter. Despite these issues, Carvana posted strong Q4 results, exceeding revenue and profit expectations. The company posted revenue of $3.55bn, up 32% YoY, surpassing the $3.34bn estimate, though slightly lower than 3Q’s number of $3.66bn. Carvana also reported earnings per share of $0.56, beating the $0.31 estimate, and adjusted EBITDA of $359mn, above the expected $329.4mn. However, revenue per vehicle fell by $1,000 to just over $22,000, and retail gross profit per unit dropped by $270. Wholesale gross profit per vehicle also missed forecasts. The company projected stronger sales volumes and earnings for this year, but the weakness at both the retail and wholesale levels raised concerns about lower-margin growth. Carvana’s stock pulled back by up to 10% in after-hours trading, after hitting a new 52-week high earlier in the day. Its dollar bonds also plunged as shown in the chart above.

For more details, click here

Go back to Latest bond Market News

Related Posts: