This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Capitaland India Trust Launches S$ Bond; Trump Warns of 200% Tariffs on EU Wines, Spirits

March 14, 2025

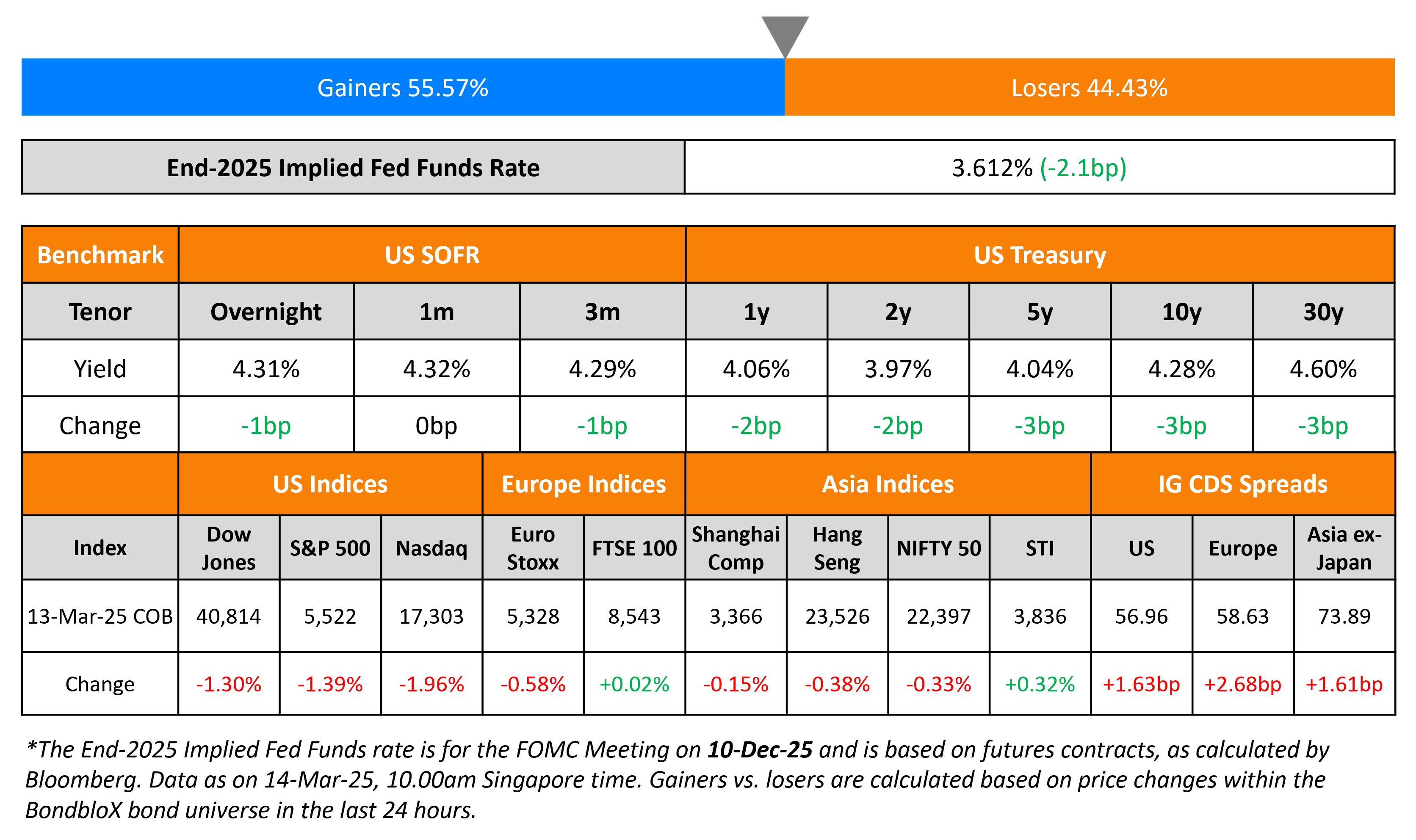

US Treasury yields eased marginally by 2-3bp across the curve. US PPI for February came-in at 3.2% YoY, softer than expectations of 3.3% and the prior month’s 3.7%. Core PPI came-in at 3.4%, also softer than expectations of 3.5% and the prior month’s 3.8%. US President Donald Trump warned that he would place 200% tariffs on all wines and spirits from EU countries, if the EU’s retaliatory 50% tariff on US whisky is not removed.

US equity markets ended lower with the S&P and Nasdaq down 1.4% and 2.0% respectively. Looking at credit markets, US IG and HY spreads CDS spreads widened 1.6bp and 12bp respectively. European equity markets ended mixed. The iTraxx Main and Crossover CDS spreads widened by 2.7bp and 11bp respectively. Asian equity markets have opened in the green this morning. Asia ex-Japan CDS spreads were wider by 1.6bp.

New Bond Issues

- Capitaland India Trust S$ 5Y at 3.2% area

DBS raised $2bn via a three-trancher. It raised:

- $500mn via a 3Y bond at a yield of 4.403%, 23bp inside initial guidance of T+65bp area

- $1bn via a 3Y FRN at SOFR+60bp vs. initial guidance of SOFR equivalent area

- $1bn via a 5Y FRN at SOFR+65bp vs. initial guidance of SOFR equivalent area

The senior unsecured notes are rated Aa2/AA-. Net proceeds will be used for general business purposes and to finance and treasury activities, including provision of intercompany loans (or other forms of financing) to DBS Bank Ltd. and its subsidiaries.

Beijing Capital raised $450mn via a 3Y bond at a yield of 7.15%, 60bp inside initial guidance of 7.75% area. The senior unsecured note is rated Baa3/BBB-/BBB-. BCG Chinastar International Investment Ltd is the guarantor and Beijing Capital Group Co Ltd will be the keepwell provider. Proceeds will be used to refinance mid or long-term offshore debt due within one year including, funding their concurrent tender offer.

ESR REIT raised S$125mn via a PerpNC5 bond at a yield of 5.75%, 25bp inside initial guidance of 6% area. The senior unsecured bond is unrated. If not called by 20 March 2030, the coupon will reset to the SGD Swap rate plus 351.2bp. Proceeds will be used to refinance existing debt, including its outstanding S$75.25mn 6.632% Perp, financing/refinancing acquisitions and/or investments and any development and asset enhancement works, working capital purposes and capex requirements.

Credit Agricole raised €750mn via a 10NC5 Tier 2 bond at a yield of 4.177%, 25bp inside initial guidance of T+190bp area. The subordinated notes are rated Baa1/BBB+/A-.

New Bonds Pipeline

- Tata Capital hires for $ long 3Y bond

- Shinhan Bank hires for $ bond

- BTN Indonesia hires for $ 5Y Tier 2

Rating Changes

-

Carvana Co. Upgraded To ‘B’ On Continued Performance Improvement And Stronger Credit Metrics; Outlook Positive

-

British Airways PLC Upgraded To ‘BBB’ Following The Same Action On Parent IAG; Outlook Stable

-

Fitch Upgrades Spirit Airlines to ‘CCC+’; Assigns Exit Note Rating of ‘B-‘/’R

-

Fitch Upgrades Rolls-Royce & Partners Finance to ‘BBB’; Outlook Positive

-

Fitch Places CK Hutchison Holdings’ ‘A-‘ on Rating Watch Positive; Removes UCO

Term of the Day: Keepwell Provision

A keepwell provision is a legal agreement between a parent company and a subsidiary to ensure solvency and financial stability of the subsidiary for the duration of the agreement. Keepwell provisions are included in bond terms to offer bondholders confidence on the issuer’s ability to repay. The keepwell structure emerged around 2012-2013 to assuage concerns of investors over a bond issuer’s creditworthiness. However, it is important for investors to understand that keepwells are not a guarantee that the parent company will support the subsidiary in the event of a default, and there has previously been no precedent on the enforcement of keepwell structures.

Talking Heads

On Pessimistic US Dollar Outlook

Matthew Hornbach & Andrew Watrous, Morgan Stanley

“The prospect of a near-term US government shutdown could further weigh on the dollar broadly as investors estimate the implications for growth and future fiscal policy.”

On Uncertainty in US interest rate options market

Guneet Dhingra, BNP Paribas

“Those tail-risk probabilities have been elevated ever since Silicon Valley Bank went down in 2023. That risk has become more heightened in the last couple of weeks. (referring to market shaking events)”

Amrut Nashikkar, Barclays

“The options market is showing signs of an economic slowdown, but not a recession that causes the Fed to cut by hundreds of basis points.”

On Inflation and Economic Uncertainty in the EU

Martins Kazaks, ECB

“For euro area we expected that there is going to be some increase in inflation at the turn of the year, but we also expect that services inflation will retreat more visibly from March onwards… Clear forward implicit guidance is impossible because of the very high uncertainty…the key reasons for uncertainty are US policy shifts, the risk of potential tariff wars, and the way the European Union responds.”

On the Future of Turkish Monetary Policy

Fatih Karahan, CBRT

“We’ll do whatever it takes to reach our year-end inflation target of 24%”

Top Gainers and Losers- 14-March-25*

Go back to Latest bond Market News

Related Posts: