This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

CapitaLand Ascott REIT Launches S$ Perp; Banco BPM, NatWest, Alinma Price Bonds

May 21, 2025

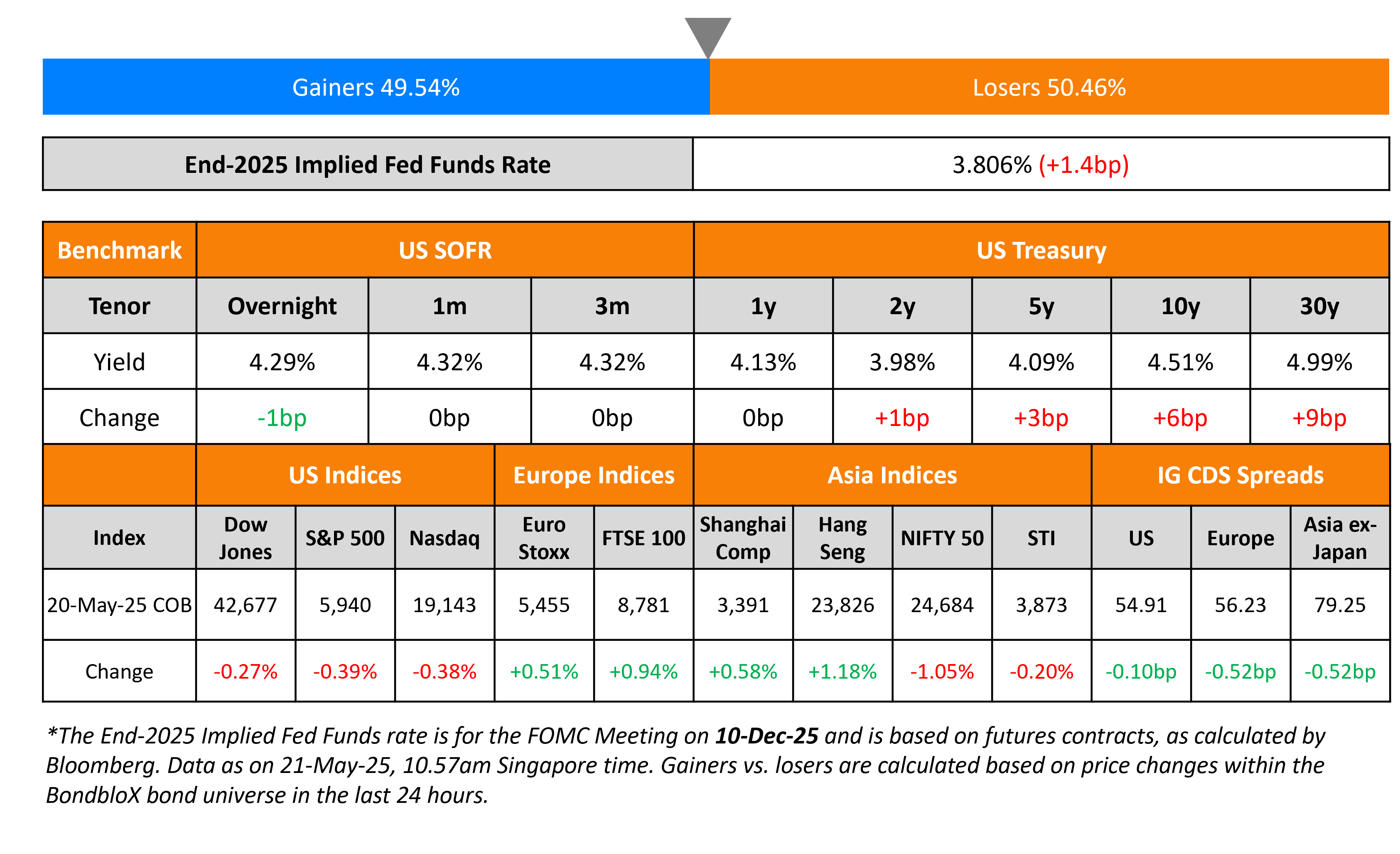

The US Treasury yield curve steepened with the 2s10s spread moving higher by 5bp. The 2Y yield rose by 1bp while the 10Y yield was higher by 6bp, crossing the 4.5%-mark. There were no major data releases yesterday. Fed speakers including Mary Daly and Beth Hammack emphasized on a wait-and-see approach regarding the central bank’s policy path. Separately, analysts estimate that President Trump’s proposed tax cuts may see US’ national debt rise by about $3-5tn, noting that this may be contributing to the rise in treasury yields.

Looking at the equity market, S&P and Nasdaq were down by 0.4%. Looking at credit markets, US IG and HY CDS spreads tightened by 0.1bp and 0.4bp respectively. European equity indices were higher yesterday. The iTraxx Main CDS spreads and Crossover CDS spreads tightened by 0.5bp and 4.2bp respectively. Asian equity markets have broadly opened higher today. Asian ex-Japan IG CDS spreads tightened by 0.5bp. Separately, Japanese government bond yields rose, particularly on the long-end, after a poor 20Y auction which saw the weakest demand in more than a decade. This comes amid the BOJ’s recent policy measures which include trimming JGB purchases.

New Bond Issues

-

Capitaland Ascott REIT S$ PerpNC5.8 at 4.5% area

-

CCB HK $ 3Y FRN/5Y FRN at SOFR+105/115bp area

Banco BPM raised €400mn via a PerpNC5.5 AT1 bond at a yield of 6.25%, 62.5bp inside initial guidance of 6.875%. The junior subordinated note is rated B+ by Fitch, and received orders of over €2.4bn, 6x issue size. If not called before 27 November 2030, the coupon will reset to the 5Y Mid-Swap plus 406.6bp. A trigger event will occur if the company’s standalone or the group’s consolidated CET1 ratio fall below 5.125%. Proceeds will be used for general banking purposes and for regulatory capital purposes. The new bond is priced at a new issue premium of ~24bp over its existing 7.25% Perp callable in January 2031 that currently yields 6.01%.

NatWest raised $1.55bn via a two-part deal. It raised $300mn via a 4NC3 FRN at SOFR+110bp, 25bp inside initial guidance of SOFR+135bp area. It also raised $1.25bn via a 6NC5 bond at a yield of 5.115%, 25bp inside initial guidance of T+135bp area. The senior unsecured notes are rated A3/BBB+/A. Proceeds will be used for general corporate purposes.

Alinma Bank raised $500mn via a PerpNC5.5 sustainability sukuk at a yield of 6.5%, 50bp inside initial guidance of 7% area. The junior subordinated note is unrated. If not called before 28 November 2030, the coupon will reset to the 5Y US Treasury yield plus 236bp. Proceeds will be used to finance and/or refinance, in whole or in part, eligible projects under its framework.

KBC raised €1bn via a PerpNC5.5 bond at a yield of 6%, 50bp inside initial guidance of 6.5% area. The junior subordinated note is rated Baa3/BB+/BBB-, and received orders of over €1.75bn, 1.75x issue size. If not called before 27 November 2030, the coupon will reset to the 5Y Mid-Swap plus 380.6bp. A trigger event will occur if the consolidated CET1 ratio fall below 5.125%. Proceeds will be used for general purposes including refinancing debt.

Pampa Energia raised $340mn via a tap of its 7.875% 2034s at a yield of 8%, 25bp inside initial guidance of 8.25% area. The senior non-preferred note is rated A3/A-/A+. Proceeds will be used redeem in full or in part, their 9.125% 2029s, and for other general corporate purposes.

New Bonds Pipeline

-

Al Rayan hires for $ 5Y Sukuk bond

- Telecom Argentina hires for $ 8Y bond

-

Macquarie Bank hires for A$ 10.5NC5.5 and/or 15NC10 bond

Rating Changes

-

Fitch Upgrades Teva to ‘BB+’; Outlook Stable

-

Pershing Square Holdings Ltd. Upgraded To ‘A-‘ On Improved Leverage And Consistent Performance; Outlook Stable

-

Fitch Upgrades Permanent TSB Group to ‘BBB’; Outlook Stable

-

Brazilian Airline Azul S.A. Downgraded To ‘CCC-‘ From ‘CCC+’ On Elevated Default Risk; Outlook Negative

-

Nitrogenmuvek Rating Lowered To ‘D’ On Missed Principal Payment

-

Moody’s Ratings downgrades Vistra Holdings’ ratings to B2 from B1, outlook changed to stable

-

Warner Bros. Discovery Inc. Downgraded To ‘BB+’ On Weak Credit Metrics; Outlook Stable; Short-Term And Debt Ratings Also Lowered

-

Fitch Revises Outlook on Oman Reinsurance Company to Positive; Affirms IFS at ‘BBB-‘

Term of the Day: Kangaroo Bonds

Kangaroo bonds are bonds issued in Australia by non-Australian issuers denominated in Australian Dollars. These bonds give foreign issuers access to another country’s capital markets and helps them diversify their capital base and could reduce borrowing costs. Although, the currency risk is borne by the issuer.

Talking Heads

On Junk Bonds Not Paying Enough for the Risk – Marty Fridson

“High-yield bond valuations are severely out of whack with the yield premium that would fairly compensate… If we enter a recession, I don’t think you’ll be able to count on the supply shortage to prevent the spread from going back to the customary 1,000 basis points plus of recession periods”

On Bond Market’s Fiscal Revolt Not Over – Tim Magnusson, Garda Hedge Fund CIO

“The bond market is going to have the final say on what happens fiscally… are going to get tested more — 5% is not the final line in the sand… market is going to bring discipline to this thing one way or the other… Inflation is on the cheap side to us”

On Bonds’ Role as Portfolio ‘Shock Absorbers’ Is Eroding – KKR

“During risk off days, government bonds are no longer fulfilling their role as the ‘shock-absorbers’ in a traditional portfolio… Many CIOs are considering moving assets out of the United States toward other parts of the world… US government is burdened with a large fiscal deficit and high leverage”

Top Gainers and Losers- 21-May-25*

Go back to Latest bond Market News

Related Posts: