This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

CapitaLand Ascendas’ REIT Launches Bond; Allianz Prices $ RT1 at 6.55%; Metro Bank, Carvana, AstraZeneca Upgraded

August 20, 2025

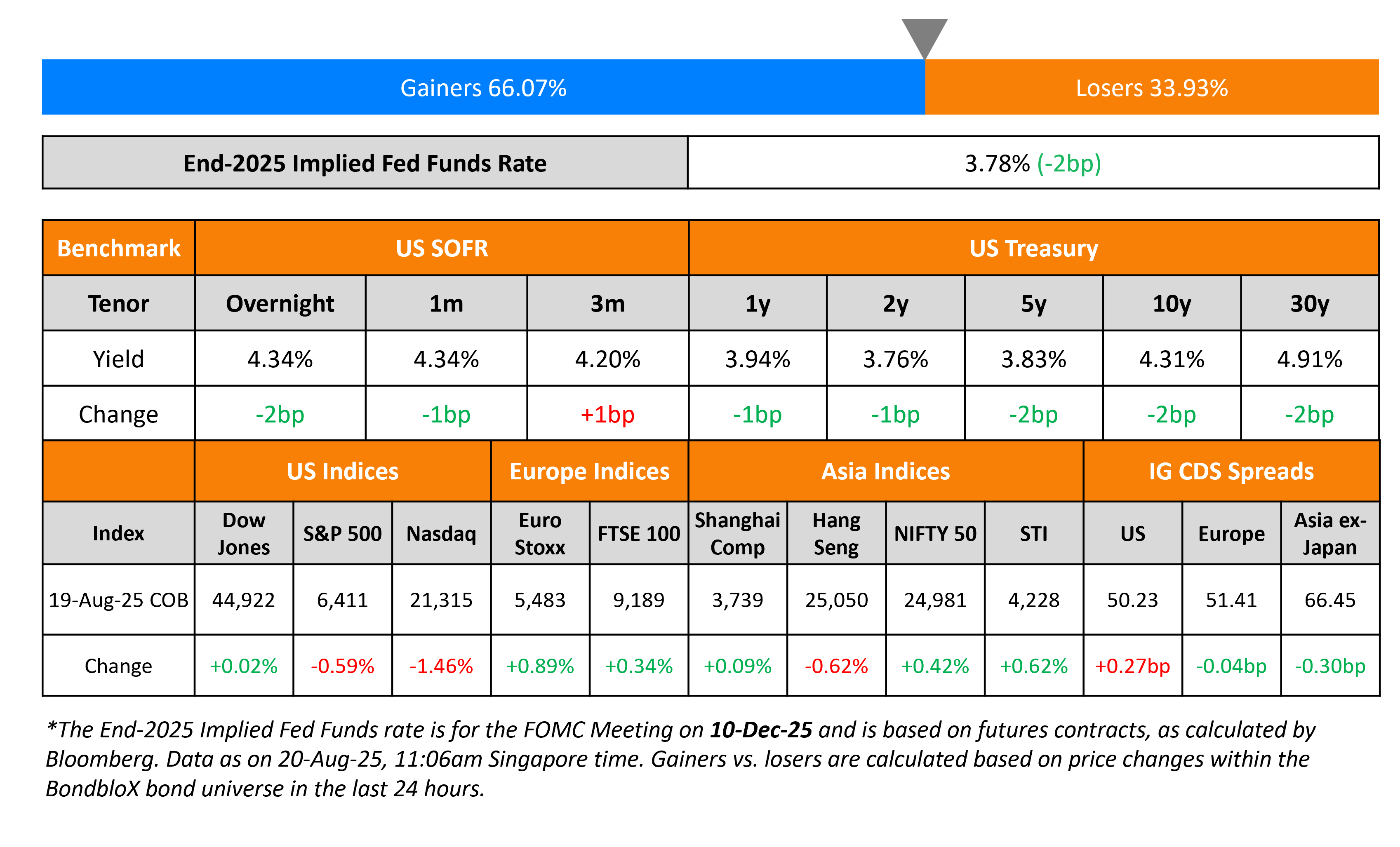

US Treasury yields ended marginally lower by 1-2bp across the board on Tuesday. The preliminary S&P PMIs are due later today, followed by the FOMC’s July meeting minutes. Markets are pricing in ~55bp in Fed rate cuts this year, with the probability of 25bp rate cut in September currently at 85%.

Looking at US equity markets, the S&P and Nasdaq ended 0.6% and 1.5% lower respectively. US IG and HY CDS spreads widened by 0.3bp and 2.4bp each. European equity markets ended higher. The iTraxx Main CDS spreads were flat while Crossover spreads widened by 1bp. Asian equity markets have opened lower today. Asia ex-Japan CDS spreads were 0.3bp tighter.

New Bond Issues

-

CapitaLand Ascendas REIT S$700mn capped 7Y Green at 2.6% area

Allianz raised $1.25bn via a PerpNC8.7 RT1 bond at a yield of 6.55%, 32.5bp inside revised guidance of 6.875% area, and 57.5bp inside initial guidance of 7.125% area. The note received initial orders of ~$12.3bn but final orders stood at $7bn, ~6x the issue size. The subordinated note is rated A3/A. If not called by 30 April 2034, the coupon will reset to 5Y CMT plus the initial margin. There is no coupon step-up. A trigger event would occur if

- Solo/Group Solvency Coverage Ratio is less than or equal to 75%

-

Solo/Group Minimum Capital Requirement is less than equal to 100%

-

Solo/Group Solvency Coverage Ratio is less than 100% but more than 75% and has not improved to at least 100% of the relevant solvency capital

Proceeds will be used for general corporate purposes. This includes refinancing existing debt, via its tender offer for the outstanding $1.25bn 3.5% Perp.

New Bond Pipeline

-

Swire Pacific USD Senior Notes

Rating Changes

-

Fitch Upgrades Metro Bank Holdings to ‘BB-‘; Outlook Positive

-

Fitch Upgrades AstraZeneca to ‘A+’; Outlook Stable; Withdraws Ratings

-

Fitch Upgrades Guangzhou Finance Holdings to ‘A-‘; Outlook Stable

-

Fitch Downgrades HSBC Uruguay to ‘BBB+’; Places Ratings on Neg Watch after BTG Pactual Agreement

-

BW Holding Inc. Downgraded To ‘D’ From ‘CCC-‘ On Revolver And Term Loan Maturity Extension

-

Moody’s Ratings revises Air Canada’s outlook to stable; affirms Ba2 CFR

Term of the Day: Restricted Tier 1 (RT1) Bonds

Restricted Tier 1 (RT1) bonds are junior subordinated securities issued by insurers that qualify as capital under Europe’s insurance regulation (known as Solvency II). To qualify as Tier 1 capital, the bonds must be perpetual, no step-up in coupon and a contractual trigger to principal write-down or equity conversion. According to the Solvency II directive, RT1s will automatically convert into equity or be written down upon three events:

– Breach of the Solvency Capital Requirement (SCR), which defines the capital required to ensure that the insurance company can meet its obligations over the next 12 months, for more than three months

– Drop of solvency ratio below 75% of the SCR

– Breach of the Minimum Capital Requirement (MCR), which is the threshold below which the national regulator would intervene.

Talking Heads

On Wager for Half-Point Rate Reduction Facing Test of Powell Remarks

Ian Lyngen, BMO Capital Markets

“It’s worth acknowledging that the front-end of the curve is vulnerable to a bearish correction if Powell doesn’t deliver on the degree of dovishness that the market is currently anticipating”

On Treasuries Rising as Traders Stick to Bets on September Rate Cut

Robert Sockin, Citigroup

“Powell is in a tough spot going into Friday because we’ve go a long way to go until we have that September meeting and a lot of data in between now and then”

Lisa Schineller, Bloomberg Analyst

Amid the rise in effective tariff rates, we expect meaningful tariff revenue to generally offset weaker fiscal outcomes that might otherwise be associated with the recent fiscal legislation, which contains both cuts and increases in tax and spending,”

On ‘Change Is Coming’ to How Fed Views AI and Crypto – Michelle Bowman, US Fed Reserve Governor

“Ideally, regulators will allow new uses to proliferate in a way that benefits the banking system…I would also like to encourage the industry to engage with regulators to help us understand blockchain and its potential to solve other problems”

Top Gainers and Losers- 20-Aug-25*

Go back to Latest bond Market News

Related Posts: