This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Brazil’s Public Debt Outlook Worsens, Treasury Warns of Higher Peak

July 17, 2025

Brazil’s Treasury now expects the country’s gross debt-to-GDP ratio to rise by 10.6% over President Lula’s term, reaching 82.3% by 2026. The projection is 0.6% higher than December’s forecast, citing higher assumptions for interest rates, inflation and FX. Gross debt is now expected to peak at 84.3% of GDP in 2028, a significant revision from projected peak of 81.8% in 2027 seen seven months ago. For 2025, Reuters expects its debt ratio to rise by 2.5% to 79.0% of GDP.

Nearly half of Brazil’s debt is linked to the Selic policy rate, which has been hiked by 450bp since September to 15%, immediately raising debt servicing costs. This continued spending has kept debt burdens elevated higher than EM peers but has failed to bring down the inflation below the 3% target.

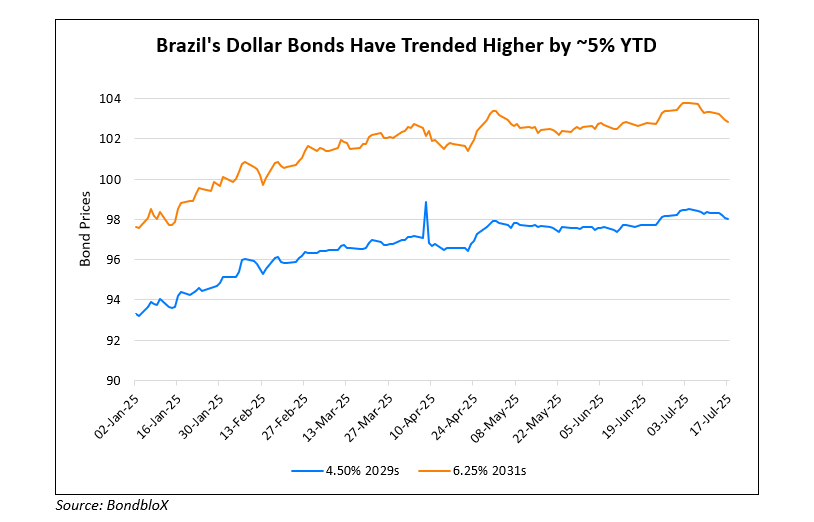

The update comes after Brazil’s dollar bonds have steadily increased over the course of the year, as seen in the chart.

Brazil’s 10.125% 2027s are down by 0.2 points at 109.8, yielding 4.43%.

For more details, click here.

Go back to Latest bond Market News

Related Posts:

Credit rating boost for Ireland & Portugal: EU inches towards recovery

September 20, 2017

China Refutes S&P Downgrade Action

September 26, 2017

Mongolia’s Credit Ratings Upgraded to B3 by Moody’s

January 19, 2018