This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Braskem Pays Coupon on Hybrid Bonds Due 2081

January 26, 2026

Braskem SA successfully paid interest due on its hybrid bonds maturing in 2081 on Friday. The notes were heavily impacted by a selloff last year because their indenture allows the company to defer interest payments without triggering a formal default. As hybrid debt, these securities rank lower in the creditor hierarchy than senior debt. This payment follows a similar move earlier this month regarding its notes due 2028, where it paid coupons despite its financial stress. The company is currently working toward presenting an out-of-court restructuring plan by March. The timeline depends on the outcome of IG4 Capital acquiring Novonor’s stake in Braskem. The transaction still requires regulatory approval including in Brazil and the US. In the meantime, Braskem’s has coupons due on its dollar bonds maturing in 2030 and 2050 over the next five days.

Braskem’s dollar bonds were trading stable, albeit at distressed levels of 36-44 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Braskem Announces ~$1.45bn Share Offering

January 17, 2022

Braskem Idesa Upgraded to BB- by Fitch

March 28, 2022

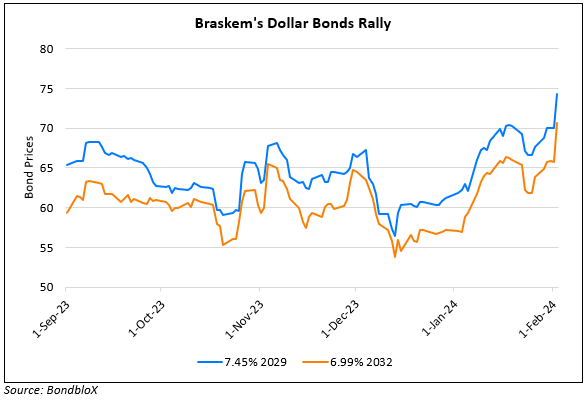

Braskem’s Dollar Bonds Rally on Reports of Stake Acquisition

February 2, 2024