This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

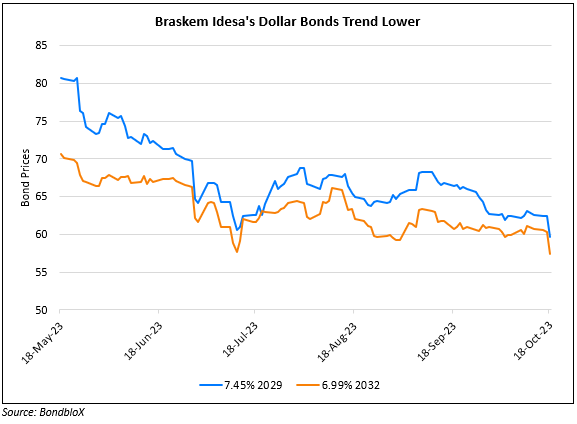

Braskem Idesa’s Dollar Bonds Drop 3 Points

October 18, 2023

Braskem Idesa’s dollar bonds were among the top losers with its 6.99% 2032s down 2.6 points and 7.45% 2029s down 3.1 points to trade at 57.3 and 59.71, yielding 16.6% and 18.9% respectively. While there was no news specific to the fall in their bonds, the company has been keenly watched given the earnings season where Fitch expects its EBITDA and liquidity to weaken. A few months ago, Braskem Idesa was downgraded to B+ from BB- by Fitch citing a “material reduction in the outlook for polyethylene (PE) and a slower-than-expected market recovery path”.

Go back to Latest bond Market News

Related Posts:

Braskem Idesa Upgraded to BB- by Fitch

March 28, 2022

Braskem Idesa Downgraded to B+ by Fitch

July 3, 2023