This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

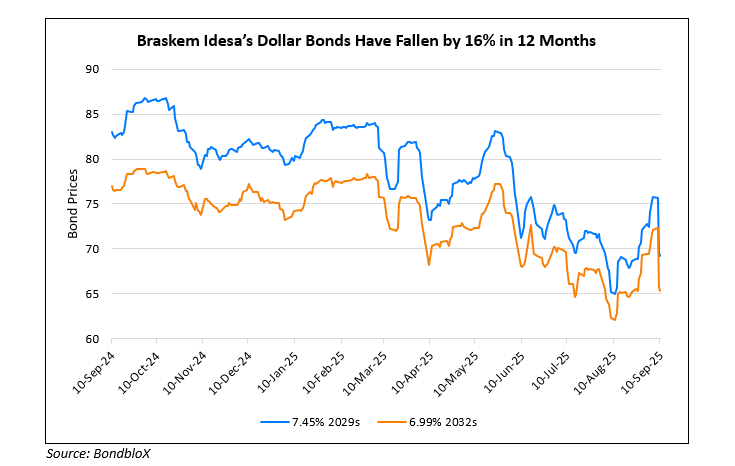

Braskem Idesa Downgraded Multiple Notches by Fitch and S&P Amid Restructuring Concerns

September 10, 2025

Braskem Idesa was downgraded by Fitch to CCC+ from B+ (three notches) and by S&P to CCC from B- (two notches). Both agencies cited heightened restructuring risks following the company’s appointment of Lazard and other advisers to evaluate financial alternatives. They also maintained a negative outlook on the company. Fitch expects Polyethylene prices to remain lower than expected in 2025 and 2026, in turn pushing net leverage above 15x in 2025. Fitch also expects cash to have fallen from the $100mn level reported on 30 June 2025. S&P similarly noted that liquidity is already tight against the company’s current structure, with limited operating cash flow and heavy interest burdens on its 7.45% 2029s and 6.99% 2032s. S&P had earlier put Braskem Idesa on Creditwatch Negative last week, citing a 46% reduction in cash in 2Q2025, high interest payments, low average utilisation of 66% and continuous decline in industry wide prices.

Braskem Idesa’s 6.99% 2032s are down by 0.4 points and are currently trading at 65.37, yielding 15.73%.

For more details, click here.

Go back to Latest bond Market News

Related Posts: