This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Braskem Faces Rating Agencies’ Scrutiny Over Depleting Cash Reserves

August 22, 2025

Braskem faces scrutiny from Moody’s and Fitch on accelerated cash burn and mounting debt. Persistent sector headwinds and the ongoing Alagoas environmental crisis have been the main reasons for eroding Braskem’s cash reserves. The agencies had recently downgraded the Brazilian petrochemical giant to B2 and BB- respectively. Braskem, known for its hefty cash reserves, has seen a 40% YoY slump, falling to $1.7bn last quarter. Braskem has consumed BRL 1.45bn ($264 mn) in cash in 2Q2025 alone and its debt coverage has fallen to 30 months from 61 months a year prior. In 2Q2025, Braskem’s net debt increased by $235mn to $6.8bn, which is 10.6x EBITDA in the last 12 months.

While no major maturities are due until 2028, Braskem still has access to a $1bn revolving credit line. Analysts said the group must act swiftly to refinance, cut costs, and consider asset sales to reduce refinancing risk. Moody’s warns that the petrochemical industry is unlikely to recover before 2030, which makes it urgent to take measures in order to shore up liquidity. Fitch has already downgraded Braskem twice this year, but its analysts said that another downgrade may come if the company does not show improvements in the next six months. They added that the current metrics are more in line with B, B- or even CCC issuers.

While the update has highlighted concerns, Braskem’s dollar bonds have inched higher by 1.5 points, albeit in a downtrend since April. Its 4.5% 2028s are currently trading at 74, yielding 18.5%.

For more details, click here.

Go back to Latest bond Market News

Related Posts:

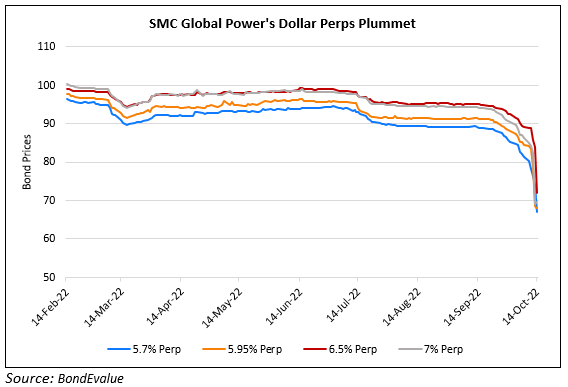

SMC Global’s Dollar Perps Drop Over 10%

October 14, 2022

Fitch Expects Mexican Government to Continue Supporting Pemex

August 17, 2023