This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Braskem Downgraded to Ba3 by Moody’s

April 9, 2025

Braskem was downgraded by a notch to Ba3 from Ba2 by Moody’s. The downgrade reflects the company’s continued weak credit metrics and cash generation, largely impacted by the petrochemical downcycle and underperformance in Mexico. At the end of 2024, Braskem’s adjusted leverage peaked at 15.3x and the company reported negative free cash flow of BRL 5.6bn ($0.9bn), driven by weak operations and Alagoas-related disbursements. According to Moody’s, Braskem’s leverage remains high despite expecting it to improve to 6.5–7.5x over the next 12–18 months with better EBITDA and cost-saving measures. The company is taking steps to improve resilience by cutting costs, reducing capex, and selling non-core assets but its ability to withstand prolonged industry weakness has narrowed, Moody’s highlighted.

Braskem’s bonds were trading stable with its 4.5% 2028s at 90.4 cents on the dollar, yielding 8.5%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Braskem Announces ~$1.45bn Share Offering

January 17, 2022

Braskem Idesa Upgraded to BB- by Fitch

March 28, 2022

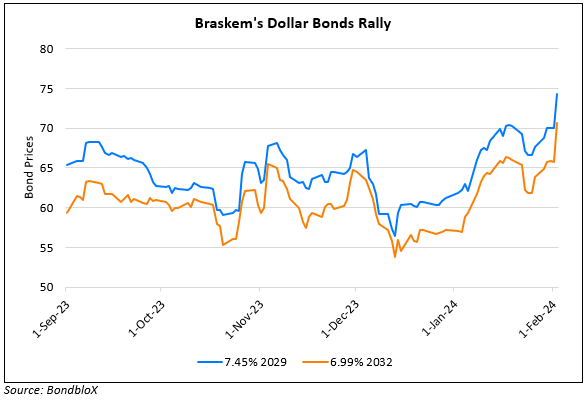

Braskem’s Dollar Bonds Rally on Reports of Stake Acquisition

February 2, 2024