This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BPCE Assurances, Wulf Compute Price Bonds

October 17, 2025

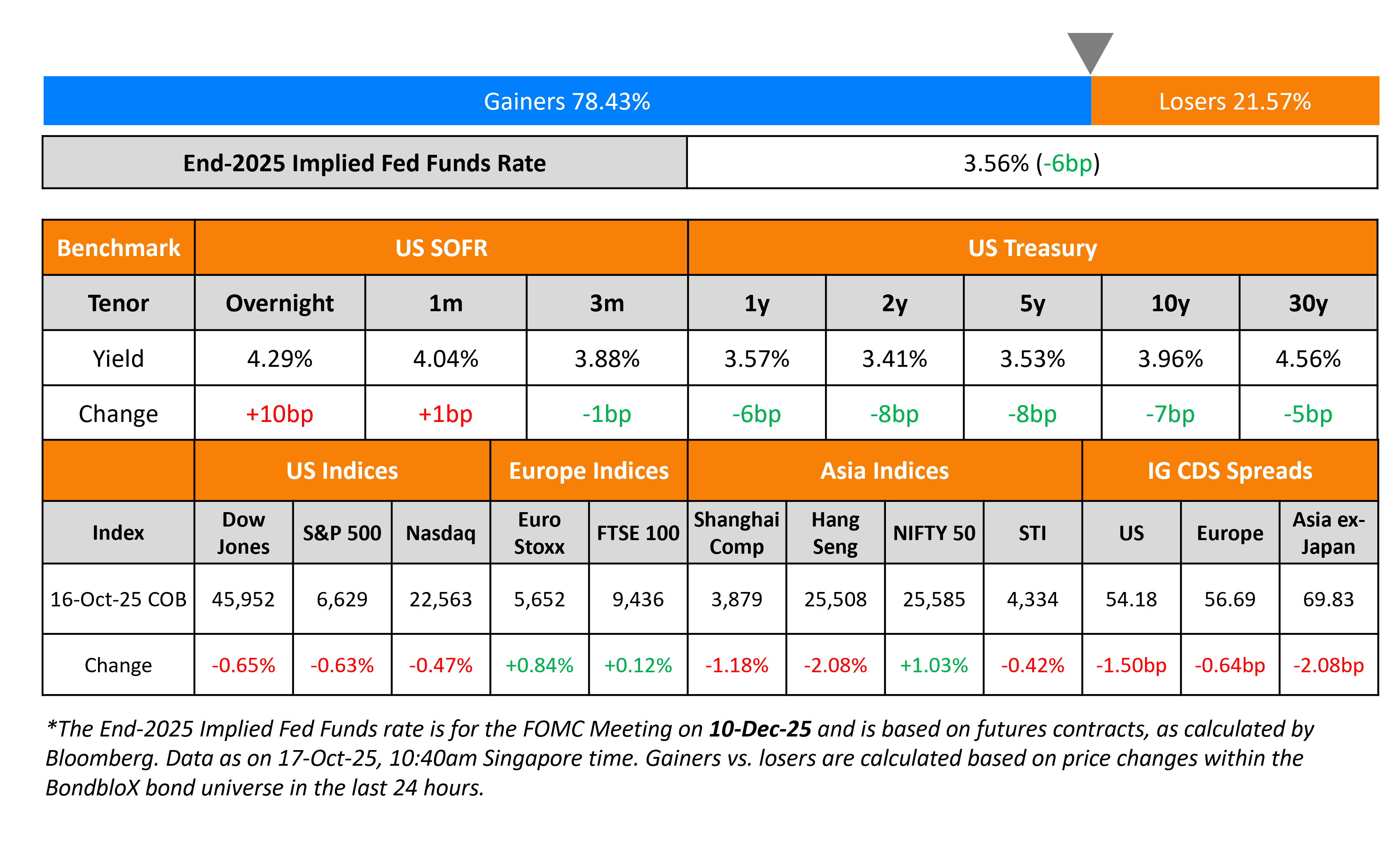

US Treasury yields eased by 5-8bp across the curve with the 10Y ending below 4% at 3.96%. The US budget deficit fell by $41bn to $1.775tn in fiscal 2025 (year ended September 30), as higher tariff revenues under President Trump and education spending cuts partially offset increased healthcare, retirement, and debt interest costs, according to the Treasury Department. Fed Governor Christopher Wallers said that he favors another interest rate cut at the next Fed policy meet later this month because of worrisome labor market developments. However he will weigh further rate cuts depending on the incoming data.

Looking at equity markets, both the S&P and Nasdaq ended lower by 0.6% and 0.5% respectively. The US IG and HY CDS spreads widened by 1.5bp and 12.1bp respectively. European equity indices ended higher. The iTraxx Main CDS spreads were 0.6bp wider while the Crossover spreads were 3.9bp wider. Asian equity markets have opened broadly lower today. Asia ex-Japan CDS spreads were 2.1bp wider.

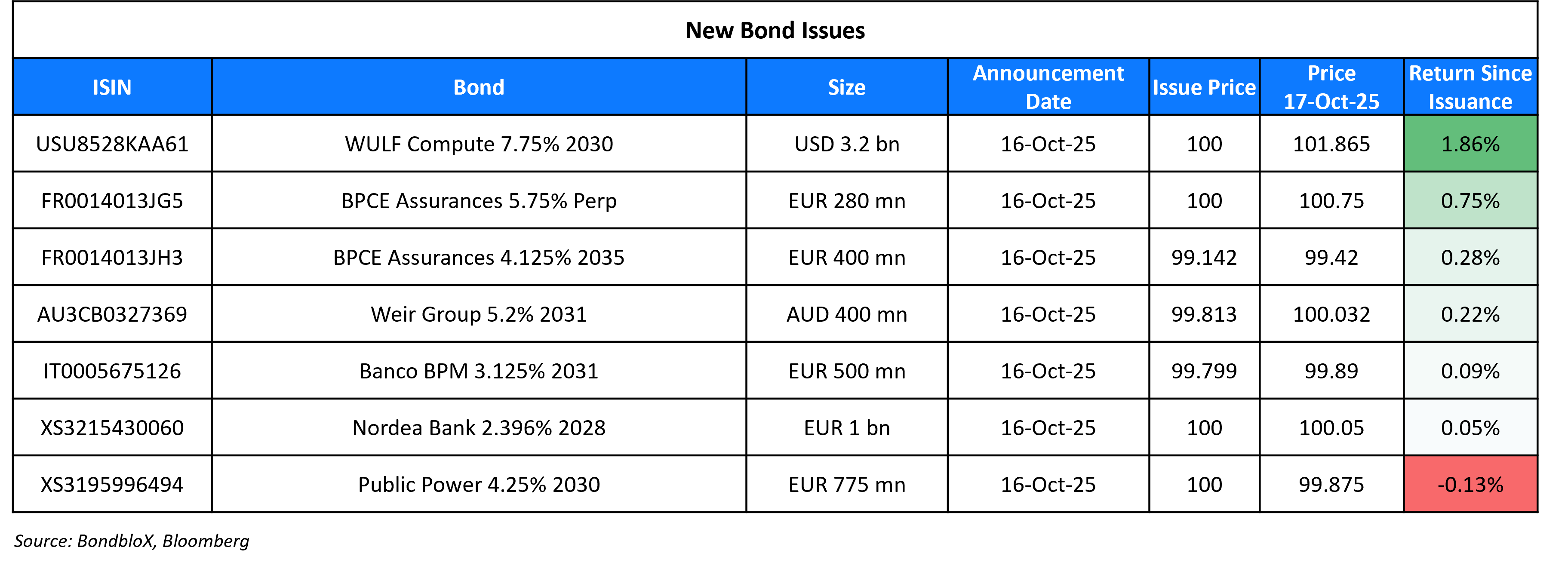

New Bond Issues

- Stockland Trust A$ 10Y at ASW + 150bp area

BPCE Assurances raised €680mn via a two-part deal. It raised:

- €400mn via a 10Y Tier-2 bond at a yield of 4.232%, 35bp inside initial guidance of MS+200bp area. The subordinated green bond is rated BBB (Fitch). Proceeds will be used to finance and/or refinance, in whole or in part, Eligible Green Assets, as described in Groupe BPCE’s Sustainable Development Funding Programme Green Funding Framework.

- €280mn via a PerpNC7 RT1 bond at a yield of 5.75%, a solid 50bp inside initial guidance of 6.25% area. The deal received strong orders of over €4.3bn, 15.3x issue size. The junior subordinated bond is rated BBB (Fitch). If not called by 22 October 2032, the coupon will reset to the 5Y Mid Swaps plus 342bp. A Trigger Event will occur if (a) Own Funds items ≤ 75% of the Solvency Capital Requirement (SCR) at Group level, (b) Own Funds items ≤ 100% of the Minimum Capital Requirement (MCR) at Issuer/or Group level or (c) Own Funds items ≤ 100% of the SCR but more than 75% of the SCR at Group level and has not been remedied within 3 months. Proceeds will be used for general corporate purposes.

Weir Group raised A$400mn at a yield of 5.243%, 5bp inside initial guidance of ASW+170bp area. The senior unsecured bond is rated Baa3/BBB- (Moody’s/S&P). Proceeds will be used for general corporate purposes, including to help finance the recent acquisition of Micromine.

Debut issuer Wulf Compute raised $3.2bn via a 5NC2 bond at a yield of 7.75%, 25bp inside initial guidance of 8%. The senior secured, amortizing, green bond is rated Ba2/BB/BB (Moody’s/S&P/Fitch). A portion of the proceeds will be used to expand its data center at its Lake Mariner campus in Barker, New York, which is an eligible green project.

Banco BPM raised €500mn via a 6NC5 bond at a yield of 3.169%, 30bp inside initial guidance of MS+120bp area. The senior non-preferred green bond is rated Baa3/BB+/BBB-. Proceeds will be be allocated mainly to eligible assets related to real estate activities.

Public Power raised €775mn via a 5NC2 bond at a yield of 4.25% vs. initial guidance of mid-high 4% area. The senior unsecured, green bond is rated BB-/BB- (S&P/Fitch). The bond is callable in the 2nd year at par plus 50% (of coupon, 102.125), 3rd year at par plus 25% (of coupon, 101.06) and 4th year at par. The proceeds will be used to redeem in full its existing sustainability-linked senior notes due 2026 and pay fees and expenses. An amount equivalent to the net proceeds of this offering will be used to finance or refinance, in whole or in part, eligible green projects in accordance with its Green Finance Framework.

New Bonds Pipeline

-

Republic of Korea $ 5Y bond

- GS Caltex $ 5Y bond

- Ampol A$ FXD And/Or FRN 30NC8.25

Rating Changes

- Moody’s Ratings upgrades Volcan’s ratings to B2 and assigns a B2 rating to its proposed senior secured notes; outlook changed to positive

- Moody’s Ratings upgrades Mongolia’s rating to B1; outlook stable

- Moody’s Ratings upgrades Alpha Bank’s long-term deposit ratings to Baa1

- Fitch Upgrades BBVA’s Latin American Subsidiaries

- OCP S.A. Upgraded To ‘BBB-‘ From ‘BB+’ Following Sovereign Upgrade; Outlook Stable

- Moody’s Ratings upgrades Elanco to Ba2; outlook is stable

- Moody’s Ratings places Genting Berhad’s, Genting Overseas Holdings’ and Genting Singapore’s ratings on review for downgrade

- Fitch Revises Outlook on IIFL Finance to Positive; Affirms at ‘B+’

Term of the Day

Masala Bonds

Masala Bonds are bonds denominated in Indian Rupees (INR) that are issued outside of India. These bonds come under the External Commercial Borrowings (ECB) route as categorized by the Reserve Bank of India (RBI). Masala bonds are typically issued by Indian entities that are looking to raise debt offshore. If an Indian corporate that earns majority of its revenues/profits in INR has to raise money in foreign currency, the interest and principal have to be paid in foreign currency, which can lead to foreign currency risk. Since masala bonds are denominated in INR, the issuer does not bear foreign currency risk. This makes masala bonds an issuer-friendly fund raising option. Recently DBS came under scrutiny by Indian tax authorities over its 2019 Masala bond investments.

Talking Heads

On Risks of Domestic Borrowing in Sub Saharan Africa – IMF

“The domestic cost of capital remains elevated across the region. Local financial markets are underdeveloped – characterized by shallow depth, fragmentation, illiquidity and high transaction costs and lending spreads”. The IMF warned that new domestic public borrowing is “significantly more expensive than external borrowing” in many countries.

On French Bonds Facing Risk of Sell-off

Claudia Panseri, UBS Global Wealth Management

The yield premium investors demand to hold French debt “could increase further if the average sovereign credit rating falls,” warning of “potential forced selling by rating-constrained investors.”

Moritz Henkel, VanEck

“We are aware of the current developments and continue to monitor the situation closely. We are in contact with the index provider to stay informed and are reviewing potential market developments around timing and liquidity.”

On Split Opinions Over AI Bubble

Jeff Bezos, Amazon

“When people get very excited as they are today about artificial intelligence, for example, every experiment gets funded,… And investors have a hard time in the middle of this excitement distinguishing between the good ideas and the bad ideas. A bubble like a banking bubble, a crisis in the banking system, that’s just bad … The ones that are industrial are not nearly as bad, it could even be good because when the dust settles and you see who are the winners, society benefits from those inventions.”

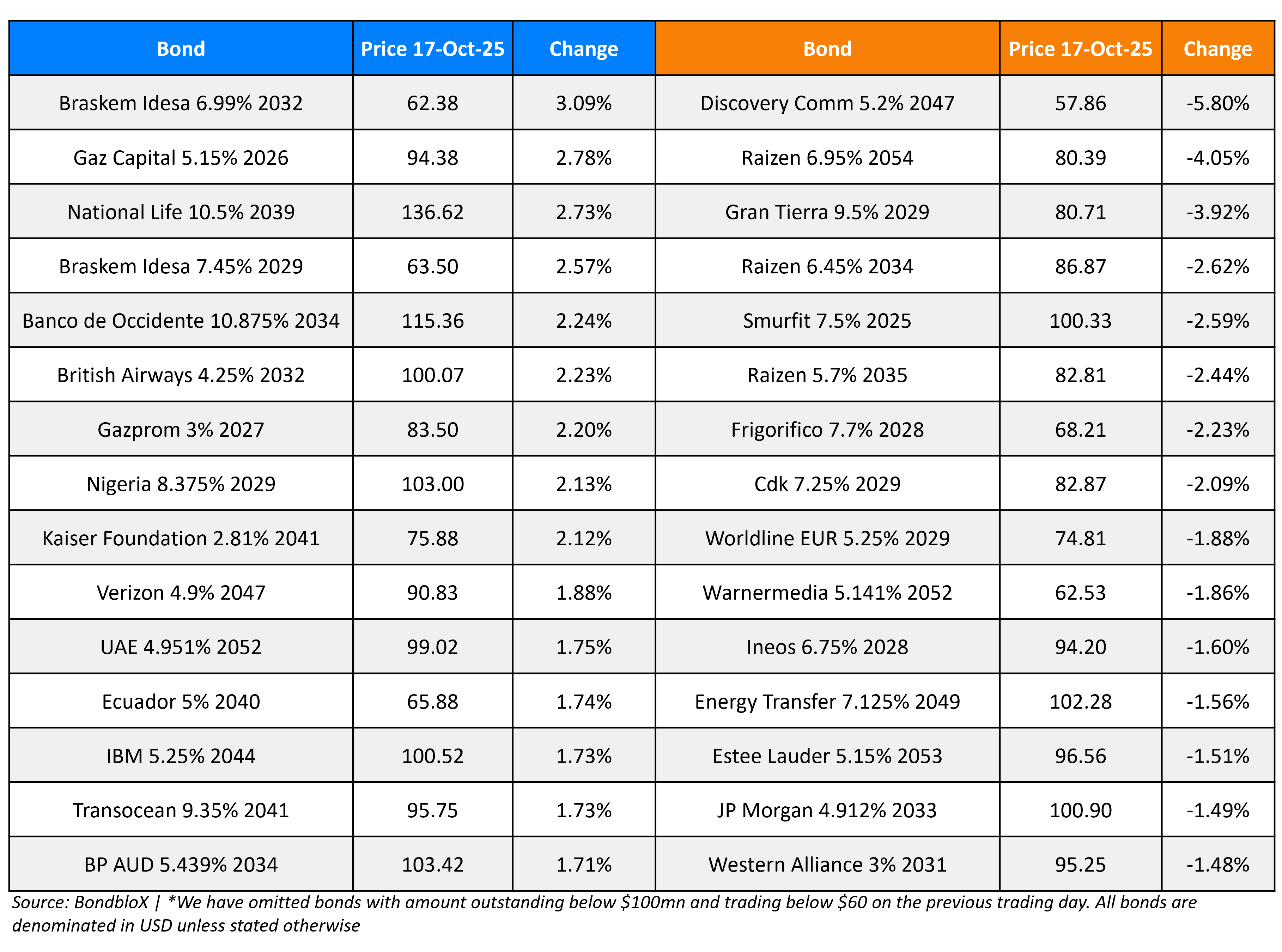

Top Gainers and Losers- 17-Oct-25*

Go back to Latest bond Market News

Related Posts: