This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

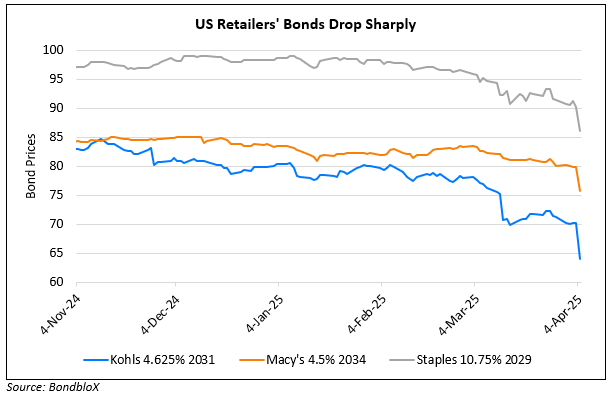

Bonds of US Retailers like Macy’s, Kohl’s Drop Over 4 Points

April 4, 2025

US retailers’ bonds including the likes of Macy’s, Staples and Kohls fell by over ~4 points across their curves. This comes amid the broader selloff in junk bonds, especially ones which are highly reliant on imports and discretionary consumer spending. The introduction of new tariffs saw bonds across these sectors move lower. Companies like Wayfair and Staples, are known to have a higher dependency on imported goods, making them vulnerable to such policy changes. Additionally, companies like Macy’s have been actively engaging in debt restructuring efforts. Kohl’s bonds have been trending lower since early March after forecasting a larger than expected drop in annual sales. Also, Kohl’s and Macy’s have announced store closures in recent times.

Go back to Latest bond Market News

Related Posts:

Staples Downgraded to B- by S&P

September 21, 2023

Staples Bonds Jump Higher on Strong Earnings

November 30, 2023

Staples Said to be Working on Refinancing Package

April 11, 2024