This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Bond Market Daily: ADP Payrolls Post First Drop in 2 Years; SoftBank, NBK, Qatar Insurance, RAK Price Bonds; Oracle Outlook Revised to Negative on Weaker Cash Flow

July 3, 2025

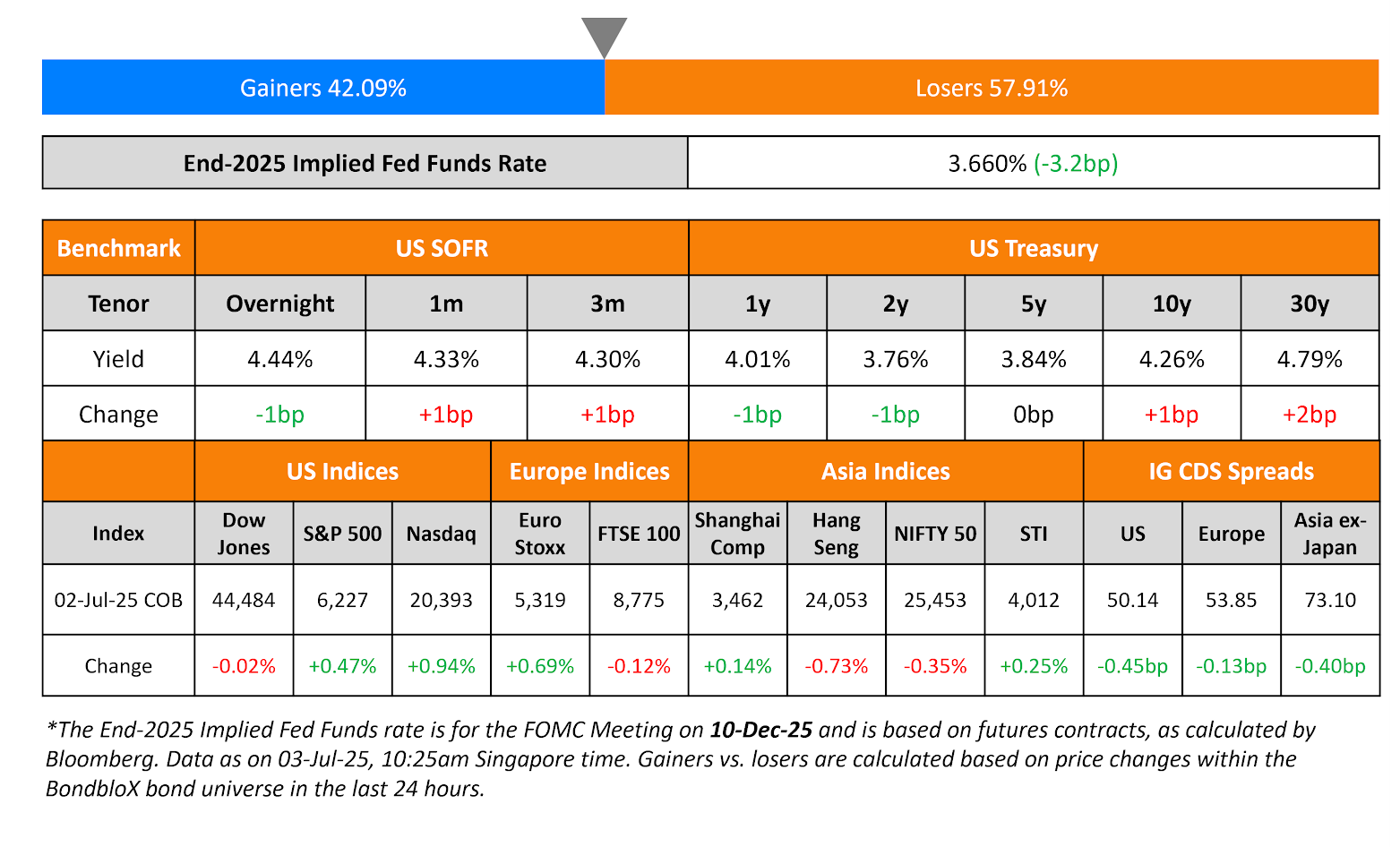

US Treasury yields were broadly unchanged on Wednesday. US ADP Private Payrolls saw its first drop in two years, coming-in at -33k vs. expectations of a 98k print. The report cited job losses in the professional and business services, education and health services, and financial activities sectors. All eyes are now on the NFP reading later today, with economists expecting a payroll growth of 106k.

Looking at equity markets, the S&P and Nasdaq ended higher, up by 0.5% and 0.9% respectively. In credit markets, US IG CDS spreads were tighter by 0.5bp and HY CDS spreads tightened 2.2bp. European equity markets ended mixed. The iTraxx Main CDS spreads tightened by 0.1bp while Crossover CDS spreads widened by 0.5bp. Asian equity markets have opened broadly higher today. Asia ex-Japan CDS spreads were tighter by 0.4bp.

New Bond Issues

- Q&M Dental Group S$ 3Y at 4.35% area

SoftBank raised €1.7bn via a three-tranche deal. It raised:

- €600mn via a 4.25Y bond at a yield of 5.25%, ~37.5bp inside initial guidance of 5.50-5.75% area. The bond is priced at a new issue premium of ~49bp over its existing EUR 4% 2029s that currently yield 4.76%.

- €600mn via a 6Y bond at a yield of 5.875%, ~50bp inside initial guidance of 6.25-6.50% area.

- €500mn via a 8Y bond at a yield of 6.375%, ~50bp inside initial guidance of 6.75-7.00% area.

These senior unsecured bonds are rated BB+ by S&P. Proceeds will be used for redemption of foreign currency-denominated senior notes due 2025 and for general corporate purposes.

National Bank of Kuwait (NBK) raised $800mn via a PerpNC6 AT1 bond at a yield of 6.375%, 50bp inside initial guidance of 6.875% area. The junior subordinated note is rated Baa3. If not called before 10 July 2031, the coupon will reset to the 6Y UST plus 240.3bp. Proceeds will be used as tier 1 capital and to fund the buyback of its outstanding $750mn 4.5% Perp in whole or in part.

Qatar Insurance raised $500mn via PerpNC6 Tier 2 bond at a yield of 6.15%, 60bp inside initial guidance of 6.75% area. The subordinated note is rated BBB by S&P and received orders above $2bn, 4x the issue size. If not called by 10 July 2031, the coupon will reset to the interpolated 6Y UST plus 220.4bp, and every 6 years thereafter.

RAK Bank raised $300mn via a PerpNC6 AT1 bond at a yield of 6.625%, 37.5bp inside initial guidance of 7.00% area. The junior subordinated note is unrated. If not called before 9 July 2031, the coupon will reset to the 6Y UST plus 266.4bp. Proceeds will be used for general corporate purposes and to further strengthen the issuer’s capital base.

New Bonds Pipeline

-

Trafigura hires for $ 5Y bond

- Shinhan Bank hires for $ 5Y bond

- Port of Newcastle hires for A$ 8Y/10Y bond

Rating Changes

- Fitch Upgrades Smurfit Westrock to ‘BBB+’; Outlook Stable

- Fitch Affirms Bunge at ‘BBB+’/Stable; Upgrades and Withdraws Viterra’s IDR

- Garfunkelux HoldCo 2 (Lowell) Upgraded To ‘CCC+’ From ‘D’; New Senior Secure Notes Assigned ‘CCC+’ Rating

- Bunge Global S.A. Upgraded To ‘A-‘ On Merger With Viterra Ltd., Off Watch Pos; Outlook Stable

- Del Monte Foods Inc. Downgraded To ‘D’ From ‘CCC’ On Chapter 11 Bankruptcy Filing

- Oracle Inc. Outlook Revised To Negative On Weakening Cash Flow To Support Growth; Ratings Affirmed

Term of the Day: Space Bonds

Space bonds are an idea that has been conceived, to let spaceports issue tax-exempt bonds to allow for the financing of spaceports. The idea was proposed in the US, in a 2024 bill.

Space Florida, an aerospace finance and development authority, is said to be advocating for tax-exempt space bonds.

Talking Heads

On Emerging Asian Bonds Looking Poised to Lure Back Overseas Funds

Khoon Goh, ANZ

“Some of the big outflows from those countries occurred following the Israel attack on Iran…With the Middle East issue now resolved and the US dollar under pressure again, we should see bond inflows”

On Investors Reaping 22% Gain as Big Rally Sweeps Mexico’s Peso Bonds

Gorky Urquieta, Neuberger

“When we look at fundamentals, technicals and even valuation for rates, they all kind of check the box”

Adriana Cristea, Pictet

“We remain invested…The trade is not over to us.”

On Bond Traders Eyeing US Jobs Report for Fed Rate Clues

Dan Carter, Fort Washington Investment

“A weak print would certainly make July a live meeting, while a strong report would take a July cut off the table completely”

TD Securities Strategists

“We would expect any downside surprises in the headline or larger upward move in the unemployment rate to generate a larger market reaction than upside surprises”

Ed Al-Hussainy, Columbia Threadneedle Investment

“The odds for the July and September meeting can go to a coin toss”

Top Gainers and Losers- 03-Jul-25*

Go back to Latest bond Market News

Related Posts: