This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Bond Investing Just Got Easier with Model Portfolios

September 1, 2025

In today’s fast-paced world, the landscape of investing can feel overwhelming. With countless options and endless data to sift through, knowing where to start, or what to do next, can feel like a challenge. The goal of investing should be to help you build and secure your financial future, not to add more stress to your life.

That is why we at BondbloX are excited to announce the launch of Model Portfolios, a new feature designed to make your bond investing journey simpler, smarter, and more accessible.

Model Portfolios takes the guesswork out of investing by providing you with curated, expertly-designed investment strategies executable on the BondbloX app. This isn’t just another tool, but a new way to think about building and managing your bond portfolio.

What Are Model Portfolios?

Think of a Model Portfolio as a pre-packaged, professionally crafted bond investment strategy. Instead of spending hours researching individual bonds, comparing issuers, and trying to balance risk, you can invest in a portfolio of individual BondbloX that have been carefully selected by professionals as a bundle to meet a specific objective. Whether you’re aiming for stability, seeking growth, or targeting a specific sector, a Model Portfolio provides a clear and transparent path.

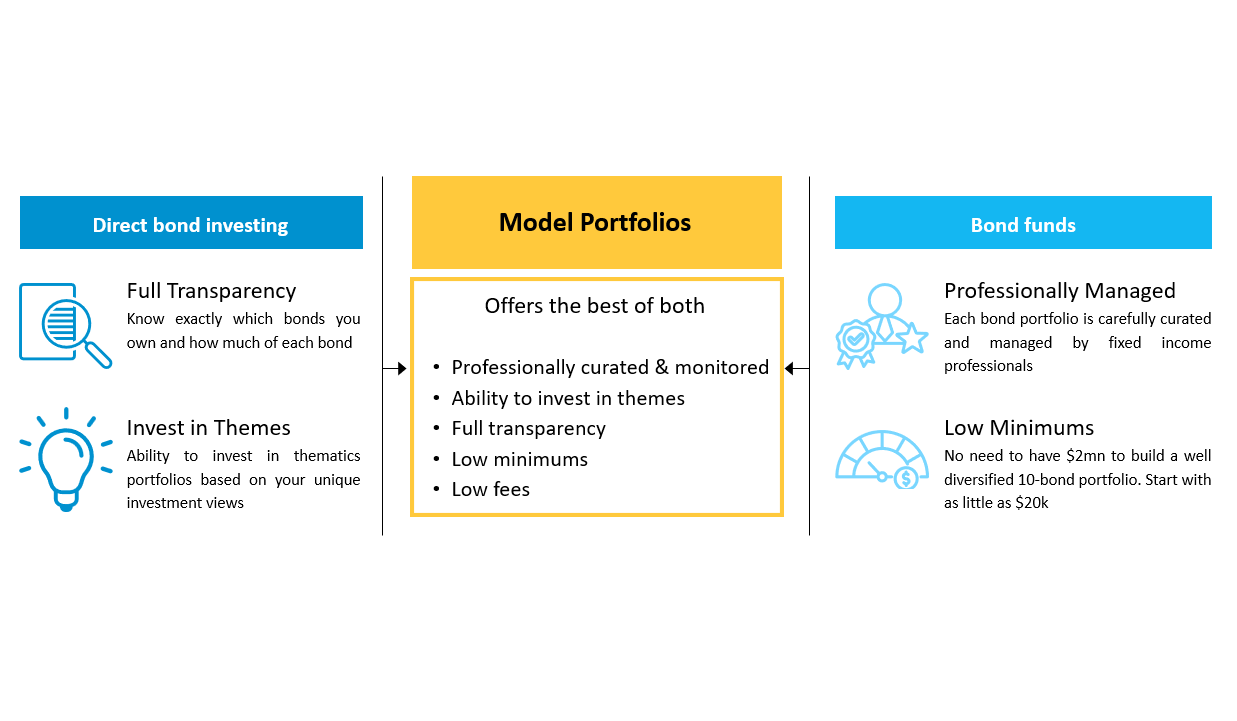

Model Portfolios offers:

– Full transparency on what bonds you own and how much of each, just like direct bond investing

– Curated and monitored by fixed income professionals

– Ability to invest in themes or take a view, just like direct bond investing

– Low minimums starting at just $10k for a 10-bond portfolio vs. the traditional $2mn

How do Model Portfolios Work?

The Portfolio Provider, an independent third party asset manager or a credit research firm, will leverage their expertise in fundamental research coupled with quant models to curate a series of model portfolios, each with a different theme and objective. These portfolios will be loaded directly on to the BondbloX App, where BondbloX’s members can access all relevant information including the list of bonds and weights. With just a few clicks, you can put in an order to buy the portfolio which will comprise a bundle of individual curated BondbloX, tapping on BondbloX’s best execution capabilities.

The portfolios are continuously monitored by the Portfolio Provider, who will provide quarterly updates on the constituents and make ad-hoc adjustments to the portfolio based on their assessment of credit and valuations.

Model Portfolios are designed to offer several key advantages that address some of the biggest pain points for investors:

– They Save You Time: The complexity of researching and constructing a diversified portfolio can be a major barrier. Model Portfolios eliminate this by giving you a ready-made solution, freeing up your time to focus on your other priorities.

– They Simplify Diversification: One of the most important principles of investing is diversification—spreading your risk across multiple securities to protect against losses. Our Model Portfolios are built with this in mind, providing you with a diversified mix of 10 bonds per portfolio selected by professionals.

– They Are Cost-Effective: Unlike funds that typically have multiple layers of fees (as high as 2%!), the model portfolios on BondbloX will have a transparent fee structure so that you know exactly how much of fees you will be paying.

– They Are Transparent: Again unlike funds, you will have complete visibility on all the bond holdings within a portfolio.

The BondbloX Advantage: Simple, Smart, and Accessible

The launch of Model Portfolios on the BondbloX Exchange marks a significant step forward in our mission to make the bond market more accessible and efficient for everyone. We believe that investing should be clear, transparent, and aligned with your personal financial goals.

With Model Portfolios, we’re putting professional-grade investment strategies directly into your hands, accessible with as little as $10k with just a few clicks.

Learn more about Model Portfolios on the BondbloX App here.

Disclaimer

The materials and information contained herein are solely for general information reference, and not intended to constitute nor as a substitute for legal, commercial and/or financial advice. The information, opinions and views expressed herein are not, and shall not constitute an offer, or a solicitation of an offer, or an inducement, or a recommendation, to purchase or sell any investment product or service or engage in any investment strategy. Nothing herein has been tailored to the investment objectives or financial situation of any specific individual, are current only as of the date hereof and may be subject to change at any time without prior notice. No representation, warranty or claim whatsoever is made nor implied as to the accuracy or completeness of any material or information contained herein, and we have no liability whatsoever for any error, inaccuracies or omissions. No reliance should be made on the materials or information herein for any investment decision, and we accept no liability whatsoever for any direct or indirect loss whatsoever which may arise from the use or reliance of any such material or information. All investments involve risks. The business of investing is a complicated matter that requires serious financial due diligence for each investment. No representation whatsoever on the suitability or otherwise of any securities, products, or services for any particular investor is made or implied. Each investor is solely responsible for its own independent investment decision based on its personal investment objectives, financial circumstances and risk tolerance, and should seek its own independent legal, tax and other professional advice prior to any such decision.

Go back to Latest bond Market News

Related Posts: