This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BoJ Keeps Rates Unchanged at 0.5%; USDJPY Above 150 Handle; Binghatti, Keppel REIT Price Bonds

August 1, 2025

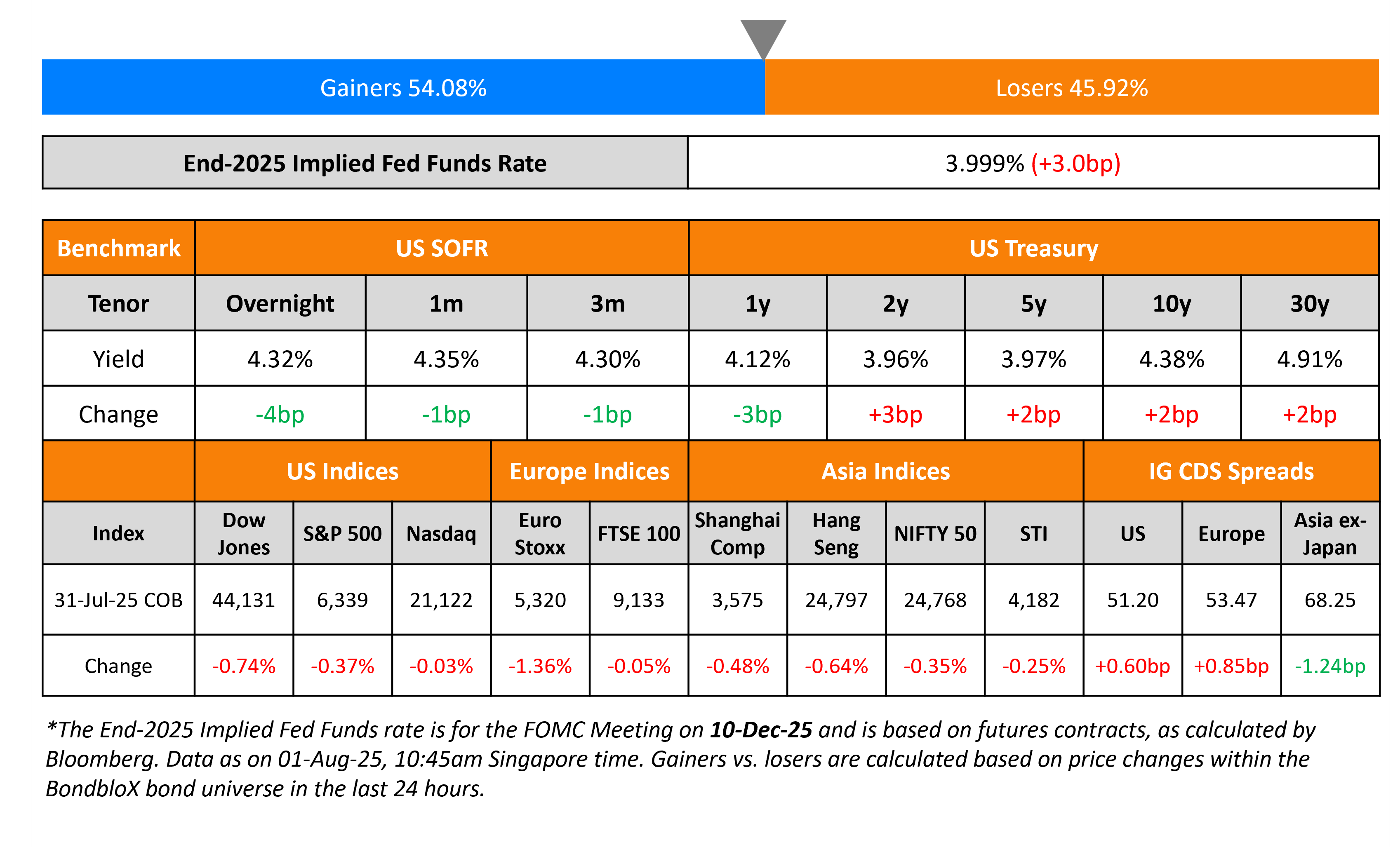

US Treasury yields inched parallelly higher across the curve by 2-3bp. US Headline PCE for June came-in at 2.6% YoY, higher than the expected 2.5%. The Core PCE Index, also known as the Fed’s preferred inflation measure came-in at 2.8% YoY vs. expectations of 2.7%. Separately, US President Donald Trump doled out tariffs on several other countries including Canada, Switzerland, Thailand, Cambodia and Taiwan.

Looking at US equity markets, the S&P ended lower by 0.4% while the Nasdaq closed flat. US IG CDS spreads were 0.6bp wider and HY CDS spreads widened by 2.2bp. European equity markets ended lower. The iTraxx Main and Crossover CDS spreads widened by 0.9bp and 2bp respectively. Asian equity markets have opened lower today. Asia ex-Japan CDS spreads were 1.2bp tighter. The BOJ kept its target rate unchanged at 0.5%, in-line with expectations. This was followed by the USDJPY rallying above the 150 handle for the first time since March.

New Bond Issues

Binghatii raised $500mn via a 5Y sukuk at a yield of 8.125%, 37.5bp inside initial guidance of 8.5% area. The senior unsecured note is rated BB- by Fitch.

Keppel REIT raised S$300mn via a PerpNC3 bond at a yield of 3.78%, 32bp inside initial guidance of 4.10% area. The subordinated note is unrated. HSBC Institutional Trust Services Singapore Ltd. will act as a trustee. If not called by 11 August 2028, the coupon will reset to the SGD 3Y swap plus 222.5bp. The notes have a dividend stopper but do not have a dividend pusher. Proceeds will be used by Keppel REIT’s Trustee toward refinancing borrowings including financing redemption of its existing S$300mn 3.15% Perp. Private banks received a 20-cent rebate.

New Bonds Pipeline

- Indonesia hires for A$ 5Y/10Y bond

Rating Changes

-

American Tower Corp. Upgraded To ‘BBB+’, Outlook Stable, Under Our Updated Methodology; Off UCO

-

Fitch Downgrades JetBlue to ‘B-‘; Downgrades and Affirms Certificate Ratings; Outlook Negative

-

Fitch Downgrades Victoria to ‘CCC-‘ on Potential Distressed Debt Exchange; Places on Watch Neg

-

Victoria PLC Downgraded To ‘CCC-‘ And Placed On CreditWatch Negative On Proposed Debt Exchange

Term of the Day: Personal Consumption Expenditures (PCE)

Personal Consumption Expenditures (PCE) is an inflation metric measuring consumer spending on goods and services, released by the US Department of Commerce. The Fed’s preferred measure of inflation is the Core PCE – this refers to the Headline PCE after stripping out two volatile components, namely, food and energy.

The US also publishes another inflation metric, the CPI (Consumer Price Inflation), a key inflation indicator. CPI and PCE differ on four fronts: formula, weight, scope and other factors. As per the BLS, “CPI sources data from consumers, while PCE sources from businesses. The scope effect is a result of the different types of expenditures CPI and PCE track…CPI only tracks out-of-pocket consumer medical expenditures, but PCE also tracks expenditures made for consumers, thus including employer contributions. The implications of these differences are considerable.”

Talking Heads

“I don’t see any reason at all for why he should prejudge that question… it will depend on who the next Fed chair is and what the sense is of how the Fed is going to operate going forward…I suspect Chair Powell doesn’t know what he will do…Preserving flexibility was the right course of action for him to take”

On Bond Trading Bots Getting Smarter and Powering Through Market Unrest

David Massingham, Morgan Stanley

“There is a big difference between how algos generally performed this time around compared to 2020

Kevin McPartland, Crisil Coalition Greenwich

“March 2020 was a really big test for auto-quoters and automatic execution and not everything worked as planned”

Adam Jones, RBC Capital Management

“Nobody’s really switching them off anymore”

On Yen Being Its Weakest Since March

Katsunobu Kato, Japan Finance Minister

“The government is deeply concerned about trends in the currency market, including speculative movements…It’s important for exchange rates to remain stable, reflecting economic fundamentals”

Tohru Sasaki, Fukuoka Financial

“Ueda was still quite dovish, so I see an even greater chance of the yen weakening past the 155 level against the dollar”

Top Gainers and Losers- 1-Aug-25*

Go back to Latest bond Market News

Related Posts: