This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BOJ Hikes Rates; SocGen Prices $ AT1 at 8.5%; HSBC Prices € Tier 2 at 4.599%

March 19, 2024

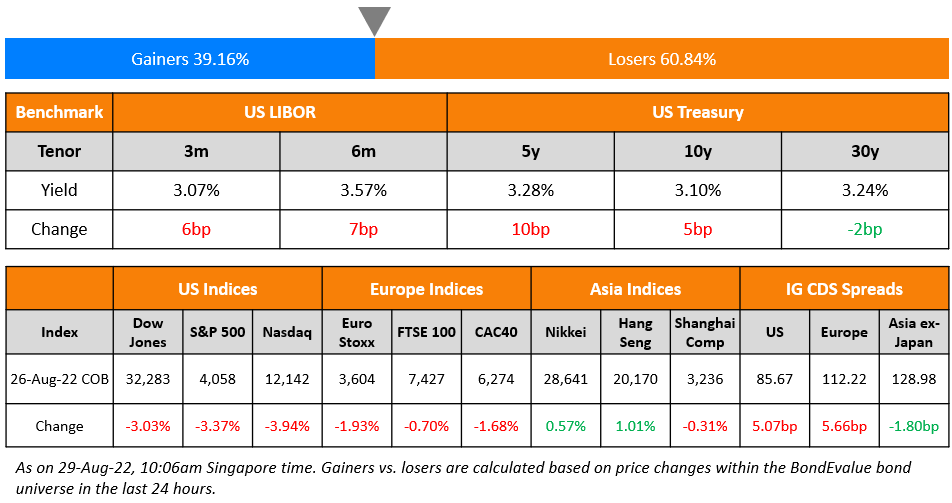

US Treasury yields inched higher by up to 3bp across the curve on Monday. Markets await the FOMC’s policy meeting on Wednesday. Credit markets saw US IG CDS spreads tighten 0.8bp and HY spreads tighten by 4bp. Looking at equity indices, S&P and Nasdaq rose 0.6-0.8%.

European equity indices closed near flat. European IG CDS spreads tightened 0.6bp and HY spreads were 3.3bp tighter. Asian equity markets have opened mixed today. Asia ex-Japan IG CDS spreads were 1.7bp tighter. The BOJ hiked its policy rate as expected, and set a new policy rate range of between 0-0.1%, shifting from its -0.1% regime. The vote for the rate hike was 7-2. The BOJ also scrapped the yield curve control program whilst pledging to keep buying long-term government bonds as needed. It said that financial conditions will remain accommodative, indicating that it was not the beginning of an aggressive tightening cycle.

New Bond Issues

- Bank of the Philippine Islands $ 5Y at T+140bp area

SocGen raised $1bn via a PerpNC10.5 AT1 bond at a yield of 8.5%, 50bp inside initial guidance of 9% area. The junior subordinated notes are rated Ba2/BB/BB+. The coupons are fixed until the first reset date of 25 September 2034 and if not called, will reset to the 5Y US Treasury yield plus the reset spread of 415.3bp. The notes have a mechanical trigger if the CET1 ratio of the group falls below 5.125%. The new bonds offer a yield pick-up of 103bp over UBS’s 9.25% Perp (callable in November 2033) that currently yield 7.47%. UBS’s 9.25% Perp is rated Baa3/BB/BBB- and has a reset spread of 475.8bp over the US 5Y Treasury yield.

HSBC raised €1bn via a 11NC6 Tier 2 bond at a yield of 4.599%, 35bp inside initial guidance of MS+220bp area. The subordinated notes are rated Baa1/BBB/A-, and received orders of over €4.25bn, 4.25x issue size. The bonds are callable on 22 March 2030. The new bonds are priced roughly in-line with BPCE’s 5.125% 2035s (callable in January 2030 and rated Baa2/BBB/BBB+) that currently yield 4.58%. As compared to ING Groep’s 5% 2034s (callable in November 2033 and rated Baa2/BBB/A-) that currently yield 4.51%, the new bonds offer a ~9bp yield pick-up.

India Vehicle Finance raised $300mn via a 6.5Y bond at a yield of 5.85%, 30bp inside initial guidance of 6.15%. The senior unsecured notes are rated BBB- (Fitch). Proceeds will be used to subscribe to: (a) 95% of INR senior pass through certificates (PTCs) issued by Sansar Vehicle Finance Trust December 2022 and; (b) for transaction related fees and expenses including capitalization of issuer. The issuer is an offshore SPV incorporated in Mauritius and registered as an FPI with SEBI. The notes have a weighted average life of ~3.5Y on the basis of the principal repayment schedule. The security against the notes includes having a pledge over 100% shares of the issuer and a charge over all assets of the issuer (other than Indian assets including INR senior PTCs and manager indemnity assets. The seller of the PTCs is Shriram Finance Ltd.

JPMorgan raised €2bn via a 10NC9 bond at a yield of 3.761%, 30bp inside initial guidance of MS+135bp area. The notes are rated A-.

Morgan Stanley raised €5bn via a three-part deal. It raised:

- €1.5bn via a 3NC2 FRN at a yield of 3m Euribor+65bp, 30bp inside initial guidance of 3m Euribor+95bp area

- €1.5bn via a 6NC5 bond at a yield of 3.79%, 30bp inside initial guidance of MS+130bp area. The new bonds are priced 3bp wider to its existing 4.656% bonds due March 2029 (callable in March 2028) that currently yield 3.76%

- €2bn via a 11NC10 bond at a yield of 3.955%, 35bp inside initial guidance of MS+160bp area

The notes are rated A1/A-/A+, and proceeds are used for general corporate purposes.

New Bond Pipeline

- EHi Car Services hires for $ bond

- Shinhan Bank hires for bond

Rating Changes

- Fitch Upgrades TAV Holding to ‘BB+’ on Sovereign Upgrade

- Cenovus Energy Inc. Rating Raised To ‘BBB’ From ‘BBB-‘ On Achieved And Targeted Debt Reduction; Outlook Stable

- Moody’s downgrades Yuexiu REIT’s ratings to Ba2; outlook remains negative

- Intrum Downgraded To ‘B’ After The Announced Evaluation Of Its Capital Structure; Rating Placed On CreditWatch Negative

- Egypt Outlook Revised To Positive On Extensive External Support Program; ‘B-/B’ Ratings Affirmed

Term of the Day

Yield Curve Control

Yield Curve Control (YCC) is a policy that targets long term interest rates by buying or selling long term bonds to keep the interest rate from rising above it’s target. This is a measure taken to stimulate economic growth. Yield curve controls are also sometimes referred to as Interest Rate Pegs. The Bank of Japan (BOJ) is famous for having had a YCC policy in place where they peg the yield on 10-year Japanese Government Bonds (JGB) to fight persistently low inflation.

Talking Heads

On Equities Rally at Risk From Yields – Morgan Stanley’s Wilson

“We view 4.35% on the 10-year US Treasury yield as an important technical level to watch for signs that rate sensitivity may increase for equities… Fed and BOJ meetings will be important tests”

On AllianzGI, BlueBay Cutting Pakistan Bond Holdings on IMF Uncertainty

Tim Ash, senior EM sovereign strategist at BlueBay

“Pakistan has come a long way in a short period of time, and still significant risks remains… with the IMF relationship, it will be difficult with lapses on the policy front.”

Jenny Zeng, CIO for APAC fixed income at Allianz Global Investors

“Even if a new IMF program is obtained, its ability to resume fiscal and structural reforms could still be hampered”

On Bond Traders Surrendering to Higher-for-Longer Reality From the Fed

Earl Davis, head of fixed income and money markets at BMO Global Asset Management

“The Fed wants to ease but the data isn’t allowing them. They want to maintain optionality to ease in summer… will start to change, if the labor market is tight and inflation remains high”

Nomura economists

“With little urgency to ease, we expect the Fed will wait to see whether inflation is slowing before beginning a rate-cut cycle”

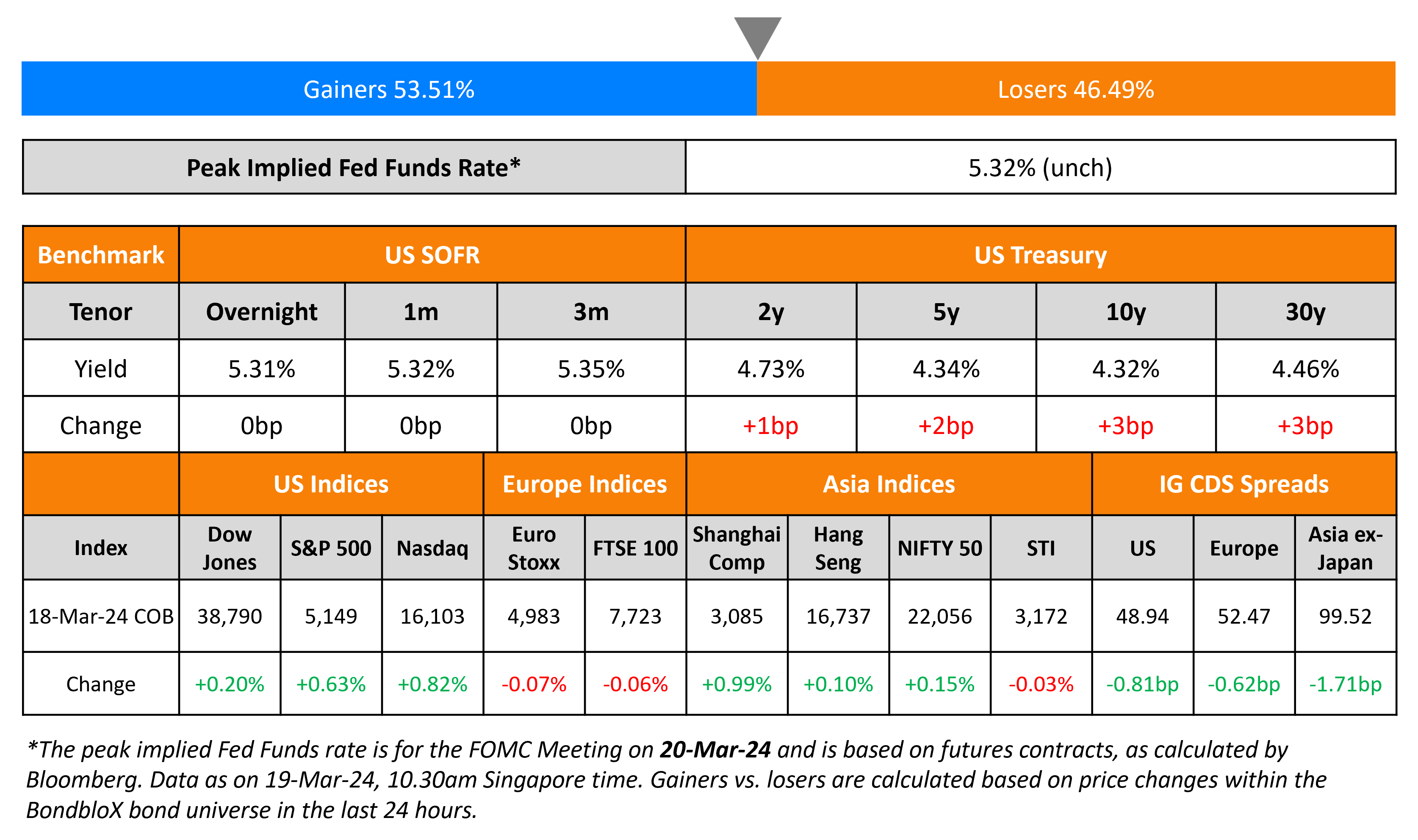

Top Gainers & Losers- 19-March-24*

Go back to Latest bond Market News

Related Posts: