This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BofA, UBS, Sharjah Price Bonds

February 7, 2025

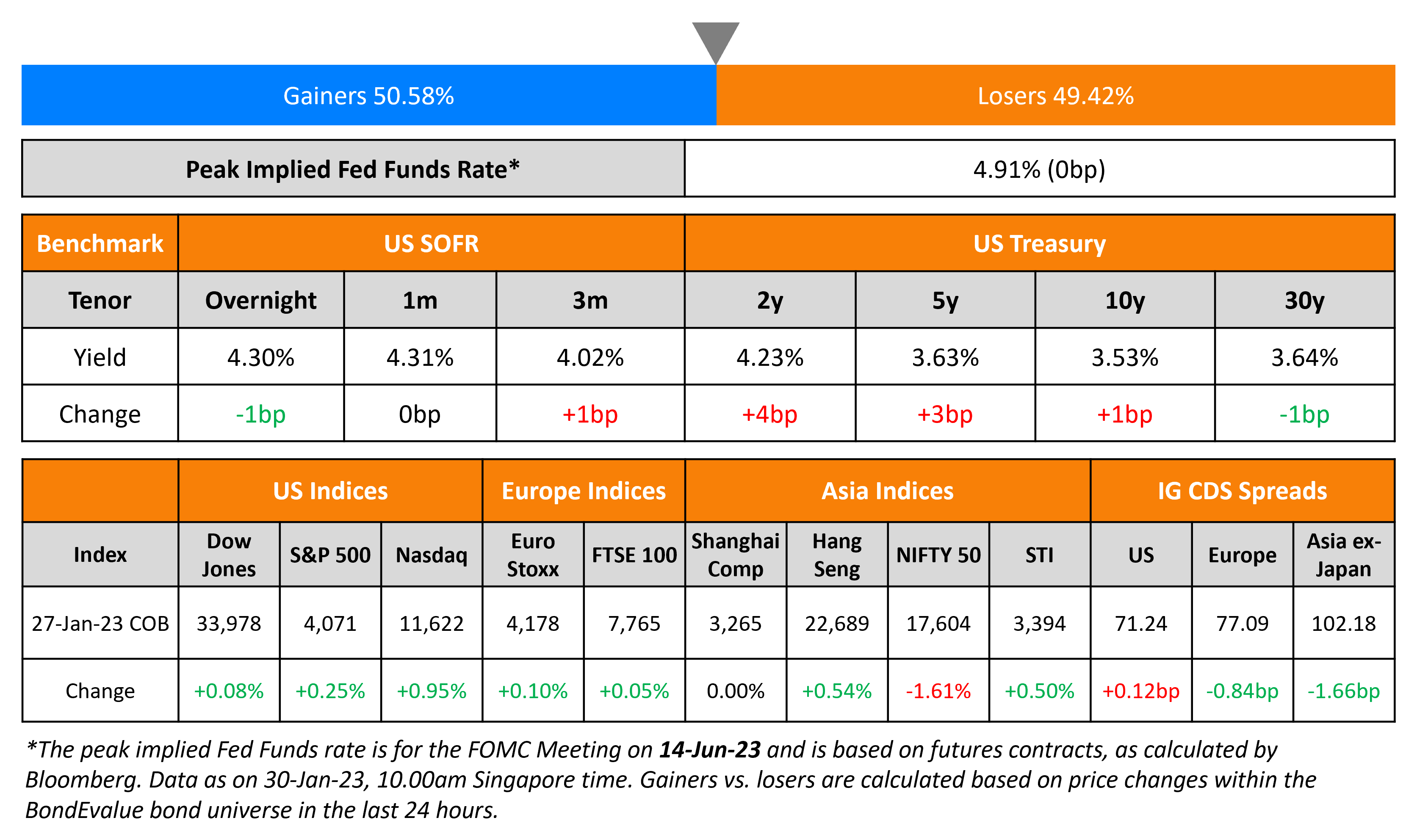

US Treasury yields inched higher by 2-3bp across the curve. Initial jobless claims for the previous week rose to 219k vs. expectations of 213k. Separately, Dallas Fed President Lorie Logan said that interest rates may already be near a neutral level. She added that even if inflation readings were to come close to 2% in the coming months, it would not necessarily warrant the FOMC to cut rates soon, in her view.

US equity markets saw the S&P and Nasdaq move higher by 0.4-0.5%. Looking at credit markets, US IG and HY CDS spreads widened by 0.1bp and 0.8bp respectively. European equity markets were higher. The iTraxx Main and and Crossover CDS spreads tightened by 0.8bp and 2.7bp respectively. The Bank of England (BoE) cut its policy rates to 4.50% from 4.75%, in-line with expectations. Asian equity markets have opened broadly mixed. Asia ex-Japan CDS spreads were tighter by 1.6bp.

New Bond Issues

Bank of America (BofA) raised $2.5bn via a 11NC10 bond at a yield of 5.744%, 23bp inside initial guidance of T+155bp area. The subordinated bond is rated A3/BBB+/A. Proceeds will be used for general corporate purposes.

Kepco raised $400mn via a 3Y bond at a yield of 4.812%, 32bp inside initial guidance of T+90bp area. The senior unsecured bond is rated Aa2/AA. Proceeds will be used for general corporate purposes and not for any efforts pertaining to construction of new coal fired generation units.

Sharjah raised €500mn via a 7Y bond at a yield of 4.698%, 30bp inside initial guidance of MS+275bp area. The senior unsecured will-not-grow (WNG) bond is rated Ba1/BBB-.

Deutsche Bank raised €1bn via a 6NC5 bond at a yield of 3.466%, 35bp inside initial guidance of MS+160bp area. The senior non-preferred bond is rated Baa1/BBB/A-. Proceeds will be used for general corporate purposes.

Santander raised €1.25bn via a 10Y bond at a yield of 3.506%, 30bp inside initial guidance of MS+150bp area. The senior non-preferred bond is rated Baa1/A-/A-. Proceeds will be used for general corporate purposes.

UBS raised €2.75bn via a two-trancher. It raised €1.25bn via a 5NC4 bond at a yield of 2.971%, 27bp inside initial guidance of MS+105bp area. It also raised €1.5bn via a 9NC8 bond at a yield of 3.311%, 35bp inside initial guidance of MS+140bp area. The senior unsecured bonds are rated A3/A-/A.

Rating Changes

-

Several Argentine Corporate, Infrastructure Entities Upgraded On Improved Transfer And Convertibility Risk Assessment

-

Argentine Banks Upgraded To ‘B-‘ On Lower Risk To Foreign Currency Access; Outlook Stable

-

Moody’s Ratings upgrades EnLink’s notes to Baa2 following ONEOK’s acquisition

-

New Fortress Energy Inc. Downgraded To ‘B’ From ‘B+’ On Weak Liquidity And High Leverage; Outlook Negative

-

Moody’s Ratings downgrades Paramount’s CFR to B1 and will subsequently withdraw ratings at issuer’s request

-

Ford Motor Co. And Subsidiary Outlook Revised To Negative On Weaker-Than-Expected Profitability Prospects; Ratings Affirmed

-

Moody’s Ratings changes outlook on BAE Systems to positive from stable, affirms Baa1 ratings

Term of the Day: Gearing

Gearing refers to the financial leverage a company takes in the form of debt. While gearing ratio is typically calculated as a company’s debt divided by its equity, it could also be measured as a company’s debt divided by its total assets, since it ultimately shows leverage. Companies typically define gearing as the ratio of net debt to net debt plus equity. Within this adjustments may occur, like reducing cash and cash equivalents.

Talking Heads

On Fed’s Waller Says Stablecoins Could Back Dollar’s Reserve Status

“I view stablecoins as a net addition to our payment system. You might want some regulatory rails around it to make sure the money is there…. something to go forward with”

On BOJ to Stay on Rate Hike Path as Deflation Has Ended – Fmr. BOJ Governor Haruhiko Kuroda

“Japan’s economy is completely back. It’s perfectly natural for the BOJ to conduct policy normalization… no mistake that a virtuous cycle between wages and inflation has been recovered.. BOJ will proceed with normalization by carefully watching those”

On Seeing High-Grade Bonds, MBS as Top Bets for 2025

Phil Jacoby, CIO at Spectrum Asset

“The fund will maintain its core positioning in junior subordination in 2025 in order to pick up the yield and income advantage over more senior corporate paper”

Alfred Murata, PM at PIMCO

“We’re benefiting from the fact that we can invest in very high quality assets, but also assets that have much wider spread than typical”

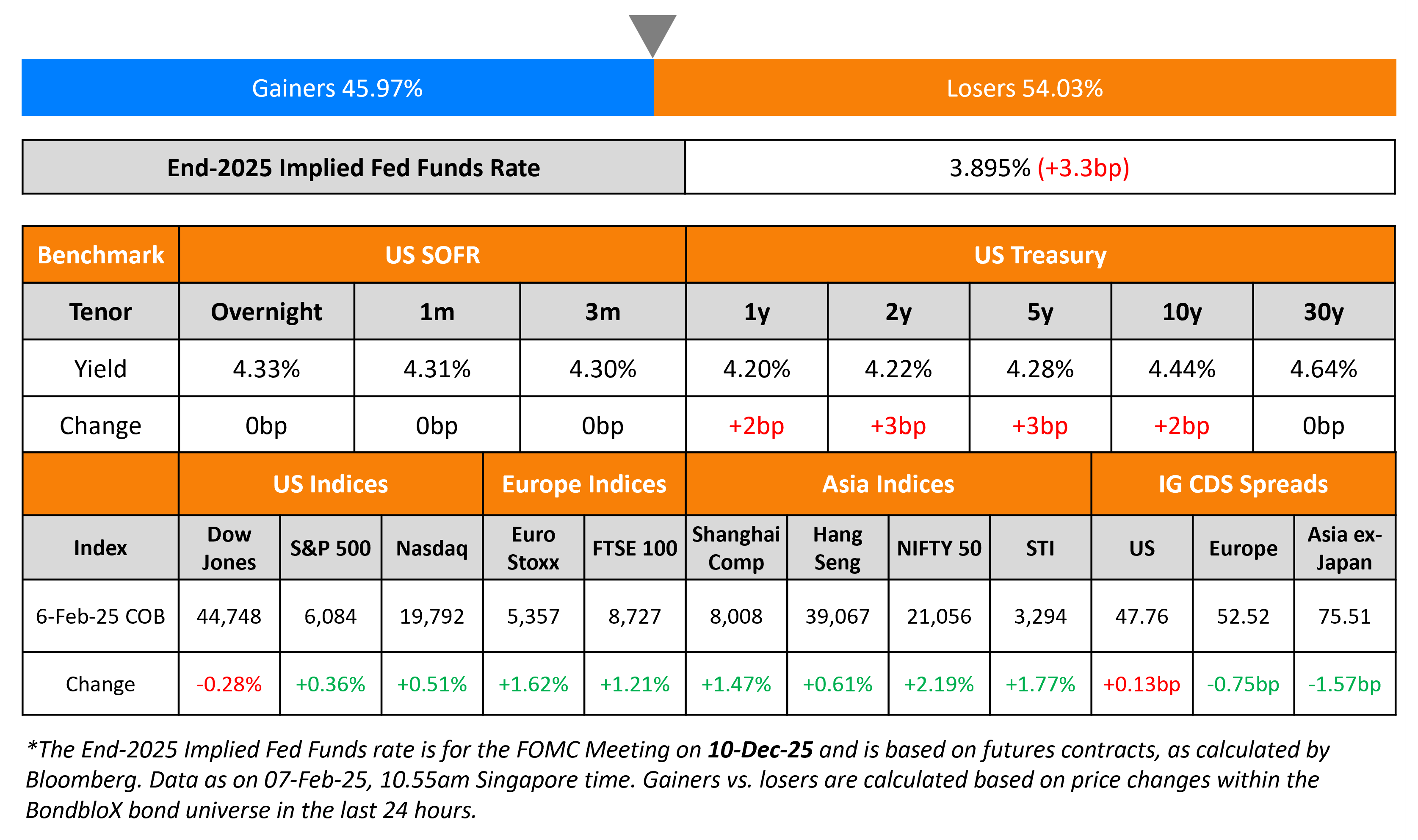

Top Gainers and Losers- 7-February-25*

Go back to Latest bond Market News

Related Posts: