This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BoE Surprises With a 50bp Hike; Powell Sticks to Hawkish Stance

June 23, 2023

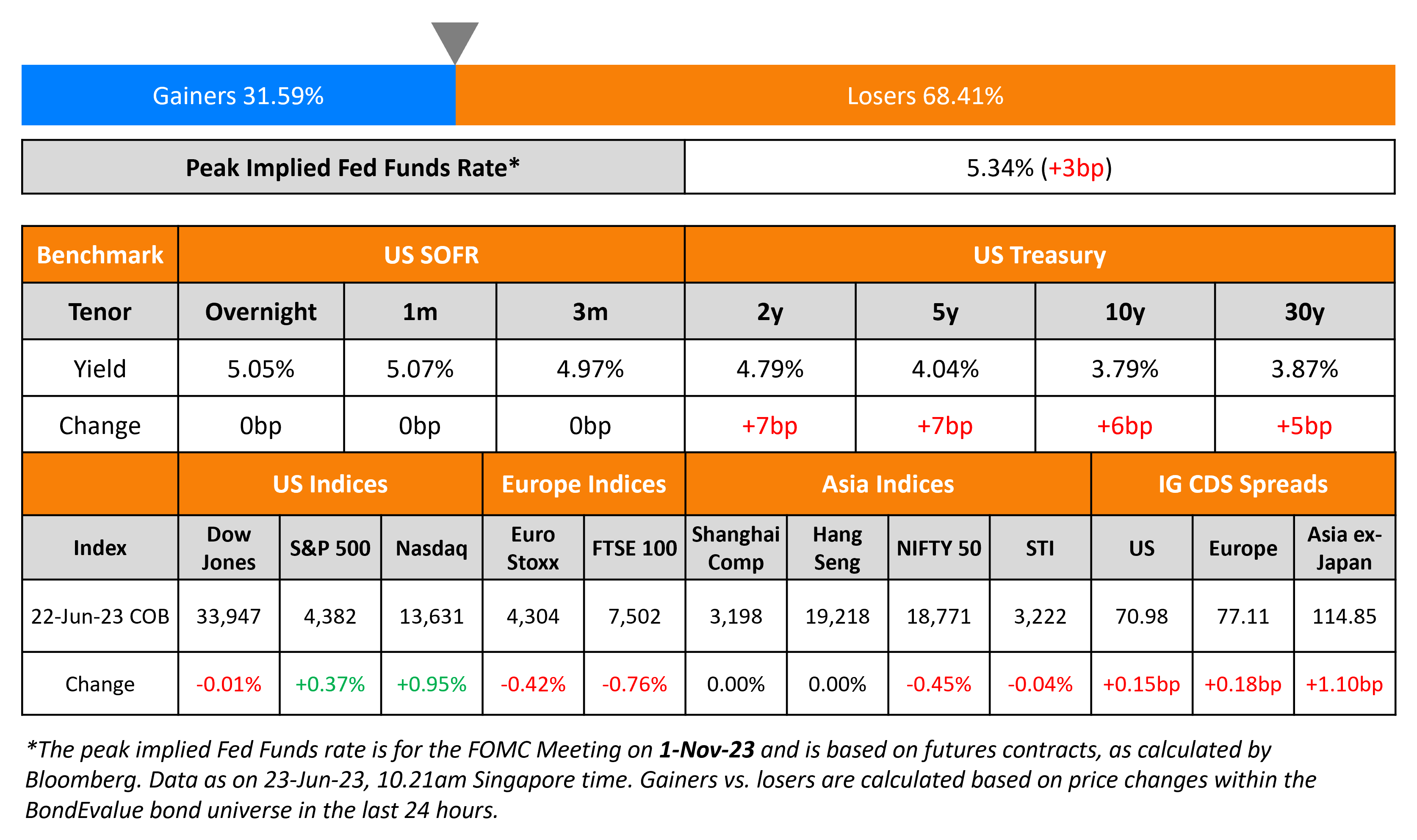

US Treasury yields were higher by 5-7bp across the curve yesterday. Fed Chair Jerome Powell stuck to his hawkish (Term of the Day, explained below) stance of further rate hikes ahead. US Initial jobless claims for the prior week remained at a 20-month high at 264k, above the 260k forecast. Markets continue to price in a 25bp hike in July and expect them to stay at that level till the end of the year, as per CME probabilities. The peak Fed Funds rate rose 3bp to 5.34%. US equity indices ended in the green after three consecutive days in the red with the S&P and Nasdaq closing 0.4% and 1% higher respectively. US IG and HY CDS spreads widened 0.2bp and 3.3bp respectively.

European equity indices closed lower with European main and Crossover CDS spreads wider by 0.2bp and 2.4bp. The Bank of England surprised markets by hiking its policy rate by 50bp to 5% (vs. forecasts of a 25bp hike), the highest level since 2008. The committee voted 7-2 for the hike, noting that inflation was too high and that they are watching for indications of persistent inflationary pressures. Separately, Turkey’s central bank hiked its policy rate by 6.5%, lower than the forecasted 12% (scroll for more details.) Asia ex-Japan CDS spreads widened by 0.9bp. Asian equity markets have opened over 1% lower this morning.

New Bond Issues

BBVA México raised $1bn via a 15NC10 subordinated bond at a yield of 8.45%, 30bp inside initial guidance of 8.75% area. The bonds have expected ratings of Baa3/BB. Proceeds will be used to strengthen its capital ratios and for general corporate purposes.

Cosan Luxembourg raised $550mn via a 7NC3 bond at a yield of 7.5%, inside initial guidance of high 7% area. The bonds have expected ratings of Ba2/BB and are guaranteed by Cosan SA. Proceeds will be used to finance the concurrent $250 million tender offer for its 2027 notes and for general corporate purposes.

New Bonds Pipeline

- Nonghyup Bank hires for $ 5Y Agriculture Supportive Social bond

- KoGas hires for $ bond

Rating Changes

- Moody’s changes Armenia’s outlook to stable from negative; affirms Ba3 rating

Term of the Day

Hawkish

Hawkish is a term used for a monetary policy stance where policymakers are concerned about inflation or overheating risks and therefore adopt a tightening stance. A hawkish stance could be either in the form of rate increases, asset purchases decreases or even indications on the same relative to market expectations. This is the opposite of a dovish stance which tries to ease financial conditions.

Talking Heads

On the Necessity of Fed Rate Hikes to Contain Inflation – Fed Governor Michelle Bowman

“…I believe that additional policy-rate increases will be necessary to bring inflation down to our target over time…Although tighter monetary policy has had some effect on economic activity and inflation to date, we have seen core inflation essentially plateau since the fall of 2022…I expect that we will need to increase the federal funds rate further to achieve a sufficiently restrictive stance of monetary policy to meaningfully and durably bring inflation down.”

On a Sharp Fall in Colombian Bond Sales

Nicolas Mayorga, head of issuers, analysis and research at Colombia’s stock exchange

“We’ve never seen a drop that steep, but then again, we’d never had so many market shocks at the same time.”

Luis Carlos Sarmiento Gutierrez, CEO of Grupo Aval

“It’s not so much about companies wanting to issue or not…It’s about issuing large amounts of debt at such a high cost and maybe not being able to sell it all because uncertainty overseas is still high and everyone is waiting to see how these reforms pan out.”

“In equities, absent pre-emptive Fed easing – vs. Fed dots that imply two more hikes by year-end – we expect a more challenging macro backdrop for stocks in 2H, with softening consumer trends at a time when equities have re-rated sharply…In short, the risk of another unknown unknown resurfacing appears high.”

On the Probability of a Recession in the US – US Treasury Secretary Janet Yellen

“…my odds of (a recession), if anything, have gone down — because look at the resilience of the labor market, and inflation is coming down…We probably need to see some slowdown in spending in order to get inflation (under control).”

On a Tightening of Lenders’ Capital Requirements in the US – Fed Chair Jerome Powell

“The capital requirements will be very, very skewed to the eight largest banks…There may be some increase for other banks. None of this should affect banks under $100 billion in assets.”

Top Gainers & Losers – 23-June-23*

Go back to Latest bond Market News

Related Posts: