This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BOCOM, Sumitomo Mitsui Launch $ Bonds

March 3, 2025

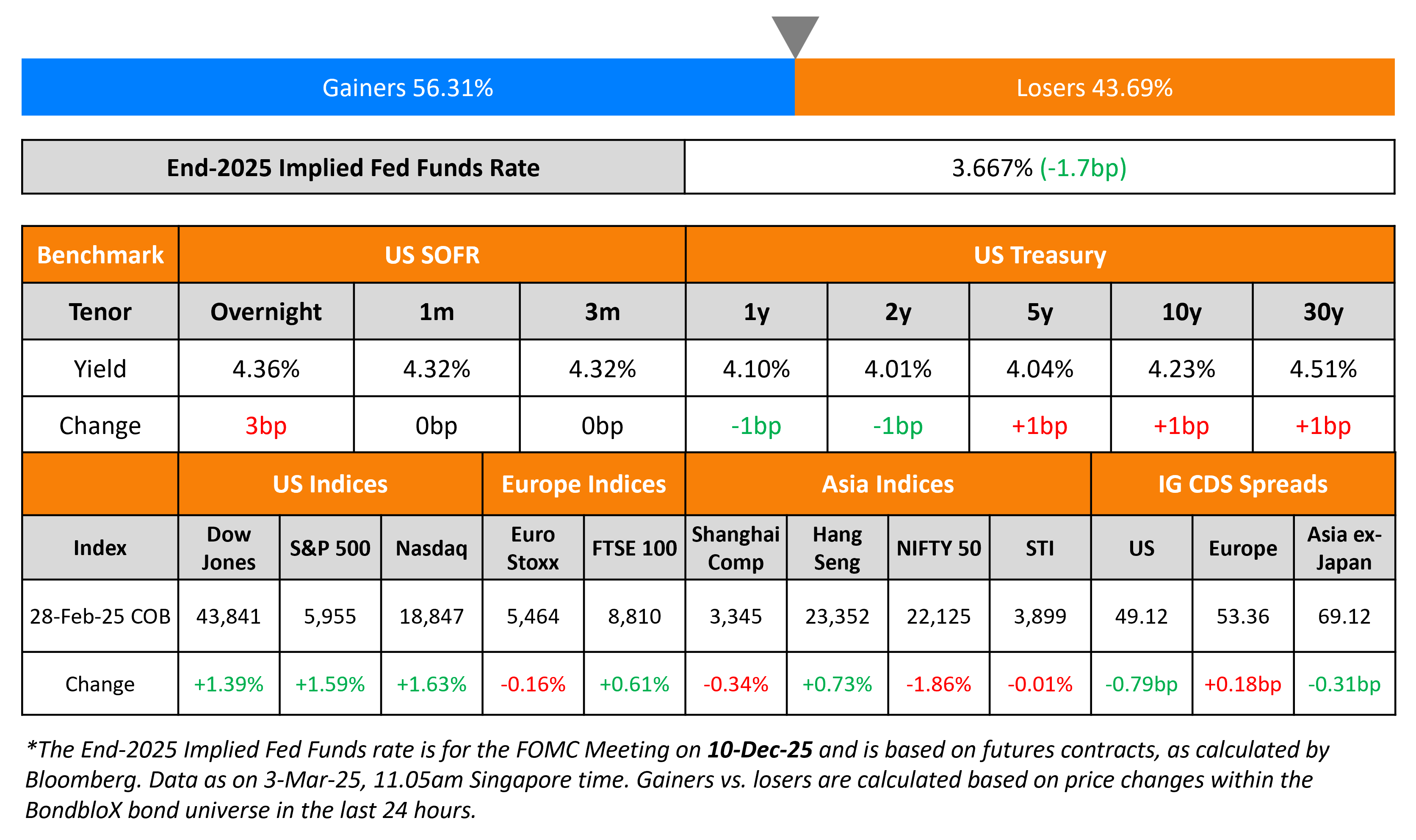

US Treasury yields held steady across the curve after a broad risk-off led week. The PCE Price Index rose 2.5% YoY in January, easing from the prior 2.6% reading. The Core PCE reading rose 2.6%, easing from the prior 2.9% reading. Markets are currently pricing-in a 25bp rate cut by the Fed in June and a second rate cut roughly in September.

US equity markets saw the S&P and Nasdaq end higher by 1.6% each. Looking at credit markets, US IG and HY spreads CDS spreads were tightened 0.8by and 4.8bp respectively. European equity markets ended higher. The iTraxx Main and Crossover CDS spreads widened by 0.2bp and 1bp respectively. Asian equity markets have opened in the green this morning. Asia ex-Japan CDS spreads were tighter by 0.3bp.

New Bond Issues

-

BOCOM $ 3Y/5Y at T+115/130bp area

-

Sumitomo Mitsui Trust $ 3Y/5Y/5Y FRN/10Y at T+85/100/SOFR Equiv/120bp area

New Bonds Pipeline

- Central Nippon Expressway hires for $ 1Y bond

- Meiji Yasuda hires for $ 30.25NC10.25 bond

- Hysan Development hires for $ Perp bond

Rating Changes

-

Moody’s Ratings upgrades Tunisia’s rating to Caa1; maintains stable outlook

-

Latam Airlines Group Upgraded To ‘BB’ On Solid Performance And Cash Flow; Outlook Stable

-

Portugal Upgraded To ‘A’ On Ongoing External And Government Deleveraging; Outlook Positive

-

Fitch Upgrades Ibercaja to ‘BBB+’; Outlook Stable

-

Fitch Upgrades Unicaja to ‘BBB’; Outlook Stable

-

Fitch Upgrades Abanca to ‘BBB’; Outlook Stable

-

Senegal Rating Lowered To ‘B’ On Large Fiscal And Debt Revisions; Outlook Negative

-

Fitch Downgrades Nissan Motor Acceptance Company’s IDR to ‘BB+’; Outlook Negative

-

Altice France Holding And Altice France Downgraded To ‘CC’ On Proposed Debt Restructuring; Outlook Negative

Term of the Day: Stagflation

Stagflation refers to a period of (stag)nant economic growth and high in(flation). It is an economic phenomenon when economic growth is stagnant and the unemployment rate and inflation are high. Stagflation is most commonly caused by supply shocks leading to higher commodity prices or monetary policies that increase money supply in the economy too quickly. An example of stagflation was in the US during the 1970s, when high inflation and high unemployment was at its peak on the back of a surge in commodity prices. Generally. monetary and fiscal policies are not effective at solving economic problems related to a supply side shock, hence it is tougher to get through a period of stagflation.

Talking Heads

On Increasing Interest in EM due to Trump Administration

Brendan McKenna, Wells Fargo

“Many Middle East nations are interesting options…The United Arab Emirates, Saudi Arabia and Qatar in particular can act as safe havens or locations for investors to deploy capital and be isolated from Trump risk”

Marcelo Assalin, William Blair

“Selective investment in local-currency debt will tend to outperform…The higher-yielding currencies like Brazil, Mexico, South Africa, Turkey will tend to outperform this year because they are very undervalued fundamentally and they offer much higher carry”

“Over the next 6 to 12 months, as we deregulate, drill more American energy we could very quickly go back to the Federal Reserve target of 2%… The housing market is stuck now, but I would expect that the housing market, sometime in the next few weeks, is going to unfreeze”

Gregory Daco, EY

“There’s a slight smell in the air of stagflation, [but] we’re not there yet”

Diane Swonk, KPMG

“They may have been slow on the uptake in raising rates this last time, but stagflation is a whole other ball game for the Fed…They cannot allow something like that to take hold”

Ajay Rajadhyaksha, Barclays

“If consumer sentiment drops, at some point you start to worry that consumption is actually next.”

Top Gainers and Losers- 03-March-25*

Go back to Latest bond Market News

Related Posts: