This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BOC Aviation, Muthoot, Philippines Launch $ Bonds

May 7, 2024

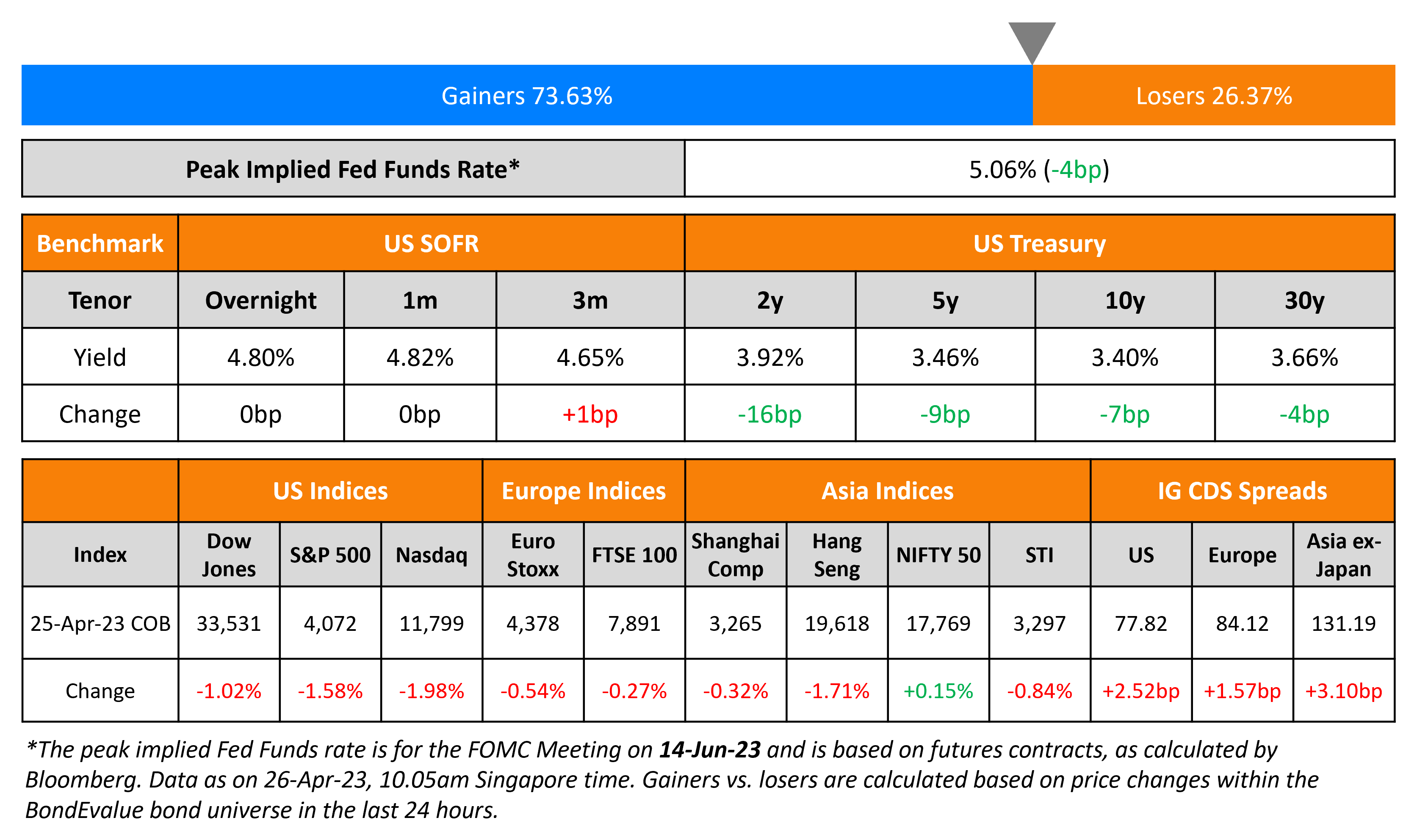

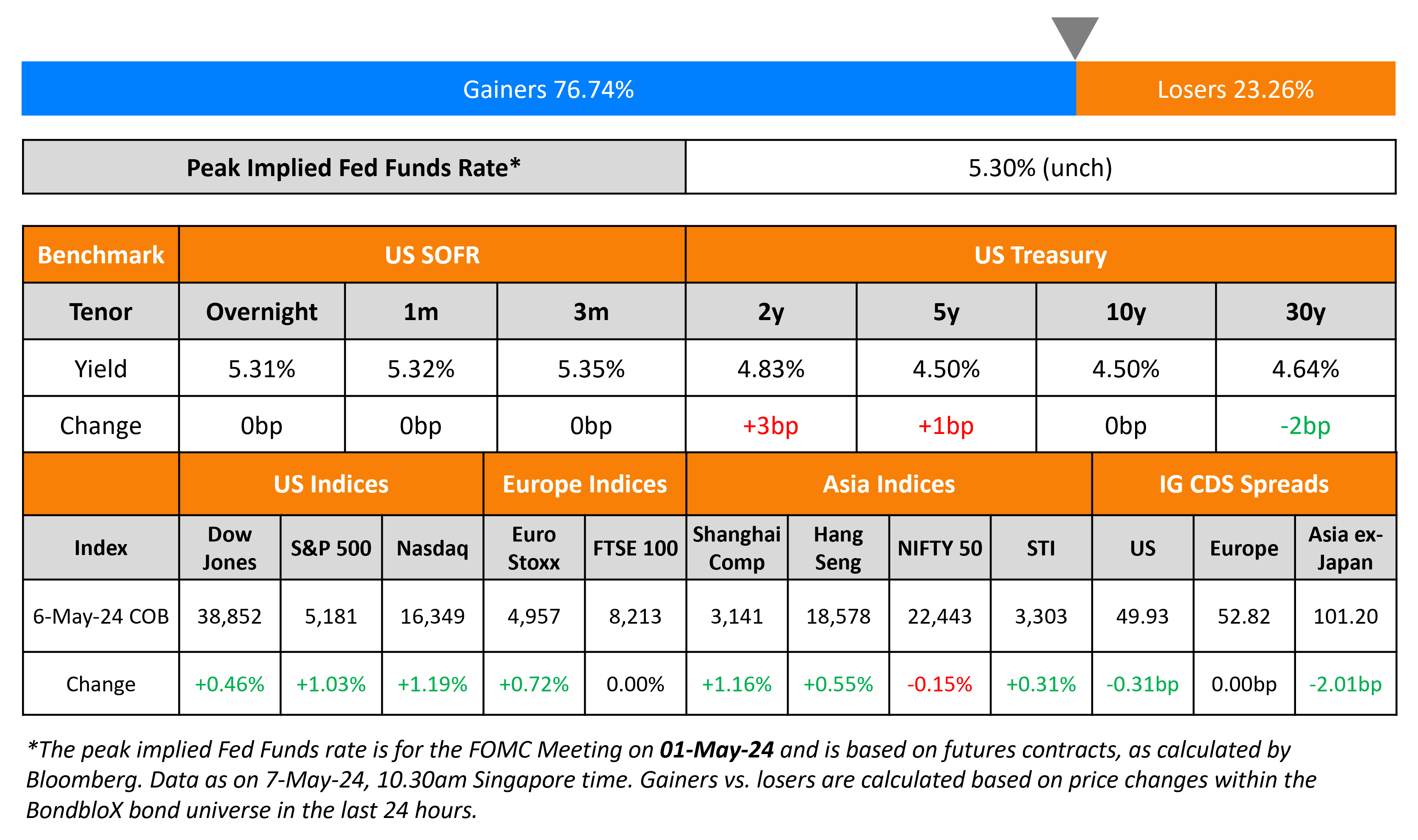

US Treasuries were stable on Monday with no economic data releases. Richmond Fed President Thomas Barkin has said that the current rates can “take the edge off demand in order to bring inflation back to our target” He added that “the full impact of rates is yet to come”. Separately, New York Fed President John Williams reiterated that there will be rate cuts eventually, however, the timing depends on data. S&P and Nasdaq continued to march higher by 1-1.2%. US IG CDS spreads tightened 0.3bp and HY spreads were 3bp tighter.

European equity markets were higher. European CDS markets and UK equity markets were closed. Asian equity indices have opened weaker this morning. Asia ex-Japan CDS spreads tightened 2bp. China’s Caixin Services PMI for April came at 52.5, in-line with expectations and slightly lower than the prior reading of 52.7. This was the sixteenth consecutive month of expansion in its services PMI print.

New Bond Issues

- BOC Aviation $ 5Y at T+125bp area

- Muthoot Finance $ 3.75 at 7.375% area

- Korea Expressway $ 3Y at T+90bp area

- Philippines $ 10Y/25Y Sust. at T+120bp /6.05% areas

New Bonds Pipeline

- Export Import Bank of Thailand hires for $ 5Y bond

- China Ping An Insurance hires for $ bond

Rating Changes

- Pioneer Natural Resources Co. Upgraded To ‘AA-‘ From ‘BBB’ Following Acquisition By ExxonMobil, Outlook Stable

- Whirlpool Corp. Downgraded To ‘BBB-‘ From ‘BBB’ On Subdued Profit Forecast; Outlook Stable

- Fitch Revises FirstEnergy Corp’s Outlook to Positive; Upgrades Subsidiaries’ Ratings

- Moody’s Ratings changes Altria’s outlook to negative; affirms A3 senior unsecured ratings

Term of the Day

Door to Door Tenor

Door to door tenor refers to the total time period within which the entire borrowing has to be repaid, inclusive of moratoriums and postponements. For example, a loan may be payable in three years but with an initial moratorium of 6 months, totaling to a door to door tenor of 3.5 years. These are mentioned in project finance documents. Muthoot Finance has launched a bond with a door to door tenor of 3.75 years and a Weighted Average Life (WAL) of 3.25 years.

Talking Heads

On Buy Bonds in Bet That Inflation Will Retreat – Morgan Stanley Strategists

“Even if the economy doesn’t go down, bond yields could still fall dramatically as inflation data disappoint the higher-forever true believers. Buy bonds… It would also involve the market pricing in a much more substantial easing cycle in 2025”

On Seeing Inflation as Key for Path of Stocks – Morgan Stanley Strategists

“One might even want to consider adding a bit of exposure to defensive sectors like utilities and staples… The price reaction on the back of this release may be more important than the data itself”

On Jane Street and Citadel Securities Race Deeper Into Bond Markets

Av Bhavsar, global head of fixed income at Citadel Securities

“It’s part of the evolution that frankly started many decades ago in equities and soon after that in FX. Given the advancement of technology… a pretty natural thing that you will have new participants in the delivery of these products”

Valerie Noel, head of trading at Syz

“Quantitative algorithms enable them to have a comprehensive and detailed view of the market at any time”

Top Gainers & Losers- 07-May-24*

Go back to Latest bond Market News

Related Posts: