This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BNP Prices $ AT1 at 6.875%; Minmetals Prices Dual-Tranche Perp

December 9, 2025

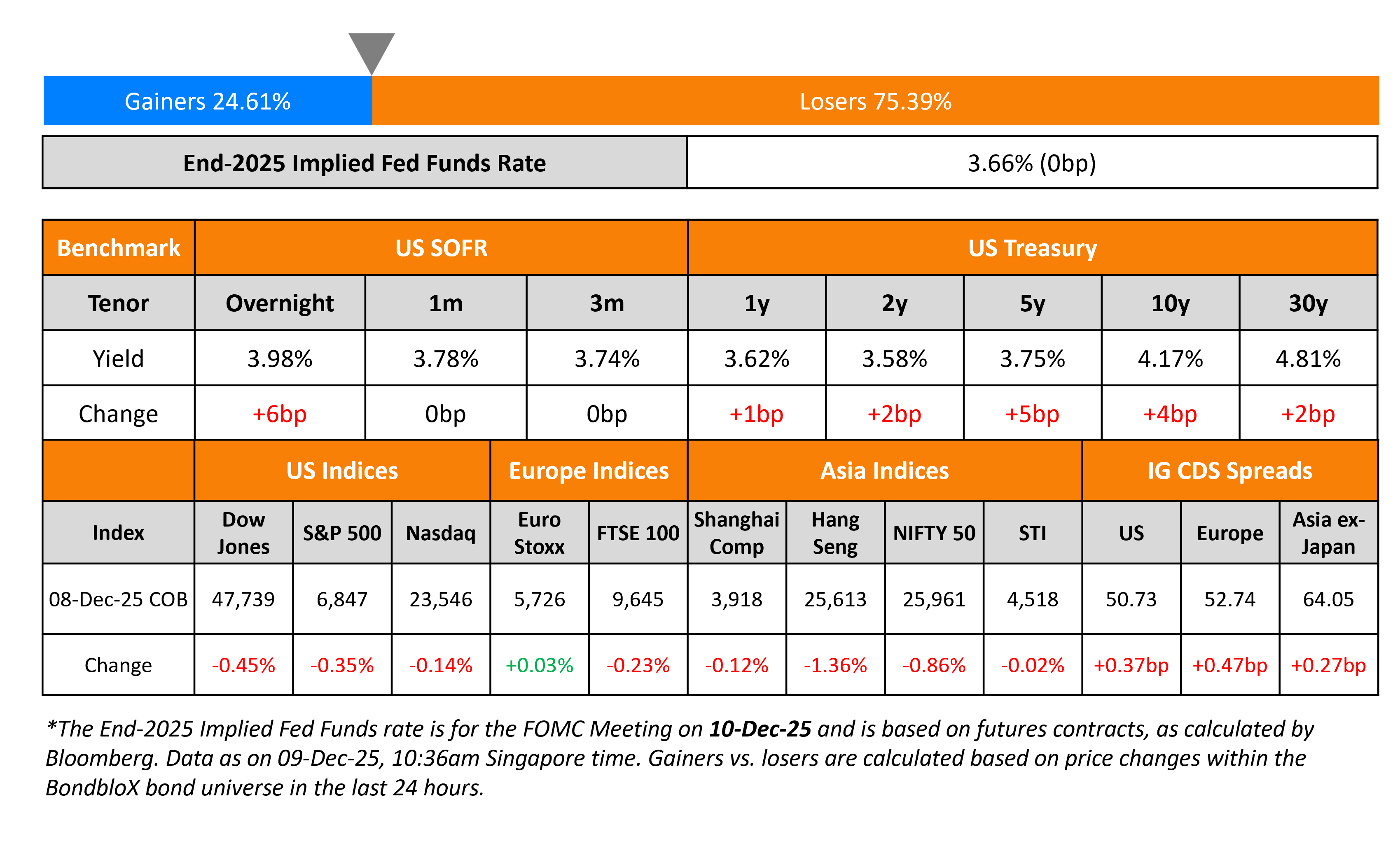

US Treasury yields ticked higher again across the curve by as much as 5bp. While there were no macro data points, several market analysts have indicated the possibility of lower chances of rate cuts in 2026. While a 25bp cut in the FOMC’s meeting tomorrow is already priced-in, markets are pricing-in a little over 50bp in rate cuts for 2026. However, the FOMC’s dot plots in the upcoming meeting is expected to give a better understanding of the Fed’s outlook.

Looking at US equity markets, the S&P and Nasdaq closed lower by 0.4% and 0.1% respectively. US IG CDS spreads were 0.4bp wider and HY spreads widened by 2.5bp. European equity indices ended mixed. The iTraxx Main CDS spreads widened by 0.5bp while the Crossover CDS spreads were 3.4bp wider. Asian equity markets have opened weaker this morning. Asia ex-Japan CDS spreads were 0.3bp wider.

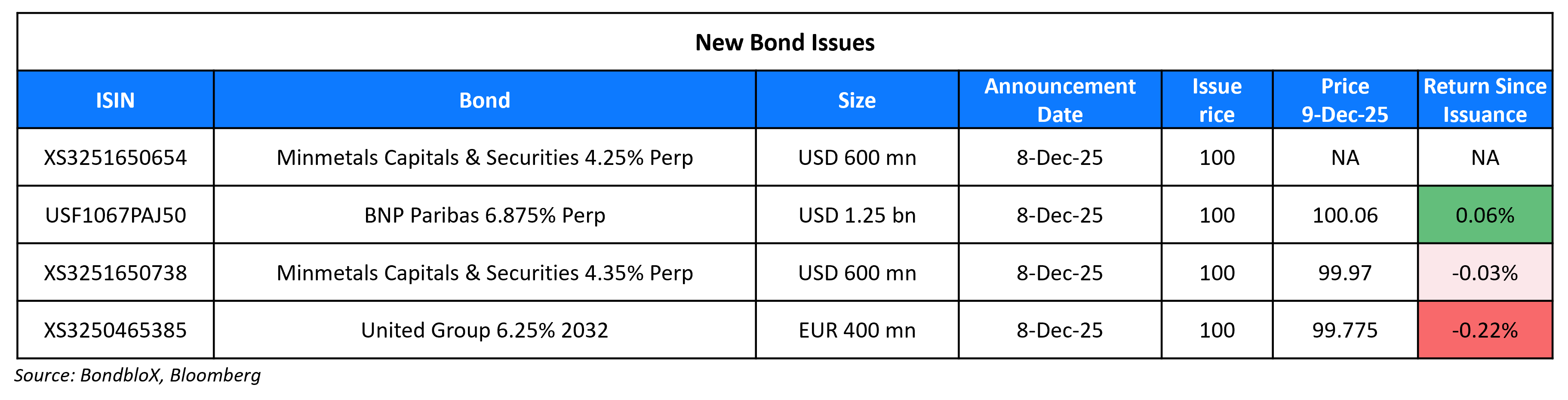

New Bond Issues

- China Hainan Rubber $ PerpNC3 sustainability at 6.4% area

- Chengdu Xingcheng Investment $ 3Y at 4.6% area

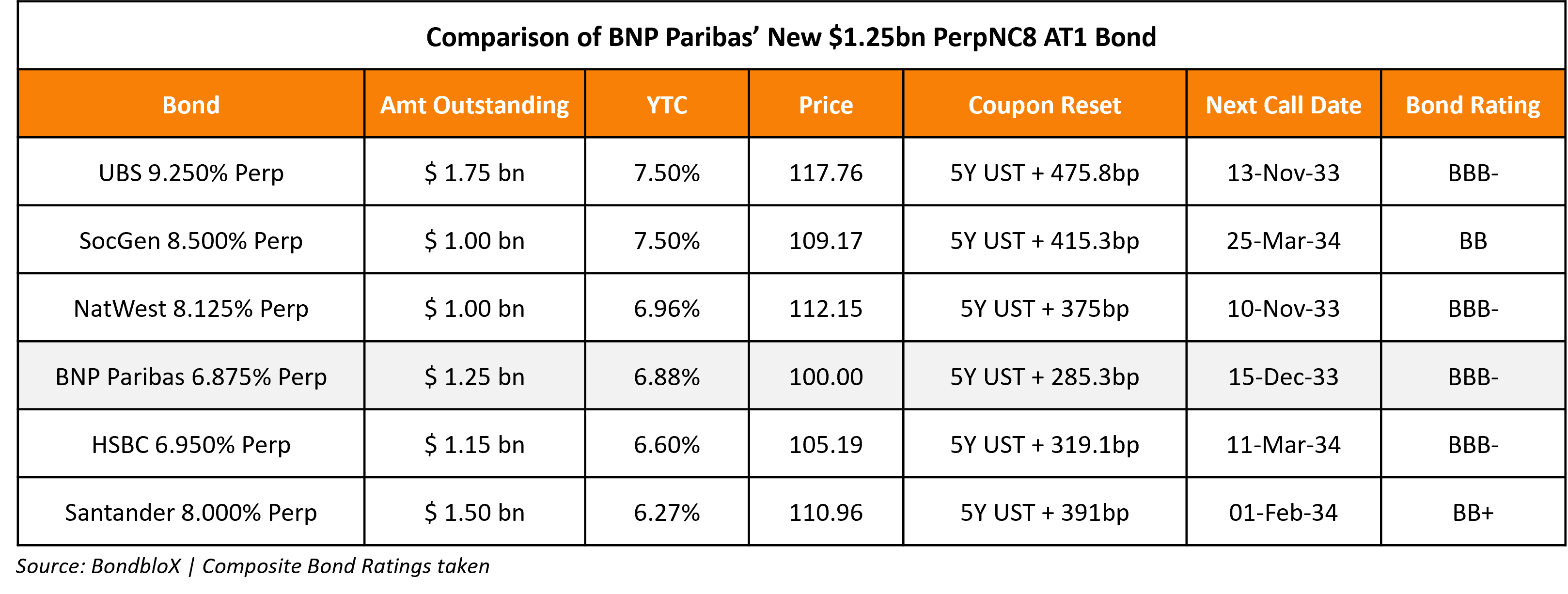

BNP Paribas raised $1.25bn via a PerpNC8 AT1 bond at a yield of 6.875%, 50bp inside initial guidance of 7.375% area. The junior subordinated note is rated Ba1/BBB-/BBB. If not called by 15 December 2033, the coupon will reset to the US 5Y Treasury yield plus 285.3bp. A trigger event would occur if the CET1 Ratio of the Group falls below 5.125%.

Minmetals Capitals & Securities Inc (China Minmetals) raised $1.2bn via a two-part offering. It raised:

- $600mn via a PerpNC3.5 bond at a yield of 4.25%, 55bp inside initial guidance of 4.80% area. If not called by 15 June 2029, the coupon will reset to the US 5Y Treasury yield plus 364.5bp. There is also a coupon step-up of 300bp if there is a change of control, breach of covenants event or a relevant indebtedness default event. The step-up will be eliminated if any of the above events are remedied.

- $600mn via a PerpNC5 bond at a yield of 4.35%, 55bp inside initial guidance of 4.90% area. If not called by 15 December 2030, the coupon will reset to the US 5Y Treasury yield plus 361.9bp. There is also a coupon step-up of 300bp if there is a change of control, breach of covenants event or a relevant indebtedness default event. The step-up will be eliminated if any of the above events are remedied.

The subordinated notes are rated Baa2. Both notes have a coupon step-up of 300bp if there is a change of control, breach of covenants event or a relevant indebtedness default event. The step-up will be eliminated if any of the above events are remedied. Proceeds will be used for working capital and general corporate purposes, including refinancing existing debt..

Rating Changes

- Fitch Upgrades Oman to ‘BBB-‘; Outlook Stable

- Fitch Upgrades Al Rajhi Banking and Investment Corporation to ‘A’; Stable Outlook

- Fitch Upgrades The Saudi National Bank to ‘A’; Stable Outlook

- Fitch Upgrades Aristocrat’s IDR to ‘BBB’; Outlook Stable

- Moody’s Ratings downgrades Genting Berhad and Genting Overseas Holdings to Baa3; Genting Singapore to Baa1; outlook stable

- Moody’s Ratings downgrades Owens & Minor’s CFR to B2, outlook negative; concludes the review

- Moody’s Ratings revises Adani Green restricted groups’ outlook to stable; affirms Ba1 rating

- Moody’s Ratings revises Adani Energy Solutions Limited Restricted Group 1 (AESL RG1)’s outlook to stable; affirms Baa3 ratings

- Moody’s Ratings says Warner Bros. Discovery, Inc.’s ratings remain on review for downgrade after Netflix acquisition announcement

- International Business Machines Corp. Outlook Revised To Negative On Acquisition Of Confluent Inc.

Term of the Day: Hostile Takeover

A hostile takeover is an M&A strategy used by the potential buyer to directly go to the target company’s shareholders by making a tender offer or through a proxy vote. This is in contrast to a friendly takeover wherein, the target company’s board approves of the takeover and recommend shareholders vote in favor of it. Target companies can use anti-takeover strategies like poison pills, golden parachutes etc.

Talking Heads

On Warning of ‘Dangerous’ Credit-Ratings Dynamic

Dan Ivascyn, PIMCO

“It is very, very dangerous to assume something has an investment-grade rating just because the rating agencies assign a rating to it… been so much growth in lending to lower-quality companies. And again, the last major cycle was lending to lower-quality households… markets increasingly have to stand on their own, stand on their own based on fundamentals”

On Powell’s Vote-Gathering Challenge Showing Test for Next Fed Chair

Loretta Mester, Former Cleveland Fed President

“I would be more concerned if there weren’t disagreements. The dissents that we’re seeing really are illustrative of the fact that the economy could evolve in different ways.”

Marc Giannoni, Barclays Capital

“That’s the nature of the beast… much harder to argue whether policy is really neutral, expansionary or restrictive at this point”

Derek Tang, LH/Meyer Monetary Policy Analytics

“The internal politics are difficult, but if anyone can hold it together, it’s Powell”

On Stock Rally Could Stall After Fed Cut – Mislav Matejka, JPMorgan

“Investors might be tempted to lock in the gains into year end, rather than be adding directional exposure. The cut is now fully in the price, and equities are back to highs.”

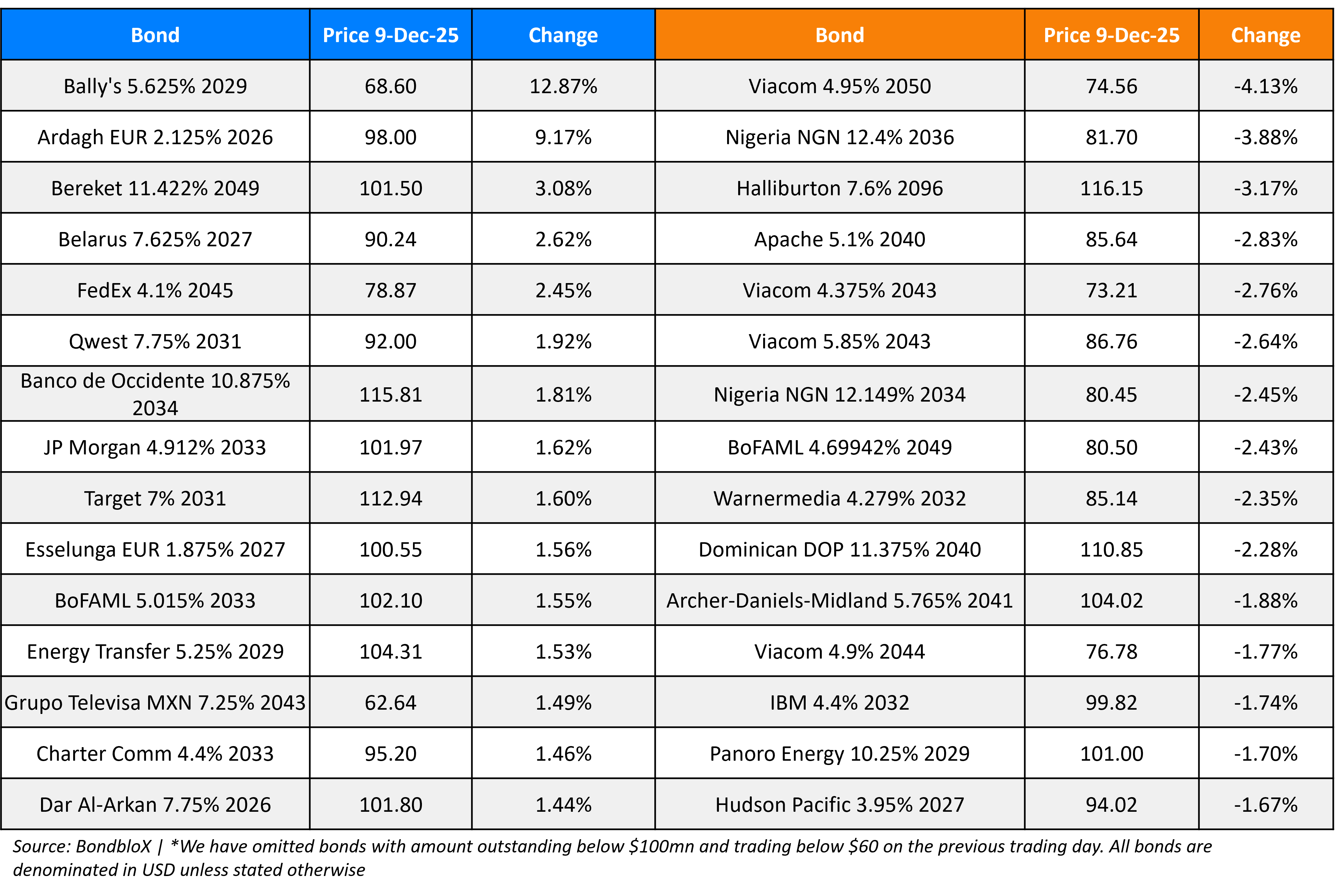

Top Gainers and Losers- 09-Dec-25*

Go back to Latest bond Market News

Related Posts: