This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Biocon Launches $ Deal; Commerzbank Prices $AT1

October 2, 2024

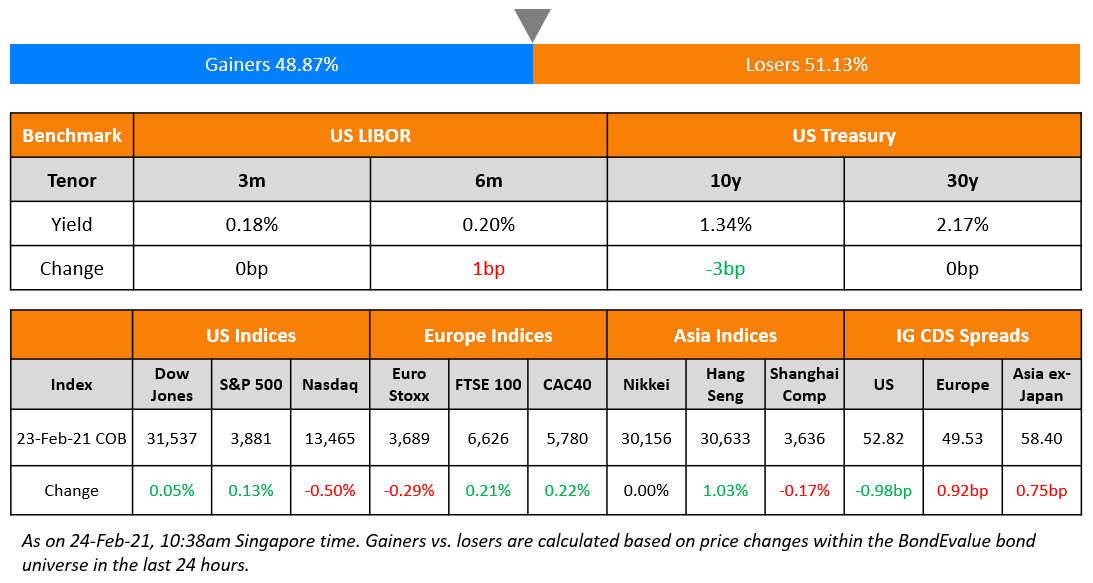

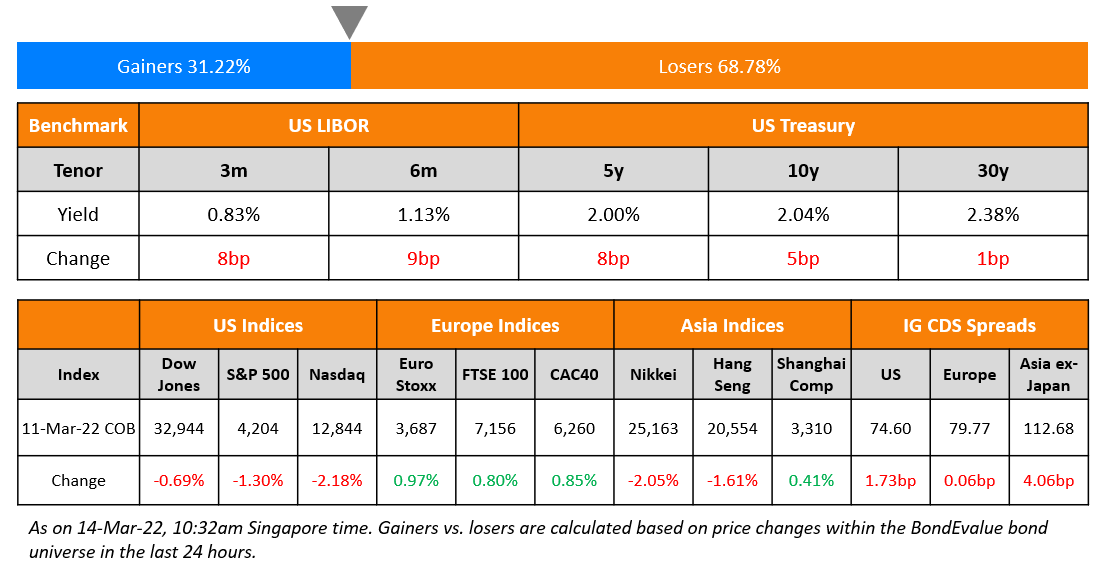

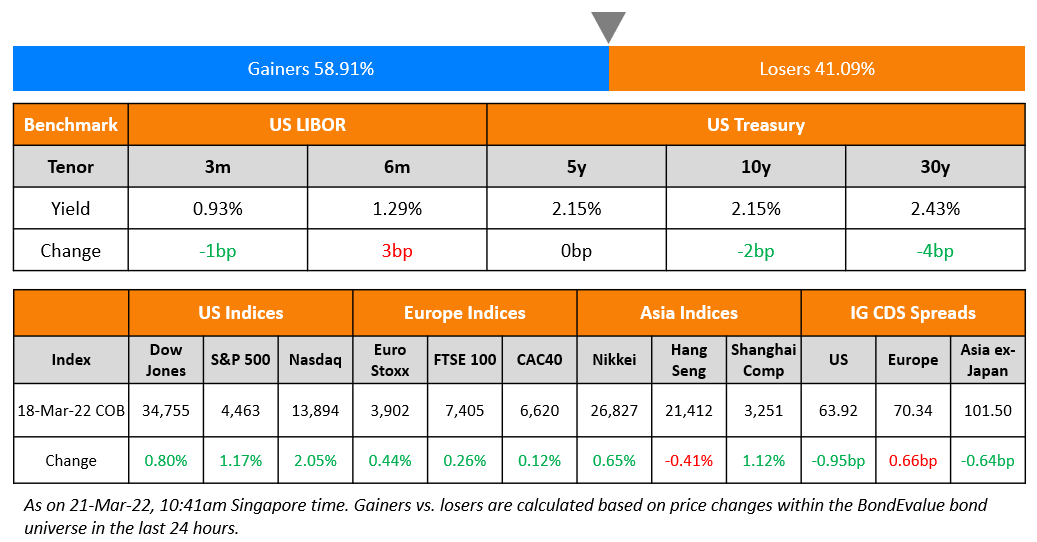

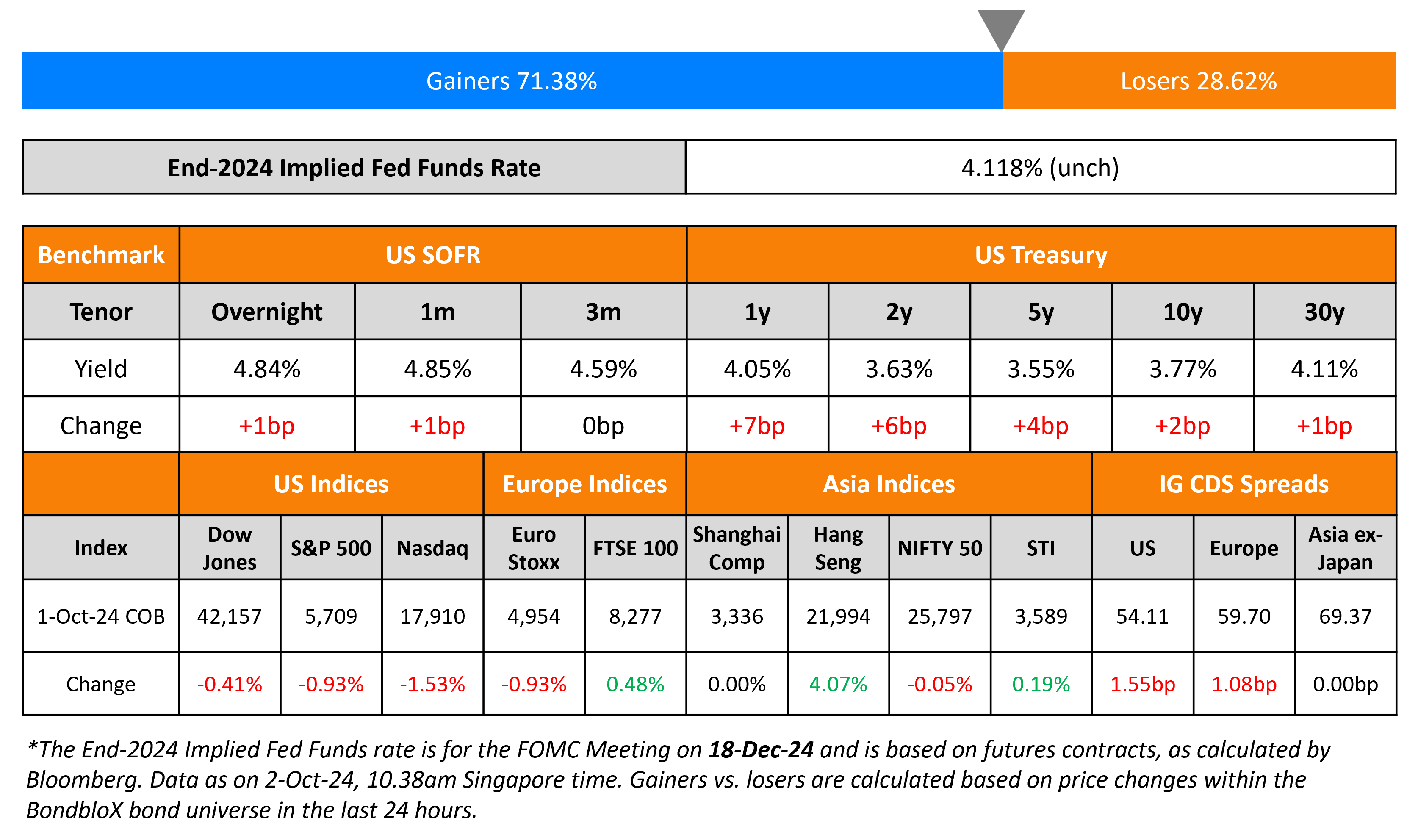

US Treasuries rallied by 3-5bp across the curve as the conflict in the Middle East escalated, boosting demand for safe haven assets. ISM Manufacturing PMI for September remained unchanged at 47.2 compared to August’s number, but came in lower than estimates of 47.5. The JOLTs job openings for August rose by 329k to 8.04mn, stronger vs. market expectations of 7.65mn. The JOLTS report also showed layoffs declining. US IG CDS widened by 1.6bp, while HY CDS tightened by 32bp. US equity markets ended lower, with both S&P and Nasdaq down by 0.9% and 1.5% respectively.

European equities on the other hand ended mixed. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 1.1bp and 6.1bp, respectively. Asian equity indices have opened broadly higher this morning. Asia ex-Japan CDS spreads remained relatively flat.

New Bond Issues

- Biocon Biologics $ 5NC2 at 7.25% area

.png) LATAM Airlines raised $1.4bn via a 5NC2 bond at a yield of 7.875%, 12.5bp inside initial guidance of 8% area. The senior secured bond is expected to be rated Ba2/BB+. The bond has a make-whole call at T+50bp prior to 15 October 2026. The bond is callable at 103.938% from 15 October 2026, at 101.969% from 15 October 2027 and at par from 15 October 2028. Proceeds will be used for repayment of certain indebtedness, including the repayment of the outstanding Term Loan B Facility and, subject to market conditions, the 2027 Notes, and any remainder for general corporate purposes..

LATAM Airlines raised $1.4bn via a 5NC2 bond at a yield of 7.875%, 12.5bp inside initial guidance of 8% area. The senior secured bond is expected to be rated Ba2/BB+. The bond has a make-whole call at T+50bp prior to 15 October 2026. The bond is callable at 103.938% from 15 October 2026, at 101.969% from 15 October 2027 and at par from 15 October 2028. Proceeds will be used for repayment of certain indebtedness, including the repayment of the outstanding Term Loan B Facility and, subject to market conditions, the 2027 Notes, and any remainder for general corporate purposes..

Commerzbank raised $750mn via a PNC6.5 AT1 at a yield of 7.5%, 50bp inside initial guidance of 8% area. The junior subordinated bond is expected to be rated Ba2/BB. The bond is callable from 9 October, 2030 until 9 April, 2031 and any interest payment date thereafter. If not called by 9 April 2031, the coupon will reset to 5Y SOFR ICE Swap Rate plus 432.2bp. The trigger event will occur if the CET1 ratio on a consolidated basis falls to or below 5.125%. The new bond was priced 25bp wider to Natwest 4.6% Perp (rated Baa3/BB-/BBB-), which currently yields 7.24%.

Dell raised $1.5bn via a two-part offering. It raised $700mn via a 5Y bond at a yield of 4.38%, 35bp inside initial guidance of T+105bp area. It also raised $800mn via a 10Y bond at a yield of 4.89%, 20bp inside initial guidance of T+135bp area. The senior unsecured bonds are expected to be rated Baa2/BBB/BBB. Proceeds will be used to redeem its outstanding 5.850% 2025s senior notes and any remaining proceeds for general corporate purposes, including the repayment of other debt.

OUE raised S$150mn via a 5Y Green bond at a yield of 4%, 20bp inside initial area of 4.2%. OUE Treasury Pte Ltd. is the issuer of the bond and OUE Ltd. is the guarantor. The senior unsecured bond is unrated. Proceeds will be used towards four green buildings in Singapore.

Rating Changes

- Moody’s Ratings upgrades Brazil’s ratings to Ba1 and maintains the positive outlook

- Southwestern Energy Co. Upgraded To ‘BBB-‘ On Close Of Merger

- Virgin Money UK And Clydesdale Bank Upgraded After Acquisition By Nationwide; Outlook Stable

- Fitch Upgrades Virgin Money to ‘A-‘ on Completion of Acquisition by Nationwide; Outlook Stable

- Moody’s Ratings upgrades Perenti’s CFR to Ba1; outlook stable

- Israel Long-Term Ratings Lowered To ‘A’ From ‘A+’ On Heightened Security Risk; Outlook Negative

- Dish DBS And Dish Network Downgraded To ‘CC’ From ‘CCC-‘ On Announced Distressed Exchange; Other Actions Taken

- Vistra Corp. Upgraded To ‘BB+’, Outlook Stable; Recovery Rating Revised To ‘3’ From ‘4’ On Senior Unsecured Debt

Term of the Day

JOLTS Job Openings

This is a survey number collected by the BLS, measuring the number of job vacancies on the last business day of the month in question. This helps give a more detailed picture of the labor market in the US, besides the typical Non-Farm payrolls (NFP), ADP Payrolls, weekly jobless claims and other metrics. A job is open if it meets all three of the following conditions:

- A specific position exists and there is work available for it

- The job could start within 30 days, whether or not the establishment finds a suitable candidate

- There is active recruiting for workers from outside the establishment location that has the opening

Talking Heads

On Global Debt Issuance Reaching Record $600bn Last Month

Kathy Jones, chief fixed-income strategist at the Schwab Center for Financial Research

“The market has been wide open and spreads are tight. From an issuer’s point of view, in the corporate world, those are pretty good conditions. If I’m an issuer and I really need to get something done, I want to do it before the election because it can get very noisy and volatile and uncertain.”

On Market Being Wrong on Fed Rate-Cut Bets

Larry Fink, CEO at BlackRock Inc.

“I don’t see any landing. The amount of easing that’s in the forward curve is crazy. I do believe there’s room for easing more, but not as much as the forward curve would indicate. There are segments of the economy that are doing really well. We spend so much time focusing on the segments that are doing poorly.”

On Zambia’s Dollar Bonds Rally

Neville Mandimika, emerging-markets strategist at Morgan Stanley

The strategist upgraded his view on Zambia’s bonds to “like” after the spending plan showed a strong fiscal performance, with revenues exceeding expectations and expenditures controlled in the first half of 2024. “The outlook showed room for further consolidation next year, which will be helped by rising output and prices for copper, Zambia’s biggest export.”, said the MS strategist

Top Gainers & Losers 2-October-24*

Go back to Latest bond Market News

Related Posts: