This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

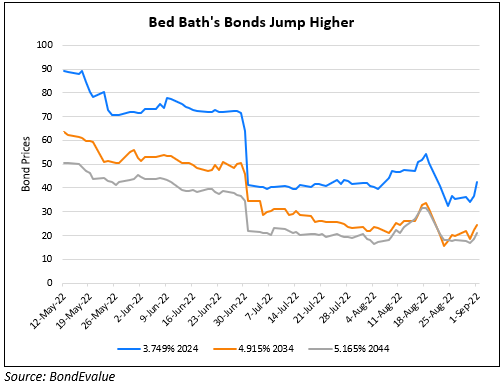

Bed Bath & Beyond Quarterly Loss Widens

September 30, 2022

Bed Bath & Beyond (BBBY) reported a further widening of its quarterly losses – its Q2 net loss came in at $366mn vs. a loss of $73mn during the same period last year. This was its lowest second quarter earnings since 2006. The widening loss was on revenues of $1.4bn, down 28% YoY. With the above, its gross margin fell 260bp YoY to 27.7%. UBS analysts estimate that BBBY will see a cash burn of $1.5bn over the next eight quarters. BBBY’s CEO Sue Gove said, “Although still very early, we are seeing signs of continued progress as merchandising and inventory changes begin… Regaining market share and enhancing liquidity are our top priorities”. Bed Bath’s struggles are not new with the company mentioning that it would close down 150 of its 953 stores. S&P had downgraded its senior unsecured bonds to CCC- from CCC with the retailer’s issuer rating at CCC. Earlier this month, they only managed to sign deals worth of $500mn in financing in an effort to raise funds.

Bed Bath’s bonds were trading flat with its 2034s and 2044s at 16 cents on the dollar.

Go back to Latest bond Market News

Related Posts: