This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BBVA Prices $ AT1 Bond at 9.375%; Rating Changes; Talking Heads; Gainers and Losers

September 12, 2023

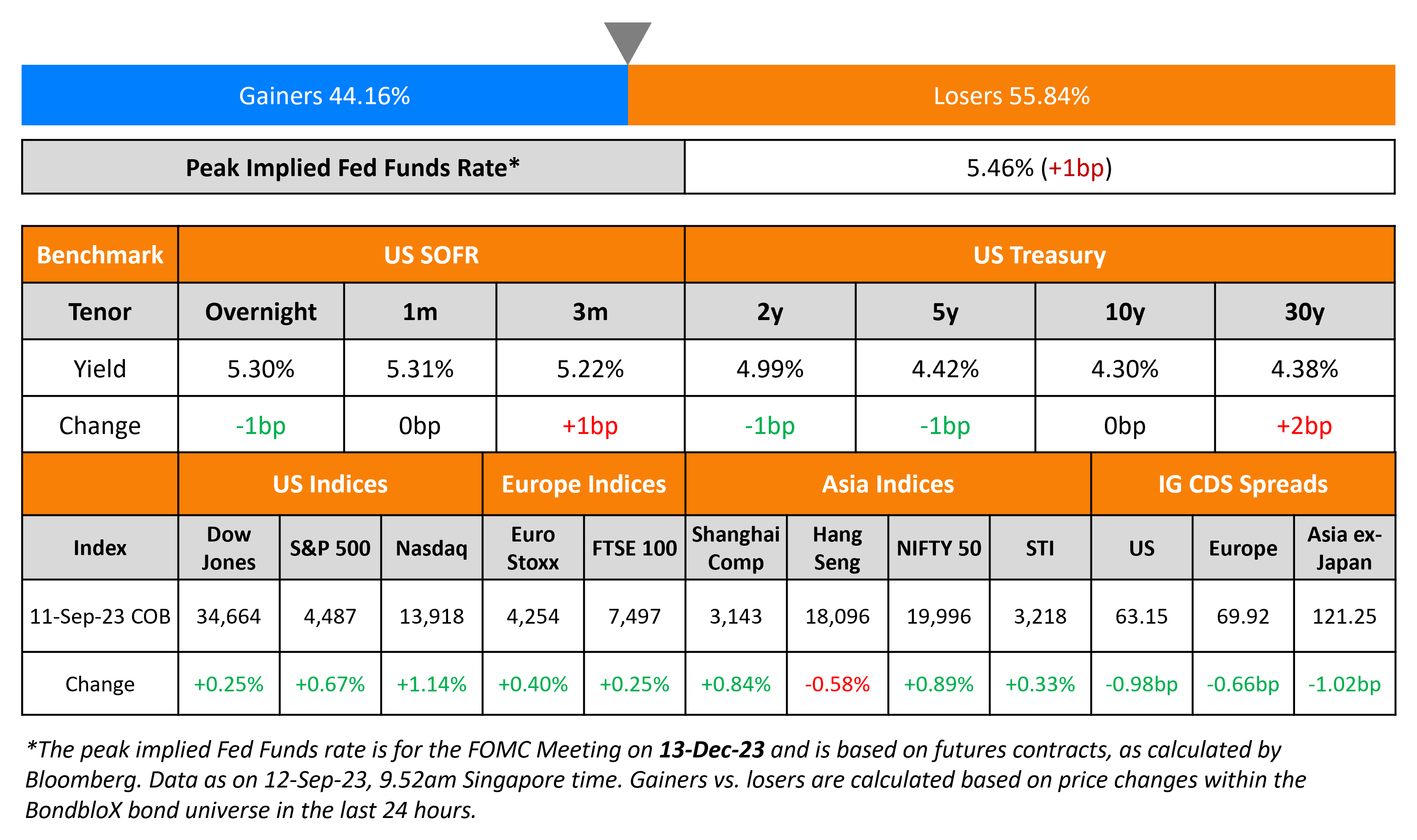

US Treasury yields were flat as markets await the US inflation report later tomorrow. US IG CDS spreads were 1bp tighter while HY spreads tightened 5.3bp. The S&P and Nasdaq moved higher by 0.7% and 1.1% respectively with the latter helped by Tesla’s 10% stock price rally. This was after a Morgan Stanley upgrade on the stock saying that the Tesla’s Dojo supercomputer may boost its value by up to $500bn.

European equity markets were also higher. In credit markets, European main CDS spreads were tighter by 0.7bp with crossover spreads tightening 4.2bp. Asian equity markets have opened broadly flat this morning while Asia ex-Japan CDS spreads tightened 1bp yesterday.

New Bond Issues

- HSBC S$ 10.5NC5.5 Tier 2 at 5.6% area

- Nissan Motor $ 3Y/5Y at T+270/300bp area

Spanish lender BBVA raised $1bn via a PerpNC6 AT1 bond at a yield of 9.375%, 25bp inside initial guidance of 9.625% area. If uncalled on the first call date of 19 March 2029, the coupon will reset on the first reset date of 19 September 2029 and every 5 years thereafter at the US 5Y Treasury plus a spread of 509.9bp. The bonds have expected ratings of Ba2/BB and a 75% clean up call. Proceeds will be used for general corporate purposes. The table below compares BBVA’s new AT1s with other similarly rated USD-denominated AT1s.

-1.png?upscale=true&width=1400&upscale=true&name=image%20(63)-1.png)

ABN AMRO raised $1.75bn via a two-part senior non-preferred deal. It raised $1.25bn via a 4NC3 bond at a yield of 6.339%, 30bp inside initial guidance of T+195bp area. If uncalled after 3 years, the coupon will reset at the US 5Y Treasury rate plus a spread of 165bp. It also raised $500mn via a 4NC3 FRN bond at a yield of 7.115%. The floating coupon will reset at the overnight SOFR (Term of the Day, explained below) plus a spread of 178bp and will be paid quarterly. The bonds have expected ratings of Baa1/BBB/A. Proceeds will be used for general corporate purposes.

KEXIM raised $2bn via a three-tranche deal. It raised

- $500mn via a 2Y bond at a yield of 5.461%, 30bp inside initial guidance of T+75bp area. The new bonds are priced 5.9bp tighter to its existing 3.25% 2025s that yield 5.52%.

- $1bn via a 5Y bond at a yield of 5.158%, 30bp inside initial guidance of T+105bp area. The new bonds are priced in line with its existing 5% 2028s that yield 5.16%.

- $500mn via a 10Y bond at a yield of 5.236%, 25bp inside initial guidance of T+120bp area. The new bonds are priced 3.6bp wider to its existing 5.125% Green 2033s that yield 5.2%.

The senior unsecured bonds have expected ratings of Aa2/AA/AA-. Proceeds will be used for general operations, including extending foreign currency loans and the repayment of maturing debt and other obligations.

Rating Changes

- Carvana Co. Upgraded To ‘CCC+’ From ‘D’ Following Distressed Exchange; Outlook Negative

- Moody’s downgrades Mercer’s CFR to B1; outlook negative

- Moody’s changes British American Tobacco’s outlook to positive from stable; Baa2 ratings affirmed

New Bond Pipeline

- Sharjah hires for $ 10.5Y sukuk

- Korea Southern Power hires for $ 3Y bond

- Energy Development Oman hires for $ 10Y sukuk

- Emirates NBD hires for Sustainable bond

- FWD hires for $ 10Y bond

- Bangkok Bank hires for $ senior bond

Term of the Day

SOFR

Secured Overnight Financing Rate (SOFR) is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities. SOFR is calculated as a volume-weighted median of three rates – tri-party repo data collected from BNY Mellon, General Collateral Financing (GCF) Repo transaction data and data on bilateral Treasury repo transactions cleared through FICC’s DVP service, which are obtained from DTCC Solutions LLC. SOFR was selected as the representative rate for use in USD derivatives, and was suggested as an alternative to LIBOR.

Talking Heads

On draft US bank capital rules – JPMorgan CEO Jamie Dimon

“I wouldn’t be a big buyer of a bank. I’d be no better than equal weight. All I want is fairness, transparency, openness… In terms of our own business, the risk-reward (from China), which was very good, has now become okay. The risk is bad”

On Liking Late-Cycle Defensive Portfolios – Morgan Stanley’s Michael Wilson

“As is typical in such periods, multiple expansion has moved ahead of where macro fundamentals dictate fair value to be, placing the burden on a growth re-acceleration and/or incremental policy support”.. recommend a “barbell” approach.

Bond strategists stand ground, say US Treasury yields have peaked

Guy LeBas, chief fixed income strategist at Janney Montgomery Scott

“There’s a huge degree of uncertainty about the future of base interest rates and what inflation looks like on the other side of the current economic strength…. not confident enough to say that we have certainly peaked for this cycle.”

Zhiwei Ren, portfolio manager at Penn Mutual Asset Management

“Currently there are two forces fighting. In the fourth quarter, we will see a weakening job market put pressure on consumer spending, which is needed to slow growth. This driver will make yields go lower”

On Hedge Funds Turning Most Bearish on Euro Since January Ahead of ECB

Mark Dowding, CIO at RBC BlueBay Asset Management

“Stagflation in Europe is a real risk. Growth is disappointing, but limited progress is being made in bringing down core inflation”

Francesco Pesole, a strategist at ING Groep

“Given the upside risks for the dollar ahead of the US CPI release, we suspect another drop below $1.07 before the ECB announcement on Thursday is all but possible”

Top Gainers & Losers- 12-September-23*

Go back to Latest bond Market News

Related Posts: