This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Barclays Prices S$ AT1 at 6.4%

November 22, 2024

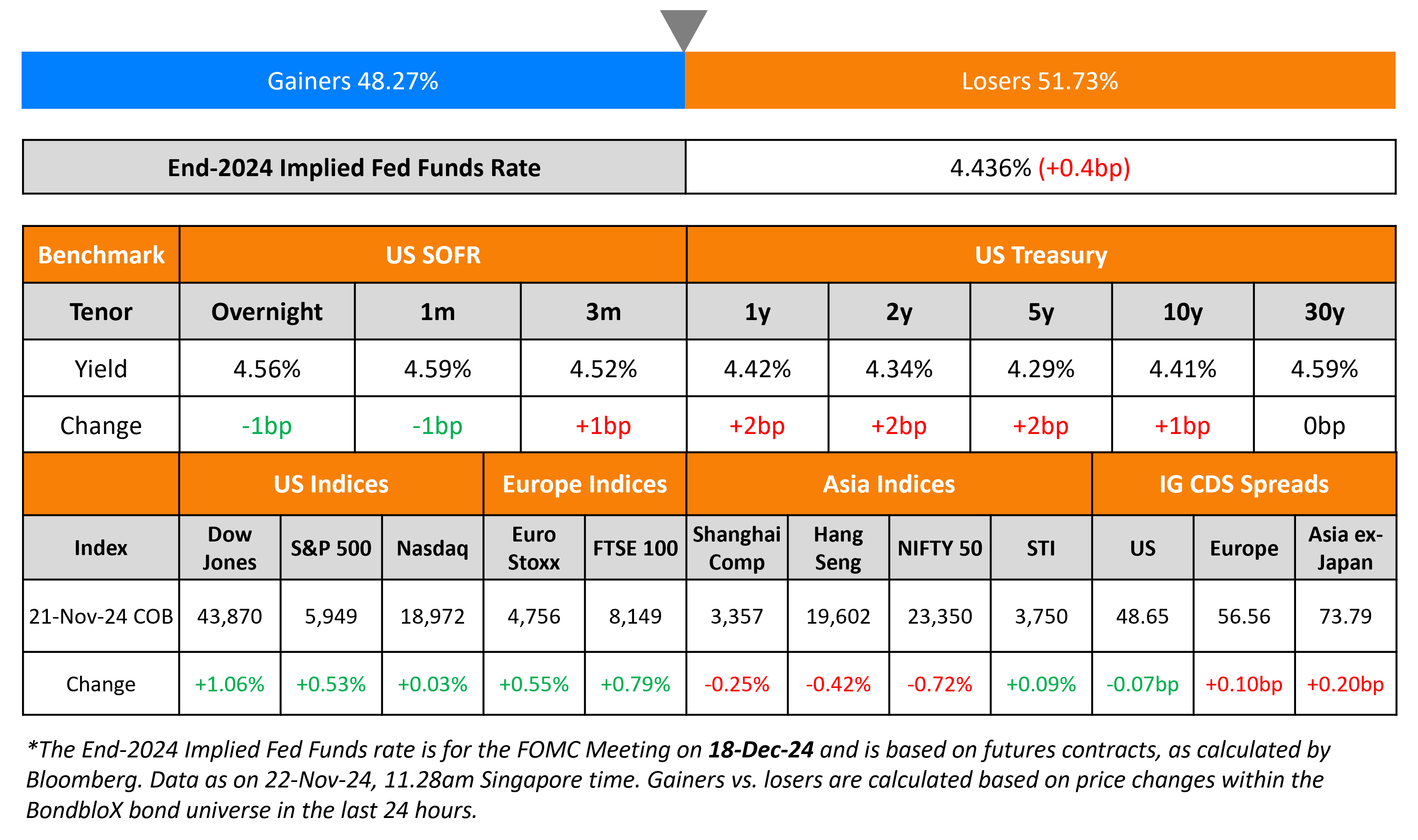

US Treasuries remained largely stable on Thursday. Chicago Fed President Austan Goolsbee remarked that the inflation rate is heading towards the 2% target citing the historical trend over the past year and a half. However, he says that policymakers do not have to rush their decision and can afford to lower rates at a slower pace over the course of 2025. US IG and HY CDS spreads tightened by 0.1bp and 4bp respectively. In terms of the US equity markets, the S&P closed higher by 0.5% and Nasdaq ended flat.

In Europe, ECB Governing Council member Yannis Stournaras cited the need to close in on the neutral rate. He said that the right course of action would be to have a fourth 25bp reduction in December, bringing the benchmark deposit rate down to 3%. This view on the rate cut trajectory was also shared by France’s central bank chief Francois Villeroy. European equities closed higher across the board. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.1bp and 0.5bp respectively. Asian equities have opened broadly mixed this morning. Asia ex-Japan CDS spreads widened by 0.2bp.

New Bond Issues

Barclays raised S$600mn via a PerpNC5.5 AT1 bond at a yield of 5.4%, 40bp inside initial guidance of 5.8% area. The subordinated notes are rated Ba1/BBB- (Moody’s/Fitch). If not called between 15 March 2030 and 15 June 2030, the coupons will reset to the 5Y SGD OIS rate plus 278.8bp. A trigger event would occur if at any time the fully loaded CET1 ratio is less than 7%. Proceeds will be used for general corporate purposes and to strengthen further capital base of the issuer and its subsidiaries and/or group.

JP Morgan raised $2.5bn via a 21NC20 bond at a yield of 5.534%, 23bp inside initial guidance of T+105bp area. The senior unsecured notes are rated A by S&P. Proceeds will be used for general corporate purposes.

New Bond Pipeline

- Vedanta Resources hires for $ 3.5NC1.5/7NC3 bond

Rating Changes

-

Fitch Upgrades Seven Argentinian Corporates Following Sovereign Upgrade

-

Moody’s Ratings upgrades Bristow’s CFR to Ba3; stable outlook

-

Moody’s Ratings downgrades Hilong’s rating to Ca; outlook remains negative

-

Fitch Revises NatWest Group’s Outlook to Positive; Affirms at ‘A’

-

JPMorgan Chase Bank N.A. 64 Various Issue Ratings Raised To ‘A-1+’ And Affirmed At ‘A+/A-1’

Term of the Day

Neutral Rate of Interest

.The neutral rate aka natural rate or “R*” is the theoretical federal funds rate at which point the US Federal Reserve monetary policy is neither accommodative nor restrictive. In other words it is the short-term real interest rate that is consistent with the economy maintaining full employment and price stability. This rate is inferred and calculated via models and varies based on economic and financial market factors.

Talking Heads

On IMF not assessing Trump’s tariff, tax-cut plans until details emerge

“The exact impact of any of these policies is very much going to depend on the details and that’s why we will wait to see the details before we make our assessment”

On Treasury Yields Are Attractive, Expecting Steeper Curve – Erin Browne, Pimco

“You are at very attractive starting levels of yields, and as the Fed cuts you’ll get the benefit of capital appreciation… We still have very elevated rate policy despite the fact that we’ve seen both growth and inflation fall back down to more normal levels.. We still have very elevated rate policy despite the fact that we’ve seen both growth and inflation fall back down to more normal levels”

On India Being Top Asia Bet Next Year in Search for Carry – Abrdn

“Fixed income looks a lot more like a carry-trade play next year in emerging markets”… “Your carry is protected” via returns from bonds, as the rupee’s depreciation is limited versus the dollar.

Top Gainers and Losers- 22-November-24*

Go back to Latest bond Market News

Related Posts: